Credit cards comprise nearly 6% of the total credit union loan portfolio and are an important element in a well-rounded product suite.

Our goal is to be our member’s primary financial institution, says Matt Freeman, head of card products at Navy Federal Credit Union ($81.5B, Vienna, VA). Providing valuable services on the card side is one step in that process.

Credit card balances across the credit union industry totaled slightly more than $52 billion as of first quarter 2017 an 8.12% increase year-over-year. And although that might pale in comparison to what banks hold, the credit union credit card penetration rate has steadily risen over the past five years, going from 14.96% as of first quarter 2012 to 17.19% as of first quarter 2017.

As card lending increases, credit unions are looking for additional ways to add value to their suite of products.

It’s about creating a relationship where we’re able to return value that makes members want to do more business with us, Freeman says.

How do credit unions return value?

One way is through credit card rewards programs.

In its 2017 Credit Card Rewards Report, WalletHub ranked the best credit card rewards programs.

The top 20, primarily large bank programs, did include programs at five credit unions including Navy and Alliant Credit Union ($9.8B, Chicago, IL). The study mostly considered the two-year value of rewards programs, potentially underselling the long-term value of the cards.

The average cardholder at Navy, for example, has had their account for 10 years, and Freeman says members can expect to see greater value long-term.

That said, lists and rankings such as these play a role in driving the decision-making process.

Any time your products can be recognized is a good thing, Freeman says. We know consumers are evaluating these lists when considering which products to choose.

Here, Navy, Alliant, and TDECU ($3.1B, Lake Jackson, TX) share best practices for starting and running a rewards programs.

Cater To The Member

CU QUICK FACTS

Navy FCU

Data as of 03.31.17

HQ: Vienna, VA

ASSETS: $81.5B

MEMBERS: 6,994,229

BRANCHES: 299

12-MO SHARE GROWTH: 13.6%

12-MO LOAN GROWTH: 9.8%

ROA: 1.50%

Navy carries more than $12 billion in credit card balances on its books, ranking the Virginia-based cooperative as one of the largest credit card players among all U.S. financial institutions. Of its five credit cards, four have a rewards component, says Freeman, and 80% of Navy’s card balances are tied to one of those rewards cards.

We want to provide options for our members, says the head of card products.

At the highest end of its rewards products, Navy offers its Flagship Rewards card. The card carries a $49 annual fee, and members earn two points per dollar on each purchase redeemable for cash, travel, gift cards, or merchandise. When redeemed for travel, points are worth 1%.

If a member spends $10,000 annually, then they would earn 20,000 points, Freeman says. Those points would be worth $200 in spend.

Other products at Navy include its GO REWARDS points card, which earns three points at restaurants, two on gas, and one everywhere else. Its cashRewards card earns 1.5% cashback on all purchases, and its nRewards Secured earns one point per dollar redeemable for gift cards and merchandise.

The products are designed so members can make choices for which product best suits them, he says. The nRewards card is meant for members establishing or repairing credit, but Freeman emphasizes the credit union’s cards are not segmented by credit tier.

Navy Federal is a large operation, but Freeman says certain practices apply to any credit union jumping into rewards offerings. First and foremost, understand where members are spending their money and make sure the incentives provide value. Survey members, he suggests, and find out what they are interested in.

As you design the rewards program, don’t get too far away from what’s important to most credit union members, like low fees and fates, Freeman advises. Those are going to be considered when they shop around. You cannot compete on rewards alone.

Click through the tabs below for a deeper dive into Navy, Alliant, and TDECU’scredit card data. Click on the graphs to view in Peer-to-Peer.

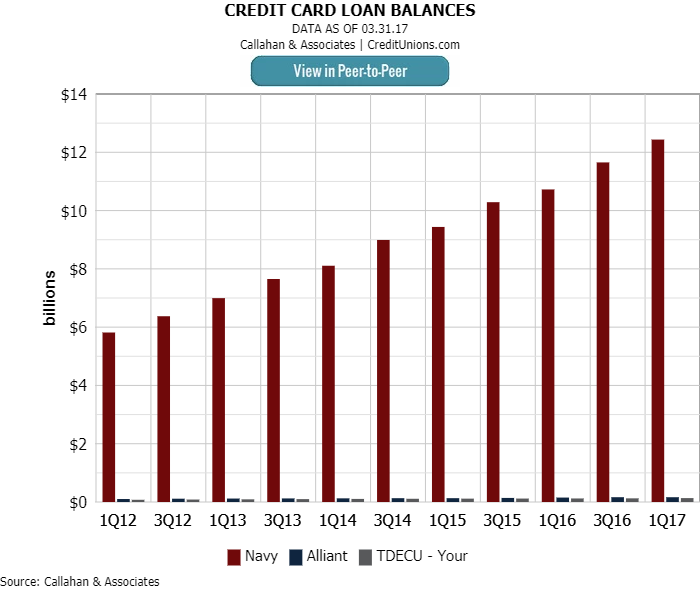

CREDIT CARD LOAN BALANCES

Navy holds more than $12 billion in credit card loan balances. Alliant and TDECU hold $164 million and $134 million, respectively.

