The economy in western Michigan is steadily recovering and home values are appreciating, but long-term success in mortgage lending hinges on more than the environment. To make a measurable, positive impact in the marketplace, credit unions must start early and fully invest.

I never thought a credit union would be as open to the mortgage business as we are, says Eric Burgoon, senior vice president of mortgage lending for Lake Michigan Credit Union ($2.9B, Grand Rapids, MI). Burgoon joined the leadership team at LMCU two years ago bringing with him mortgage industry experience from both large, national banks and local, mid-sized institutions.

We’re currently No. 1 in market share for each of the regions we serve, including Kent, Ottawa, and Kalamazoo counties, Burgoon says. People here recognize we’re the best place to get their mortgage

According to Callahan & Associates’ Mortgage Analyzer, in 2011 the credit union captured a 10.44% market share by number of applications. Today, LMCU averages between 18% and 23% market share, Burgoon says.

Although the credit union benefits from the area’s improved economics and the consumer shift away from large banks, it is not relying on external boons for growth. Instead, it adjusts its mortgage business model based on cooperative advantages such as localized service, financial soundness, and community engagement.

1: Build On Your Strengths

For the past year and a half, LMCU has repositioned itself to serve the purchase market, adding five new loan officers at its Kalamazoo, MI, location, opening a new office with five additional loan officers in northern Michigan, and expanding loan staff in its core Grand Rapids and Lakeshore markets. These hires not only help funnel existing books of business into the credit union but also provide better coverage of branch operations, which is essential to service quality.

LMCU is now able to maintain a dedicated loan presence at each of its 32 locations as well as in the offices of five real estate companies and one homebuilder, Burgoon says.

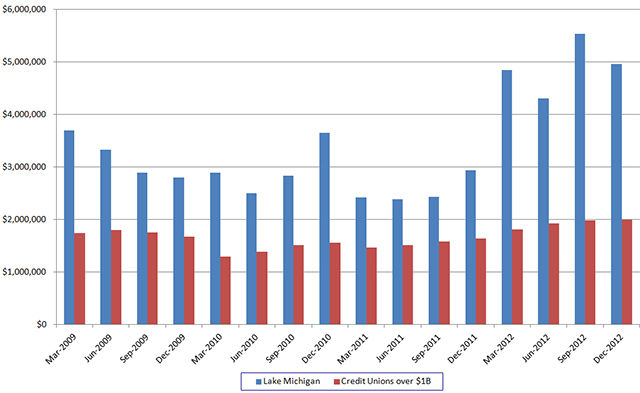

LOAN ORIGINATIONS PER EMPLOYEE (ANNUALIZED) – LAKE MICHIGAN

DATA AS OF DECEMBER 31, 2012

Callahan & Associates | www.creditunions.com

Generated by Callahan & Associates Peer-to-Peer Software

The credit union currently averages 650 new home purchase applications each month nearly three times the volume from two years ago. That’s approximately 60% of all mortgage applications the credit union receives. By comparison, refinance activity at LMCU has stayed steady at 450 to 500 per month over the same timeframe. Although focusing on purchases can create inconsistencies in the look-to-book ratio, the credit union steadily approves and funds between 70% and 75% of all applications.

2: Embrace New Partnerships

LMCU has tapped Carter Oosterhouse an LMCU member and the host of several home renovation shows on the HGTV network for a series of awareness campaigns.

We weren’t looking for a spokesperson, Burgoon says. This was a random coincidence that turned into a great opportunity.

Oosterhouse refinanced his own mortgage with LMCU, so the television personality had first-hand knowledge of the mortgage department’s service quality. And the credit union’s CEO, Sandy Jelinski, recognized that Oosterhouse’s ties to the state and home building community could complement the credit union’s mission.

The credit union is now sponsoring a series of TV commercials and billboards, on-site realtor and employee events, and a $25,000 home makeover giveaway with design and eco-friendly building tips from Oosterhouse that is open to the entire community.

This celebrity partnership is helping LMCU widen its outreach and become top-of-mind for consumers, realtors, and other area businesses. In return, LMCU employees are donating their time and resources to support the Carter’s Kids charity, which takes on activities such as building new playgrounds in the community.

3: Expand The Business Model

LMCU leverages its reputation for service, accessibility, and proactive communication to bolster its correspondence lending program. Today, the credit union offers capital to and purchases loans from roughly 80 approved clients, which consist primarily of small to mid-size banks and credit unions as well as bank-owned mortgage companies. Approximately half of these companies conduct regular business with LMCU.

You’re dealing with a higher level of company in the correspondence space, Burgoon says. Our main advantage is that these institutions can talk to our underwriters and the people who are funding their loans they enjoy that high touch kind of relationship we provide.

LMCU stays clear of brokerage relationships, Burgoon says. However, the credit union underwrites the loans for those who want the service. If partner companies choose to underwrite the loan themselves, they are still subject to the credit union’s checks and filters.

Burgoon admits it can be harder to develop a deep financial relationship with members acquired through correspondence lending, but this business model drives additional income, which helps create more attractive rates for LMCU’s primary membership base.

4: Complement Your Strengths With Diversity

LMCU embraces current areas of opportunity, but the credit union also taps into niche mortgage markets and adjusts its existing products to better position it for the marketplace of the future.

For example, HELOC activity is relatively low compared to first mortgage activity, yet the credit union is redesigning its home equity product to make it more competitive in the future.

One day rates are going to go back up, Burgoon says. Once people have their first mortgage at an attractive rate, any new financing they need is going to be through a home equity product.

LMCU also offers a mortgage product tailored to doctors to serve the many health care professionals in its marketplace. Other uncommon loan features include a one-time close construction draw product that lets qualified members finance the building of their home through the cooperative instead of the builder, a nonwarrantable condo product designed to fill the need left by FHA financing restrictions, and a jumbo loan product.

LMCU has approximately 150 construction loans in addition to its other niche alternatives, yet the credit union has not experienced a loss with any of these products.

If it’s a good loan, we’ll almost always find a way to make it, Burgoon says.