Star One Credit Union($7.32B, Sunnyvale, CA) is an efficient credit union. Its first quarter efficiency ratio of 44.57% was the third-lowest among the 237 credit unions with $1 billion or more in assets, according to data from Callahan & Associates.

The big Silicon Valley credit union’s ability to onboard new members and accounts online is a good example of how it got that way. The 94,000-member credit union has only five branches and opens approximately 22% of its new memberships each monthonline.

CU QUICK FACTS

STAR ONE CREDIT UNION

Data as of 03.31.15

- HQ: Sunnyvale, CA

- ASSETS: $7.32B

- MEMBERS: 93,691

- BRANCHES: 5

- 12-MO SHARE GROWTH: 7.62%

- 12-MO LOAN GROWTH: 5.77%

- ROA: 0.76%

About 80% of those applicants upload the signature card and other documents; the rest mail them, says Margarete Mucker, Star One’s vice president of remote services. The credit union is now working on expanding funding options for new accounts,which should help it build on its top quartile performance in share growth, as well.

Here Mucker shares some insight on how Star One opens, funds, and follows up on new members and accounts.

How long have you offered online account opening?

Margarete Mucker: We began offering online account opening through uMonitor [now D+H] for the web in 2006. Along with new member applications, we have a single sign-on behind the PIN that allows existing members to open in real-time checking,sub savings, and certificate accounts.

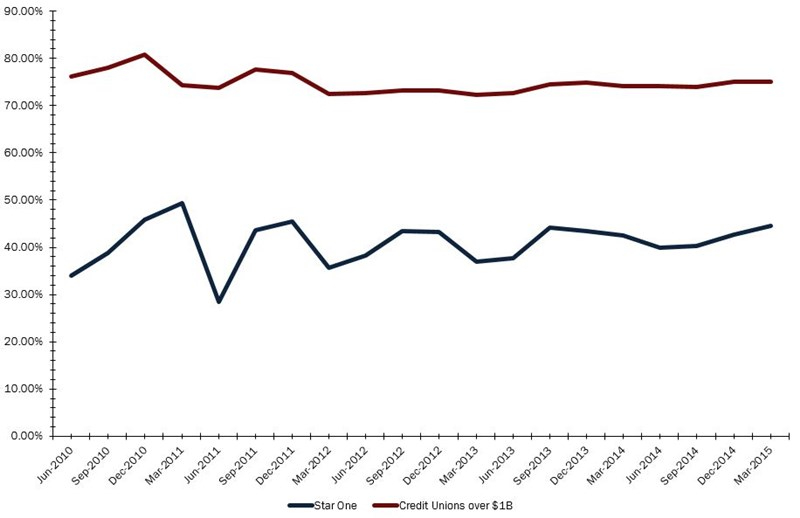

EFFICIENCY RATIO

Data as of 03.31.15

Callahan & Associates | www.creditunions.com

Online account opening helps Star One post some of the lowest efficiency ratios in the industry.

Source:Peer-to-Peer Analyticsby Callahan & Associates

How do members fund accounts?

MM: We prepopulate member information, and existing members can select which product to open and fund from existing accounts. New members can fund via ACH or by check. We are in the process of providing a credit card funding option. Wepreviously did not offer this funding method due to the additional expense.

What accounts are available for online opening, beyond general membership?

MM: We offer trust and transfers to minors applications in addition to the regular membership account. We also allow checking, additional sub savings, and certificate accounts. No loans or credit cards at this time, but we do providepreapproval for car loans or lines of credit, if the applicant qualifies.

Staff follows up on every application to ensure the new members have everything they need. The marketing department also has an onboarding process that sends multiple letters to members within the first three months of opening that extol the benefits of membership, checking accounts, and our Visa cards.

Through what channels can members open an account online?

MM: Our primary channel is the regular web. We are currently working with our account opening provider D+H and our mobile banking vendor Tyfone to bring account opening to the mobile platform for Android and Apple tablets and smartphones.And we are working on providing e-signatures to make the online account opening process even more convenient.

Would anyone be able to open an account through their phone?

MM: We might limit this initially to existing members opening additional accounts and then later for new membership applications.

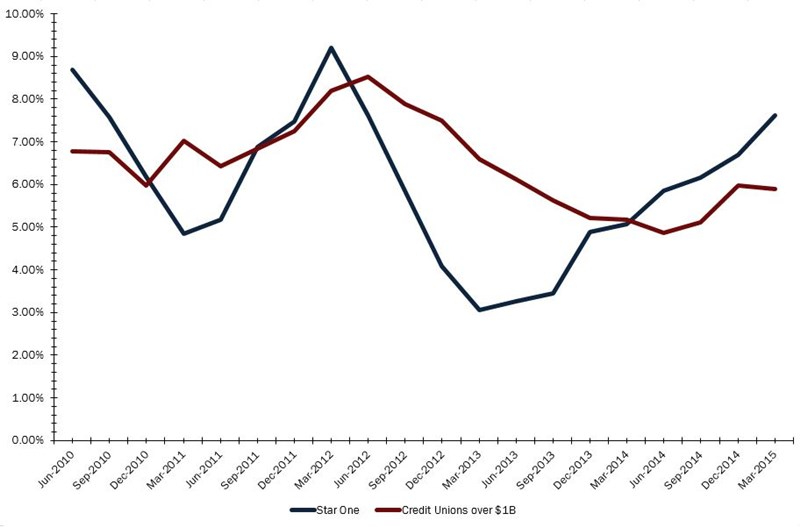

SHARE GROWTH

Data as of 03.31.15

Callahan & Associates | www.creditunions.com

The ability to electronically open and fund accounts helpsStar One post above-peer share growth numbers.

Source:Peer-to-Peer Analyticsby Callahan & Associates

How long does it take to open an account? How do you limit abandonment?

MM: It takes 10 to 15 minutes to open an account. We follow up on applications that are not completed within 30 days. Our abandonment rate is low.

How do you follow-up on new accounts, both for welcoming new members and cross-selling?

MM: Staff follows up on every application to ensure new members have everything they need. The marketing department also has an onboarding process that sends multiple letters to members within the first three months of opening that extolthe benefits of membership, checking accounts, and our Visa cards.

What advice do you have for credit unions that want to better engage members opening accounts online?

MM: Always follow up on incomplete applications don’t let a prospective member slip away. Also, use the application to run compliance requirements such as OFAC and CIP in the background. Online provides consistency and ensuresevery requirement is met.

What are lessons you’ve learned in nearly a decade of online account opening?

MM: Listen to members and employees about their online experiences and adapt your online application, if possible, to their suggestions for improvement.

What kind of reaction do you get from members and potential members?

MM: Members appreciate the technology and convenience; we know that they want it and are ready to use it.

You Might Also Enjoy

- Don’t Just Onboard, E-Board

- How To Boost Retention, Reduce Attrition, And Improve Member Engagement

- 5 Credit Unions Share How To Onboard EMV, Apple Pay, And RDC

- Indirect Lending And Onboarding At Grow Financial