CREDIT CARD LOAN GROWTH

Navy’s credit card growth rate has remained relatively steady over the past five years. At Alliant and TDECU, growth rates have fluctuated.

AVERAGE CREDIT CARD LOAN BALANCE

TDECU’s average credit card balance has, for the past five years, outstripped balances at Alliant.

CREDIT CARD PENETRATION

Alliant and TDECU rank close in terms of credit card penetration, at 19.37% and 17.25%, respectively. Navy’s credit card penetration rate neared 30% as of first quarter 2017.

Root The Decision In Data

CU QUICK FACTS

Alliant Credit Union

Data as of 03.31.17

HQ: Chicago, IL

ASSETS: $9.8B

MEMBERS: 357,192

BRANCHES: 12

12-MO SHARE GROWTH: 12.2%

12-MO LOAN GROWTH: 20.3%

ROA: 0.72%

For Alliant, member feedback plays an integral role in operations. In 2016, Michelle Goeppner, the credit union’s senior manager of card product strategy, wanted to create a true cashback card.

We were losing market share to a true cashback card, but I wanted to make sure I was rooting my decision in data, she says.

Results for a credit union survey supported her theory, and Alliant launched its new product in February of 2017.

Built for affluent members, the card earns 3% cashback on each purchase the first year and resets to 2.5% thereafter. The card comes with a $59 annual fee, which the credit union waives the first year, and has no limit on the cash back awards members can earn.

ContentMiddleAd

The signature card fits nicely into the credit union’s card portfolio as a missing piece of sorts, Goeppner says.

We have our low-rate, no-frills Platinum Card for the sector of our portfolio that is rate sensitive or new to credit, she says. And then we have our Platinum Rewards for those who are typical transactors and use it for everyday purchases.

According to Goeppner, 62% of the credit union’s card portfolio is made up of its Platinum Card, 34% in its Platinum Rewards Card, and 4% in its Signature. Its membership carries $161 million in outstanding balances, and 67% of the portfolio is gross active.

The credit union didn’t have a card for its affluent population; members earning more than $100,000 annually with credit scores above 700 and low debt-to-income ratios. Alliant is a SEG-based institution with only 12 branches but a national reach and a growing technology base (Google is a SEG). Plus, its members have a larger-than-average relationship with the credit union. According to Search Analyze data on CreditUnions.com, Alliant’s average member relationship of $45,138 more than doubles the $18,731 average relationship across all credit unions in the United States.

The affluent make up a sizable part of our membership, Goeppner says.

The rewards card is an integral selling point for Alliant’s credit card suite.

If you pay off your balance month-after-month, then you’re going to want a product that is giving you value because the rate is not that important to you, she says. This is a way for folks to turn their spend into something tangible.

Like Navy’s Freeman, Goeppner iterates the importance of taking into consideration the credit union’s member base when rolling out rewards. In addition, she highlights the importance of market research in making decisions to serve a market need.

For example, VISA provides additional benefits that financial institutions can add to their card offerings. In designing Alliant’s cashback Signature Card, Goeppner wanted to add cell phone protection that would replacement a phone if a member broke it. An obvious benefit in today’s society only not.

The research showed that nobody liked it, she says. I would have implemented some benefits that would have cost our credit union a lot of money and no one would have used it. That’s why understanding the market is important.

Be Methodological

CU QUICK FACTS

TDECU

Data as of 03.31.17

HQ: Lake Jackson, TX

ASSETS: $3.1B

MEMBERS: 260,069

BRANCHES: 40

12-MO SHARE GROWTH: 4.0%

12-MO LOAN GROWTH: 8.4%

ROA: 0.31%

TDECU offers five credit cards, one of which operates as a traditional rewards card but all of which offer a small rewards component.

The Texas-based cooperative’s Onyx Platinum card provides 2% cashback on all purchases with rates as low as 9.5%. The credit union requires borrowers to have A or A+ credit, says Chuck Smith, the credit union’s senior vice president and chief lending officer.

Onyx Platinum card balances comprise approximately 10% of the credit union’s total card portfolio, but according to Smith, it’s a valuable addition for members who have a deeper relationship with the credit union.

It’s competitive and it lets us build deeper relationships with members, Smith says. Nobody is waiting for you to invent a credit card if they already have one, so you need a hook to bring them over.

Smith acknowledges the cost-benefit balance of offering a rewards product might not always tip in favor of offering a rewards program, especially because it can cut into income.

If you give 2% cashback, then you are giving up all your interchange income, the chief lending officer says. You’re hoping that members use it and carry a balance. Some do, most don’t.

Members that carry one of TDECU’s four other credit cards aren’t left out in the cold when it comes to perks. That’s because those cards all offer $0.10 off per gallon of gas at Buc-ee’s convenience stores, a Lake Jackson-based chain that operates 32 locations, all containing TDECU ATMs, across Texas.

The gas discount, which is not available to Onyx Platinum cardholders, underscores the local connection between the two companies.

In terms of best practices in offering rewards, Smith counsels credit unions to know what they are trying to accomplish before implementing these programs.

Make sure you have a full understanding of what those rewards will provide members, what kind of business it will drive, and the cost associated, Smith says. Don’t just offer rewards because you don’t have them.