Deep diving into data is an art and a science at Charlotte Metro Credit Union ($340.8M, Charlotte, NC), where The Matrix cuts Big Data down to size.

That’s the Cooper-Leavell Matrix, devised by Paul Leavell, senior marketing analyst, and David Cooper, the credit union’s vice president of information systems, as a way to define what they can and can’t do with the vast, shifting stores of bits and bytes now known as Big Data.

|

| Paul Leavell is senior marketing analyst at Charlotte Metro Credit Union. |

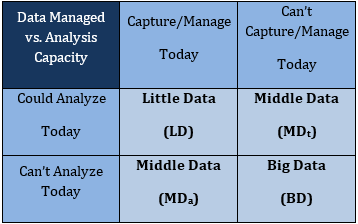

The Cooper-Leavell Matrix matches the data’s accessibility with the credit union’s ability to analyze. Conceptually, it divides data into Big Data, Middle Data, and Little Data. In action, it drives creative, tightly targeted marketing strategies that have yielded strong member response and positive ROI.

Here’s how this matrix categorizes data:

- Big data is that which the credit union can neither capture nor analyze.

- Middle data is that which it can either capture or analyze, but not both.

- Little data is that which it can both capture and analyze.

Put it all together, and it looks like this:

The Cooper-Leavell Matrix is a way to categorize data in terms

of its accessibility and utility.

The matrix was devised to be perfectly scalable, Leavell says. Big Data for us is different from Big Data for Navy Federal. But for either, the moment you’re able to acquire the data and analyze it, it moves from Big Data to Little Data.

The matrix was devised to be perfectly scalable. Big Data for us is different than Big Data for Navy Federal. But for either, the moment you’re able to acquire the data and analyze it, it moves from Big Data to Little Data.

Little Data, Big Results

Little Data is yielding big results at Charlotte Metro, helping the North Carolina credit union post peer-busting numbers across several major metrics.

A particular success Leavell points to was a campaign around the credit union being there for life changes, as indicated by such things as name changes and purchases at jewelry, bridal, and baby stores. Email response rates of 2.1% to as high as 8.0% and an average ROI of $5,132 per month resulted from targeting recipients selected by running analytical software against data already in the credit union’s core processing system.

It might sound complicated, but it’s really just knowing how to look for interesting relationships between variables.

An easy place to start is where members are buying things, Leavell advises. Are there connections between purchase activity and relationships at the credit union? Spend time identifying the relationships, test those findings, and then automate the process of outreach and tracking.

That approach also helped Charlotte Metro scored big on a PayPal/iTunes email campaign that paid a $50 credit to members who opened a new credit card account. What makes it worth it? Knowing that people who use services like PayPal and iTunes average 12.34 transactions a month compared with 3.56 for those who don’t. Plus, their average profitability is also much higher.

Charlotte Metro has built a successful return to credit card issuing with this approach.

We’ve hit 12% penetration in credit cards after re-starting the portfolio three years ago, Leavell says.

Crunching At The Core

CU QUICK FACTS

CHARLOTTE METRO Credit Union

data as of 3.31.15

- HQ: Charlotte, NC

- ASSETS: $342.1M

- MEMBERS: 45,094

- BRANCHES: 8

- 12-MO SHARE GROWTH: 5.37%

- 12-MO LOAN GROWTH: 7.81%

- ROA: 1.19%

- CORE PROCESSOR: Symitar

- MCIF/CRM: Raddon’s iNTEGRATOR

- ONLINE BANKING: Jwaala

- MOBILE BANKING: AccessSoftek

- RDC: Bluepoint Solutions

- BILL PAY: ACI

Charlotte Metro uses data it has stored in its Symitar Episys core processing system and peripherals such as its MCIF software from Raddon, where Leavell worked for six years before he joined Charlotte Metro in 2012.

The credit union analyzes data using popular programs including Excel, Microsoft’s MapPoint and, a Leavell favorite, IBM’s Statistical Package for Social Sciences.

I’m a big believer in SPSS, Leavell says. It helps us sort out things such as when differences in profitability are significant or not.

Leavell says the email campaigns involve little effort once everything’s in place. Once the credit union sets the variables, it can quickly and easily generate lists and send emails.

It takes me 10 minutes a month, maybe, and the core system does all the tracking, Leavell says. The marginal costs are practically zero.

Working with data has also helped the working relationship among people at Charlotte Metro. Silos have broken down between marketing and IT as Big Data for some becomes actionable Little Data for all.

That happens, for example, when we put in the top 30 merchants used every month by every member, covering everything our members use except physical checks bill pay, ACH, credit card, debit card, it’s all there, Leavell says. And I’m sure there’s data in accounting we’re not even aware of yet that we could use.