Read the full analysis or skip to the section you want to read by clicking on the links below.

LENDING AUTO LENDING MORTGAGE LENDING CREDIT CARDS MEMBER BUSINESS LENDING SHARES INVESTMENTS MEMBER RELATIONSHIPS EARNINGS SPECIAL SECTION: CUSOS

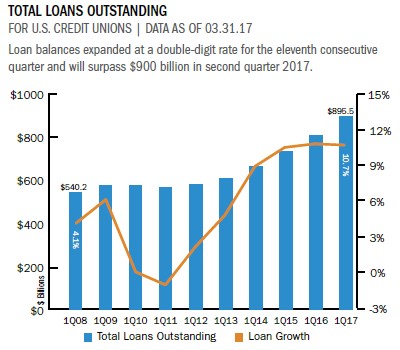

First quarter 2017 marked the 11th consecutive quarter that credit unions have posted double-digit lending growth. Total loan balances are now approaching $900 billion and will likely surpass that mark in the second quarter. Loan growth outpaced deposit growth in the first quarter for the fourth straight year and pushed the industry’s loan-to-share ratio to 77.7%.

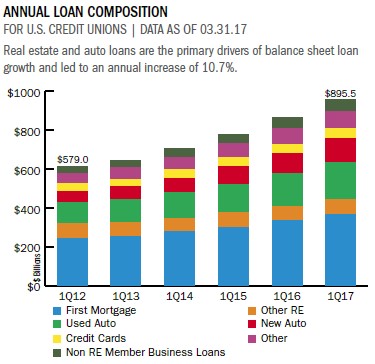

New and used auto loans combined with first mortgage lending predominately underpinned the industry’s loan growth of 10.7%. At 34.6%, the share of auto loans in the industry’s loan portfolio is second only to first mortgages at 40.9%. But the gap between the two is diminishing. New auto loan growth in the first quarter hit 16.6%. This is the second-fastest rate of the past five years. Used auto loans posted a 12.1% annual growth rate. Auto market share for credit unions reached a new record high of 18.8%. Meanwhile, first mortgage balances expanded 10.2% since March 31, 2016, and hit $33.8 billion. This is the second-largest dollar amount gain behind new and used auto loans.

Member business lending (MBL) gained momentum with the passage of the NCUA rule granting greater flexibility for business loans. MBL balances grew at 15.2% and have more than doubled since the Great Recession.

Credit unions originated $112.9 billion in loans in the first three months of the year the highest first quarter amount to date. The average amount of loan originations per full-time equivalent employee increased 8.4% year-over-year and neared $400,000 as of March 31, 2017.

Quickly find out if your credit union is keeping pace with the industry’s robust lending numbers with Callahan’s analytics software. Learn more today.

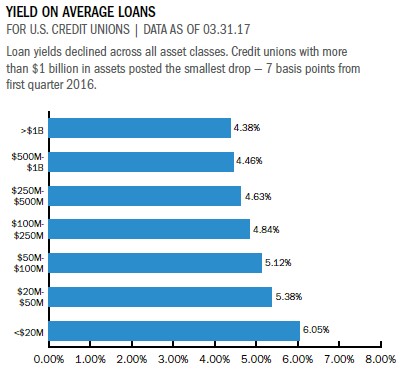

Despite gradually increasing interest rates, the industry’s average yield on loans declined 9 basis points to 4.52%. Due to loan portfolio differences, a negative correlation between loan yields and credit union asset size exists. Credit unions with less than $20 million in assets posted the largest loan yield of any asset class, 6.05%, whereas returns incrementally decrease to 4.38% for credit unions with more than $1 billion in assets.

Despite an expanding loan portfolio, credit unions are maintaining sound asset quality. Delinquency rates declined 2 basis points year-over-year to 0.69%.

Click the graphs below to enlarge and then continue reading to see how The Ohio Educational Credit Union builds a better leasing program.

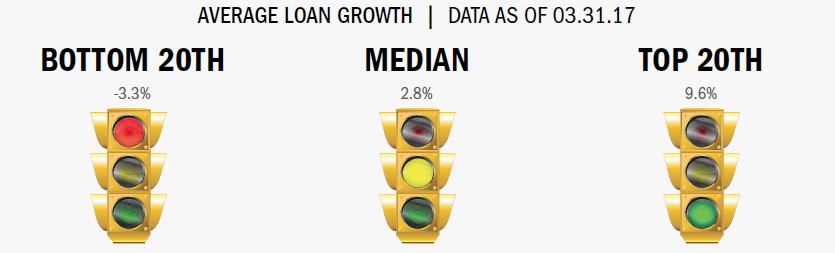

Larger institutions underpinned the growth in average loan balances across the country. Whereas the median growth rate increased 2.8 percentage points, credit unions in the top 20th percentile posted gains of 9.6% per loan.

CASE STUDY

THE OHIO EDUCATIONAL CREDIT UNION

The Ohio Educational Credit Union is one of fewer than 10 credit unions of its size nationwide that offers automotive leasing and has generated more than $650,000 in net income in that specialized lending channel since launching it three years ago.

The Cleveland credit union already had a strong indirect lending business and going into leasing seemed a natural fit, says its longtime chief financial officer Art Boehm. Now, more than 90% of OHecu’s auto loans are from indirect lending, putting it in the top 10% in that metric for all U.S. credit unions.

Many of our members already preferred leasing over purchasing, Boehm says. Indirect leasing provided an avenue to capture new business that would end up with the banks and captives.

But OHecu doesn’t expect many of those new lessees to become fullservice members.

Consumers view auto purchase and leasing as a transaction with little or no connection to their primary financial institution, Boehm says.

Instead, OHecu considers indirect lending and leasing as an alternative to investments.

Leasing has been a major contributor to improving our profitability, the veteran CFO says. He says indirect leasing has added $200,000 more to the credit union’s net income over what would have been generated by just investing the credit union’s cash.

OHecu uses a third-party partner to process the leases that OHecu then services. The credit union sets the lease money factor, comparable to an interest rate on a loan, while its vendor sets the residuals and disposes of the vehicles after the leases expire.

The money factor must be competitive with the market, Boehm says. It’s a combination of that and residual value that determines the monthly lease payment and whether we’re competitive to get the deal.

Read The Whole Story