In late 2010, Marshall Tanneberger wanted to put solar panels on his house. It was a bright idea that proved difficult to execute.

I could not find anyone that would finance solar projects at a term and rate below my monthly utility bill, says the vice president of lending at San Diego Metropolitan Credit Union ($252.3M, San Diego, CA). Not in all of California.

Tanneberger took out a five-year balloon from a California credit union and continues to pay on it. However, the search inspired him to develop a residential solar program at SDMCU that not only serves a member need but also helps the credit union reduce concentration risk in its loan balance sheet.

ContentMiddleAd

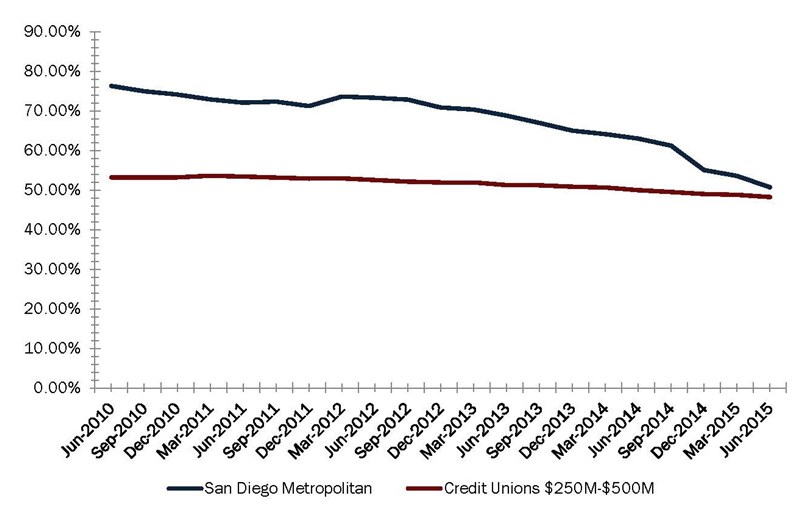

We were mostly doing real estate loans, and our examiners wanted us to reduce our concentration, Tanneberger says. Indeed, in first quarter 2010, real estate loans comprised 77.5% of SDMCU’s total loans compared to 53.2% for its asset-based peers, according to Callahan’s Peer-to-Peer data.

REAL ESTATE LOANS/TOTAL LOANS

FOR SAN DIEGO METROPOLITAN | DATA AS OF 06.30.15

Source: Callahan & Associates.

We weren’t big into indirect auto, Tanneberger says. So I said why don’t we do solar?

Solar At SDMCU

SDMCU’s solar program is much like an indirect auto program, Tanneberger says. The credit union leverages relationships with solar system contractors in the state though it is limited to serving individuals who qualify for membership. This includes residing or working in San Diego County and being part of various SEG membership groups, including some in areas outside the county.

It’s all about the relationships, Tanneberger says. Without the relationships you don’t have the program.

CU QUICK FACTS

San Diego Metropolitan Credit Union

Data as of 06.30.15

HQ: San Diego, CA

ASSETS: $252.3M

MEMBERS: 15,961

BRANCHES:3

12-MO SHARE GROWTH: -0.6%

12-MO LOAN GROWTH: 1.6%

ROA: 0.99%

SDMCU initiated the program in June 2011, and developed it slowly. The credit union spent the first two years identifying contractors it wanted to do business with based on a variety of factors including expertise and systems quality and built relationships from scratch. It offered workshops before the program started that provided training for and answered questions from solar contractors. This helped the credit union determine what contractors needed and wanted from financiers.

By the end of 2011, SDMCU had funded between $2 and $3 million in loans and built relationships with 12 contractors, Tanneberger reported. Today, the credit union works closely with the California Center for Sustainable Energy, which provides resources for SDMCU’s workshops, and has 220 contractor relationships.

Although the credit union bases its financing on a variety of factors including BBB rating and required licenses from qualified contractors, the quality of the solar system, and the location of the property the average cost is between $4 and $5 a watt, with an average capacity of seven kilowatts. Adding labor and equipment, the cost of a solar system generally runs from $30,000 to $50,000.

