There’s nothing wrong with a straightforward approach to home lending, as demonstrated by the healthy real estate growth the credit union industry is posting.

At second quarter 2015, total real estate loans many of which were garden-variety conforming and conventional first mortgages totaled north of $375 billion among credit unions nationwide, an approximate 7% increase year-over-year.

CU QUICK FACTS

Directions Credit Union

Data as of 06.30.15

- HQ: TOLEDO, OH

- ASSETS: $627.7M

- MEMBERS: 72,455

- 12-MO SHARE GROWTH: 3.01%

- 12-MO LOAN GROWTH: 8.63%%

- ROA: 0.56%

CU QUICK FACTS

Workers’ Credit Union

Data as of 06.30.15

- HQ: FITCHBURG, MA

- ASSETS: $1.2B

- MEMBERS: 85,162

- 12-MO SHARE GROWTH: 9.19%

- 12-MO LOAN GROWTH: 15.74%

- ROA: 1.37%

It’s an exciting time to be a lender, but as the national market rebounds and prices steadily climb, not all members are satisfied with the available home inventory.

In some regions, niche loan products such as construction loans and jumbo mortgages are providing homebuyers with better options to finance their distinct visions of homeownership. Even better, these products often increase the issuing credit union’s return on investment.

You Can’t Have Bob The Builder, Without Tim The Lender

Directions Credit Union ($627.7M, Toledo, OH) has offered a construction loan for more than 12 years, says Tim Crosby, senior vice president of lending at the credit union. However, for the first few years, the option served mainly as a tool for members who wanted to build high-end homes and remained a small part of the credit union’s business.

Back then, the housing inventory seemed adequate and most members were able to find a home in their price range, Crosby says.

Then in 2008 and 2009, the Great Recession hit Toledo hard. Manufacturing jobs dried up and unemployment in the city reached 12.2%.

Purse strings tightened and the credit union posted negative or stagnant total loan growth from first quarter 2009 to second quarter 2010, when it reached 2.8% growth.

By 2012, however, Crosby and the credit union noticed a change in Toledo as well as in Mansfield, Ohio, where the credit union also has a large presence. There, the inventory of homes in the $200,000 to $400,000 range began rapidly shrinking thanks to revived buyer demand.

Don’t fear the annual HMDA data dump. MortgageAnalyzer makes it easy to assess market data and trends. Request a demo today.

A lack of inventory in that buying range combined with recovery from the Great Recession resulted in our region having more homes, Crosby says. It triggered the building boom we’re experiencing now.

As of August 2015, the credit union had 91 construction loans totaling $27 million in January of 2012, it had only 19.

As of 2Q 2015, its total construction loan portfolio totals $47 million, or 24% of its mortgage loan portfolio, and year-to-date construction loan originations of $18 million represent 26% of total mortgage loan originations.

A member can’t come to us and build a home with John Q. Builder. It has to be a builder that has a good track record with and whom we are comfortable.

With this product, Directions finances the lot, associated construction costs, and the price of the finished house. Members take the lot and construction plans to the credit union and Directions sends an appraiser to the view the lot, review the plans, and determine the value of the completed project. The credit union then bases its loan amount on the appraiser’s determination.

FIRST MORTGAGE PENETRATION

Credit Unions $500M – $1B | Data as of 06.30.15

Callahan Associates |

A long-term uptick in this metric shows the return of buyer demand as well as the success Directions has had reaching homebuyers compared to similar-sized peers.

Source: Peer-to-Peer Analytics by Callahan Associates

Unlike construction loans at other institutions, Directions opts for a one-time close.

During the construction phase, which runs from six to nine months, borrowers pays only interest on the draws they make. Once the home is 100% complete, then the borrower begins to pay the principal and interest payments on a fully amortized fixed-rate loan.

For Directions, construction loan balances typically average $300,000 versus $155,000 for standard mortgage loans. And a 30-year construction loan earns the credit union a 4.5% interest rate return; higher than its current 30-year fixed-rate mortgage.

What’s more, these construction loans have not resulted in increased losses for the credit union. That’s because Directions reviews all construction loan borrowers using the same criteria it would for a traditional mortgage loan, including the ability to repay, credit history, and possession of liquid assets.

