Warren Federal Credit Union ($595.5M, Cheyenne, WY) is rewarding its members for swiping things, in this case their debit cards at the rate of five cents a transaction.

The 54,771-member institution launched its Earn 5 rewards account last October. It’s one of five free checking programs the credit union offers, and one of only two that offers rewards. The other one offers up to 2% interest, but that doesn’t serve the many members who don’t maintain significant balances but do use their debit cards a lot.

Warren designed the Earn 5 account to be easy and automatic. Participants must enroll in e-statements, have at least one automatic debit or credit to the account, and complete at least six point-of-sale purchases every month. The first five don’t earn the nickel, but the fifth one does, and the credit union automatically deposits the cash at the end of the month. The cashback limit is $25 a month, but even the heaviest users earn much less than that approximately $4 a month for their 85 swipes.

Members enroll in Earn 5 by calling a toll-free number or going to one of Warren’s eight branches in Wyoming and Colorado. And there’s no monthly fee, no minimum balance, and no penalty on the account for not earning rewards.

We based this card on people who like to spend instead of those who like to save, and it’s working very well for them and for the credit union.

Steve Salazar, Warren’s vice president of marketing, says the results have been better than expected both in terms of earning new members and higher non-interest income.

We hoped to open 25 new accounts in the first month, and we got 101 in the first two months, he says. We based this card on people who like to spend instead of those who like to save, and it’s working very well for them and for the credit union.

Earn 5 generated $10,051.72 in interchange income during its first five months and paid out $1,350.60 in rewards. For those keeping score, like CFO Kim Alexander, that’s net income of $8,701.12.

And those numbers are growing. Members made 208 transactions during the first month of Earn 5’s availability and 9,517 in the fifth.

For credit unions that have a lot of savers, take note. This program is not just for the young folks who would rather earn rewards based on spends rather than balance.

We knew a lot of millennials would go for this, but we also see a lot people from our older demographics, too, says Warren marketing manager Mindy Peep.

EARN 5 RESULTS

For all U.S. credit unions | Data as of 12.31.15

Callahan Associates | www.creditunions.com

| Income Month | Qualified Transactions | Dividends Paid | POS Sig Tran Income / Tran | POS PIN Tran Income / Tran | Average Interchange Income Per Month | Earn-Five Net Income |

|---|---|---|---|---|---|---|

| October-15 | 208 | 10.40 | 0.450 | 0.220 | 76.23 | 65.83 |

| November-15 | 3,852 | 192.60 | 0.450 | 0.230 | 1416.80 | 1224.20 |

| December-15 | 6,512 | 325.60 | 0.460 | 0.240 | 2435.07 | 2109.47 |

| January-16 | 6,923 | 346.15 | 0.460 | 0.220 | 2559.85 | 2213.70 |

| February-16 | 9,517 | 475.85 | 0.460 | 0.220 | 3563.77 | 3087.92 |

| TOTALS | 27,012 | 1,350.60 | 10,051.72 | 8,701.12 |

Source: Peer-to-Peer Analytics by Callahan Associates

In addition to generating immediate NII income, Earn 5 shows promise as a relationship builder. The average age of Earn 5 participants is 28 to 30. Many have modest incomes and a first auto loan or mortgage in place or on the way, and they’re not particularly loyal to any given institution.

Rewards for balances don’t really matter to them, Salazar says. But they’ll swipe that card all day long.

Earn 5 participants are also savvy but busy, which played into the credit union’s marketing strategy.

We looked at a lot of things based on the nickel idea, like making nickels fall from the sky, the marketing vice president says. But we wanted to keep it professional, too, so we decided the Earn 5′ idea would work well.

Warren FCU’s marketers know their market. Learn how they generated goodwill with a do-good campaign aimed at attracting young members.

It’s simple yet polished.

Warren already is well-experienced in targeting its younger demographic and using social media marketing tools, and in this case focused on Instagram and movie theater ads for the initial Earn 5 launch. Earn Money While You Spend is the program’s tagline, and its home page includes a You Tube video.

NON-INTEREST INCOME/MEMBER

For all U.S. credit unions | Data as of 12.31.15

Callahan Associates | www.creditunions.com

Source: Peer-to-Peer Analytics by Callahan Associates

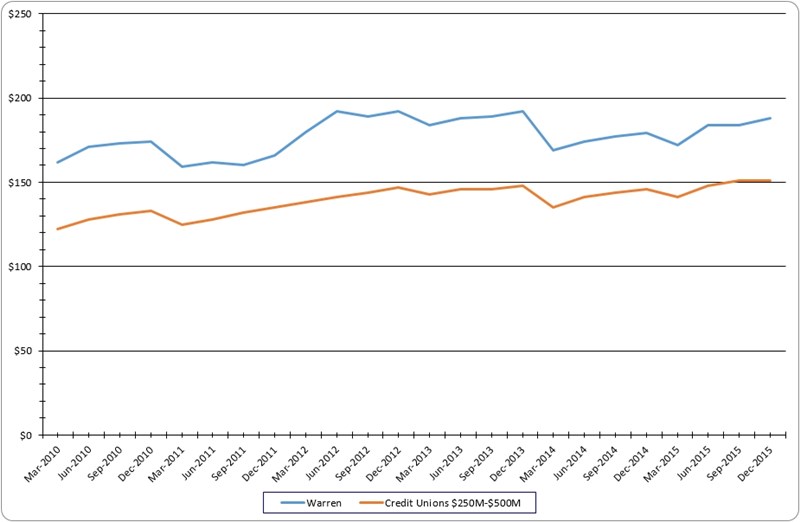

Warren FCU is a profitable institution. Its ROA of 1.11% in the past quarter is well above average, and generating non-interest income is a key component of that, garnering $10.3 million, or approximately 30% of its total income at year’s end, right at the average for its peer group.

The credit union also reported making an annualized $188 in NII per member in the fourth quarter, well above the $151 reported by the average credit union of $500 million to $1 billion in assets, according to data from Callahan Associates.

Providing member value while keeping things simple is one key to Warren’s success, but so is learning from what didn’t work so well, such as a promotion last year at its Fort Collins, CO, operation and Colorado State University.

We offered these awesome Under Armour backpacks and thought people would rush through our doors, Peep says. All they had to do is sit down with a member services representative and see where we could help.

Unfortunately, members and potential members shied away from those direct discussions, Peep says. So now the credit union offers debt consolidation and low-interest credit cards digitally, in a much less invasive way.

Don’t reinvent the wheel. Get rolling on important initiatives usingdocuments, policies, and templates borrowed from fellow credit unions. Pull them off the shelf and tailor them to the credit union’s needs. Visit Callahan’s Executive Resource Center today.

As for Warren’s debit card payback strategy, the credit union advises its fellow cooperatives to make sure operations can handle something that’s simple on the consumer end but can be complicated in the back office.

Give yourself plenty of time to ensure your core system can handle it, says Salazar, the marketing vice president. Make sure your program planning and management includes a good look at all the resources you’ll need to make sure Earn 5 can work.

You Might Also Enjoy

- A Strategy To Build Non-Interest Income One Transaction At A Time

- Clear Connections Emerge Between CUSO Activity And Diversified Earnings

- Sell Mortgages. Reap Non-Interest Income.