SDMCU offered rates from 4.99% to 7.99% and terms of five, 10, 15, and 20 years. But in order to remain flexible and compete with other solar financers such as EnerBank in Salt Lake City, that offers first and second bridge loans, the credit union has a special program for 12 years with payments as low as 1.89% APR. In that scenario, the contractor buys the rate down.

We don’t charge the member a fee, Tanneberger says. We charge the contractor a fee to participate in the Program to offer their customers a lower rate.

All in all, according to Tanneberger, SDMCU’s return on its solar program averages 5.0% – 7.0%.

The State Of Solar

California is the leading solar market in the United States. According to the Solar Energy Industries Association (SEIA), California installed more solar in 2014 than the entire country did from 1970 to 2011. The $11.7 billion Californians invested in solar installations in 2014 represents a 66% increase over the previous year, according to the SEIA, and the 10,695 megawatts of solar energy currently installed in the state produces enough energy to power 2,599,000 homes.

The opportunity in renewable energy is a hot spot in the Golden State. The state’s HERO Program provides financing for energy-efficient products, such as solar panels. HERO finances 100% of the cost to purchase and install eligible products but requires the purchaser to have 10% – 15% equity in his home. It does not have a credit score requirement and borrowers can make payments through property taxes. The loan generally cannot be subordinated behind a First Trust Deed and there are additional fees charged to the borrower, which include a 4.99% administration fee, a $95 recording fee, and a $35 annual assessment administration fee. Plus, the interest may be tax deductable.

And in 2008, the state enacted tax credits as part of the Emergency Economic Stabilization Act that included $18 billion in incentives for clean and renewable energy technologies as well as for energy efficiency improvements, allowing California solar consumers to use federal tax incentives, through the Energy Policy Act of 2005, to reduce the cost of purchasing and installing eligible solar systems by as much as 30%.

The act expires on December 31, 2016, and California residents are wasting no time installing solar systems while the costs are still subsidized, Tanneberger says.

Profitability And Performance

The NCUA and the California Department of Business Oversight tightly regulate SDMCU’s solar program, Tanneberger says, primarily because solar lending is a relatively new loan product.

They hadn’t seen it before, he says. They weren’t sure how it was going to work or how they were going to do due diligence for it.

It’s hard to climb on the roof and take off those solar panels if a member goes into default. It’s not like a car where you can repossess it.

The credit union has three underwriters that review the loans from contractors. The underwriters look at a variety of factors, but the two most important are the borrower’s ability to repay and their FICO score, which has to be 650 or higher. If a member meets these these underwriting criteria, the credit union considers them a good risk. Equity in a borrower’s home is not a requirement to obtain a solar loan, and SDMCU can subordinate the loan behind the First Trust Deed. The interest paid is considered tax deductible.

It’s hard to climb on the roof and take off those solar panels if a member goes into default, Tanneberger says. It’s not like a car where you can repossess it.

Out of the $75 million in solar loans the credit union has made to more than 2,800 home owners, cumulative losses are less than $10,000.

Still, there is risk the credit union wants to mitigate. It caps the maximum loan amount to $50,000. It also asks contractors to pay a marginal fee to participate in the program, which is less than the 4.99% participation fee HERO charges borrowers. Lastly, SDMCU files a UCC1 on the product to establish priority on the solar equipment in the case of default or bankruptcy. The credit union will subordinate, however, to accommodate a refinance. The HERO program does not subordinate should a borrower elect to refinance their mortgage.

Cap And A CUSO

By its own policy, SDMCU limits individual residential loans to approximately $50,000, although it will make exceptions for stronger borrowers. And to accommodate its desire for a diversified loan portfolio, it caps its solar loans at 350% of its net worth. As of second quarter 2015, it was at 225%.

If it were to reach that threshold, Tanneberger envisions getting board approval to raise the cap and sell the loans as participations. For now, to generate additional revenue, Tanneberger is building a platform that will allow the credit union to sell 90% of its solar loans to lenders and brokerages for a servicing fee.

Although the credit union’s field of membership is limited to San Diego County and local SEGs, the market for solar extends throughout California. According to Tanneberger, a CUSO could meet the solar needs of the entire state. As alternative energy and water conservation remain top priorities for the state, the future for solar in California is strong.

This article first appeared on CreditUnions.com in Aug. 2015.