But it also goes one step further and requires borrowers to select project builders from its own list of reviewed and approved companies.

A member can’t come to us and build a home with John Q. Builder, Crosby says. It has to be a builder that has a good track record and with whom we are comfortable.

For Those Who Like A Jumbo Slice Of Paradise

The headquarters for Worker’s Credit Union($1.2B, Fitchburg, MA) is located approximately 90 minutes east of Boston, one of the most expensive housing markets in the United States. Over the past several years, Workers’ has been steadily expanding its footprint to Boston city limits, says Tim Smith, chief financial officer at the credit union.

A good piece of our membership live in the western suburbs of Boston, he says.

With jumbo loans, if we keep them on our books, it allows us to grow the total balance more quickly. Many of our loans in our western market range from $150,000 to $200,000. So it takes three or four of those mortgages to make up one jumbo.

Although the credit union has offered jumbo mortgage loans simply a home loan in an amount above conventional conforming loan limits for a number of years, Smith says it wasn’t until it started expanding that the credit union more aggressively tried to push them.

The conforming limit for a single-family home in Boston and its suburbs is $417,000, according to Fannie Mae. The credit union’s typical jumbo loan ranges between $450,000 and $500,000, according to Smith, and it structures them under one of three different terms: 5-1 and 7-1 adjustable rates and a 30-year fixed.

Workers’ sells its 30-year fixed jumbo loans to Fannie Mae, Freddie Mac, and the Federal Home Loan Bank of Boston, so the credit union sets its requirements consistent with secondary market standards. It does not sell its jumbo adjustable rates, however, and portfolios them instead.

They’re longer than some of the other loans we have on our books, Smith says. But they’re adjustable so they’re a much lower risk than a 15- or 30-year.

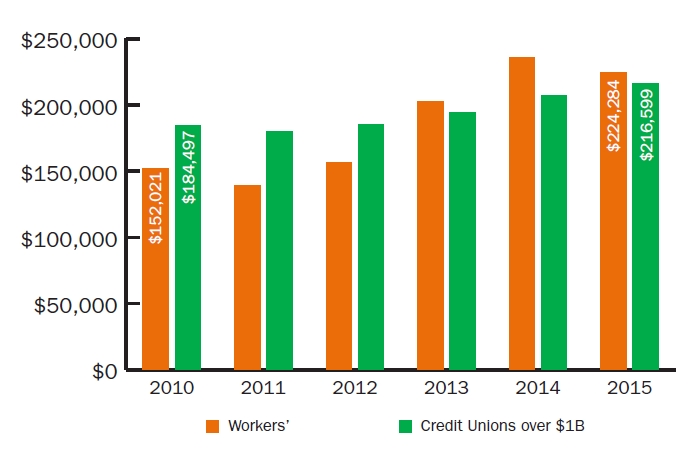

AVERAGE FIRST MORTGAGE ORIGINATIONS

For Credit Unions over $1B | Data as of 06.30.15

Callahan Associates |

The additional market demand for and credit union promotion of a high-dollar jumbo product can be seen in Workers’ higher dollar average per origination than comparable peers.

Source: Peer-to-Peer Analytics by Callahan Associates

As of second quarter 2015, 12-month loan growth at Workers’ totaled nearly 16%, and jumbo mortgage loans have grown faster than others, at a 25% clip, Smith says. In all, this product represents a portfolio of $60 million or 112 total loans.

Despite the higher balance, Smith says underwriting and marketing jumbo loans remains similar to regular mortgage loans. The target audience, however, is slightly different, and includes individuals with higher income levels and an eye on urban living.

Home prices near Boston are expected to remain larger than those around Fitchburg for the foreseeable future, according to Forbes, so Smith believes jumbos will become an even larger part of the credit union’s portfolio moving forward. This will allow Workers’ to serve a wider and more diverse set of members and increase its earning potential.

With jumbo loans, if we keep them on our books, it allows us to grow the total balance more quickly, Smith says. Many of our loans in our western market range from $150,000 to $200,000. So it takes three or four of those mortgages to make up one jumbo.

You Might Also Enjoy

-

Your Post-TRID Checkup

-

Marketing Tips For Real Estate Mastery

-

To Power More Purchases, Try A Realtor Rebate