The numbers are downright scary.

According to CUNA’s 2014/15 National Member and Non-Member Survey, the average age of a credit union member has now reached 48.5 years old. The survey also reports that only 35% of credit union members are in their peak borrowing years (ages 25-44), down from a whopping 51% in 1989. And in spite of all the discussion in the credit union space about growing membership among young adults, just 7% of members fall into the 18-24 age range, down from 9% in 2013.

While these statistics are troubling enough, what should cause even greater angst for credit union lenders and marketers is how millennials view the future of banking. According to the Millennial Disruption Index a three-year study based on a comprehensive survey of more than 10,000 people born between 1981 and 2000 banking is the industry that faces the highest risk of disruption. Per the study:

-

- 71% of millennials would rather go to the dentist than listen to what banks are saying

-

- 53% don’t think their bank offers anything different than other banks

-

- 73% would be more excited about a new offering in financial services from Google, Amazon, Apple, PayPal, or Square than from their own bank (Hmmm Apple Pay anyone?)

- 33% believe they won’t need a bank at all in five years

Ouch.

Making Relationships A Reality

At conferences and industry events, stats like those mentioned above are tossed around like grenades. Credit unions are inundated with ideas and strategies on how to build meaningful relationships with young adults, but the numbers from CUNA’s survey seem to indicate that results may be lacking.

But what about simply offering a product that we know for a fact is needed by millions of college-age kids every year? Helping families navigate the confusing maze of how to best pay for college, while also offering a fair-value private student loan to those who need to fill educational funding gaps, is proving to be a very powerful connection source for many credit unions.

Now that many of those credit unions have more than five years of experience offering this type of loan solution, it’s becoming clear that not only can this asset class perform extremely well (with annualized charge off ratios of less than 0.70%), but these borrowers are bringing real relationships and true member value to the credit union.

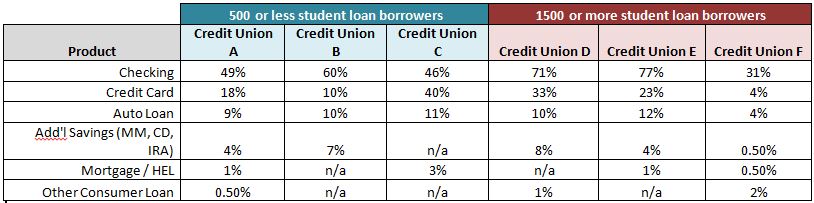

Six credit unions (ranging in assets from $250 million to $5 billion), all offering a private student lending program through Credit Union Student Choice, recently analyzed their student lending borrowers. The numbers paint a very positive picture.

Average checking account penetration was nearly 56%, while more than 21% had a credit card. Another strong indicator was that more than 9% had an auto loan with the credit union. According to one lender, total deposit balances for their student loan borrowers was more than $4.6 million while total loan balances (outside of their student loans) were approximately $3.7 million.

Although credit unions are still working to track the sequencing of account relationships in order to determine when loan and deposit accounts were opened in relation to the student loan, it is clear that these young adults are not simply indirect borrowers. They present credit unions with a genuine opportunity to deliver a lifetime of financial services, an idea not lost on other lenders.

In announcing its expanded student loan consolidation program in September, Citizens Bank referenced the importance of offering a student lending product in order to attract young, college-educated borrowers who will eventually need a mortgage, car loan, and other financial products.

The time to engage this important segment of future borrowers is during the most critical stage of their young financial lives financing higher education. Through the delivery of fair-value loans and corresponding education, credit unions can help, while also earning the loyalty that will translate to productive, long-term member relationships for years to come.

This article originally ran on CreditUnions.com on September 19, 2014.