Mazuma Credit Union ($524.3M, Overland Park, KS) has shaken up its lending portfolio since 2012, when Brandon Michaels took the helm as president and CEO and built his executive dream team.

Over the past three years, the credit union has tossed outdated lending practices and introduced products and strategies to strengthen the bottom line as well as member bonds. Want to know how the credit union tightened, lightened, and doubled down in all the right ways? Read on.

Tighten

Product-based efforts such as providing payday lending alternatives, refocusing on auto and home lending, and streamlining fee structures have all been part of the process to reshape Mazuma’s portfolio.

Prior to these undertakings, a lack of tracking and communication among departments resulted in critical oversights and unwanted surprises, including issues like business and mortgage portfolios being backed by the same collateral.

Silos happen because of a lack of trust, Michaels says. But when you start building trust, you can more easily break down those siloes.

We’re going to a new level by using analytic software to see where our opportunities are for helping members improve their financial lives.

To reduce risk, the credit union sold $25 million in mortgages and created a risk management committee to work with executives, senior leadership, and the board to categorize, quantify, and assess the credit union’s appetite for risk in each area of lending.

In addition to cleansing its loan portfolio, it also simplified its roster of 25 or so fees. It eliminated some fees completely such as for the purchase of gift cards and reduced others. The move drove a 7% annual drop, approximately, in fee income as of second quarter 2015. But the credit union plans to replace those earnings in other, healthier ways.

We’re going to a new level by using analytic software to see where our opportunities are for helping members improve their financial lives, says Justin Mouzoukos, Mazuma’s chief financial officer.

And better serving these needs is also improving the credit union’s financial life as well.

LOANS PORTFOLIO COMPOSITION

For all U.S. credit unions | Data as of 06.30.15

Callahan & Associates | www.creditunions.com

The credit union’s two biggest priorities mortgage and auto are well reflected here. Yet it’s the CUSOs and focus on additional market needs also contribute to a diverse portfolio.

Source: Peer-to-Peer Analytics by Callahan & Associates

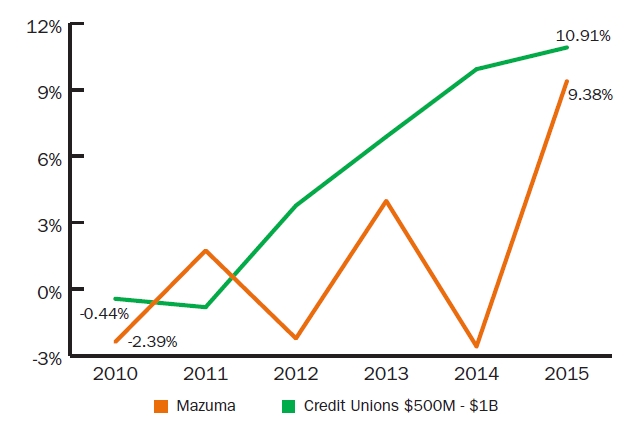

LOAN GROWTH

For all U.S. credit unions | Data as of 06.30.15

Callahan & Associates | www.creditunions.com

Mazuma suffered some growing pains during its cultural reorganization, but loan growth is closing in on comparable peers.

Source: Peer-to-Peer Analytics by Callahan & Associates

Income at Mazuma through June 2015 totaled $16.9 million, according to Callahan data; that’s up approximately 50 basis points from last summer. Loan income was up 12.1% in the same period, driven by a 17.8% gain in auto lending to $88.8 million and a 5.0% jump in real estate loans to $158.2 million at midyear.

Overall, loan originations totaled $61.9 million at the end of June 2015, a solid 24.9% gain over the $49.6 million posted one year prior.

Share growth was 5.6% in the second quarter while ROA was 0.7%, down from 1.2% at this point last year. Net income, however, was sharply lower this year and operating expenses were up as the credit union spent heavily on its new headquarters building in Overland Park, KS, and adopted several new tactics to better track income versus expenses.

We started branch accounting years ago but have since layered on branch profitability, product profitability, and lending analytics, Mouzoukos says. To me, it’s all opportunity; however, just reporting numbers has no impact on the direction of the credit union.

Rather, he adds, it’s up to Mazuma to use that information to figure out what its members need and provide it.

For example, the credit union’s website now includes a Drive Happy section that includes auto calculators, rates, and other shopping tools. In addition, its Visa credit card that is affiliated with Kansas City’s professional soccer team offers reward points redeemable for tickets, souvenirs and wearable gear, and exclusive experiences at the team’s stadium. The same location is also now home to the Mazuma Mezzanine, a branded area for enjoying a drink and snack while watching the match.

Lighten

A look at Mazuma’s past performance reveals notable swings in metrics such as loan delinquencies and return on assets throughout 2013. This is the result of a calculated whittling down of the organization’s member business lending portfolio.

As part of the reorganization he led in 2012, Michaels brought in a team of MBL specialists who cut roughly $45 million in holdings deemed too risky and not local-oriented enough to be a part of the credit union’s new lending strategy.

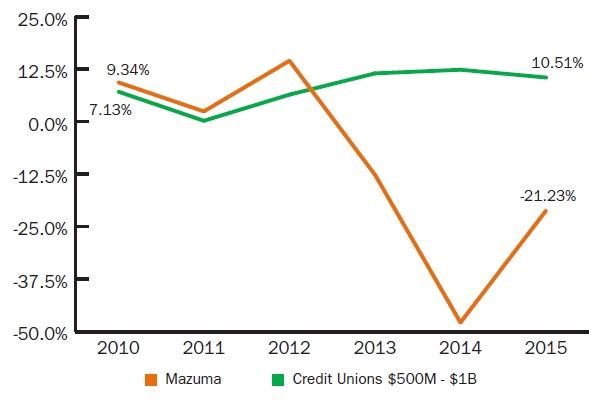

MEMBER BUSINESS LOAN GROWTH

For all U.S. credit unions | Data as of 06.30.15

Callahan & Associates | www.creditunions.com

Mazuma shed nearly 75% of its MBL portfolio in 2013 and has since begun rebuilding with an emphasis on local companies and more secure collateral.

Source: Peer-to-Peer Analytics by Callahan & Associates

Now, another team of specialists is rebuilding the MBL portfolio by concentrating on the meat-and-potatoes needs of area small businesses, including owner-occupied real estate loans and business equipment leasing.

Mazuma currently holds $15 million in its MBL portfolio and has $7 million in the pipeline. Executives expect these numbers to grow in both size and stability in the coming months thanks to new guidelines and what Michaels proudly calls an incredible team of Mazumans.

For example, the credit union now requires all MBL borrowers to have a deposit account with Mazuma. This sounds like a standard practice, but is something that was overlooked in the past. The credit union also now more consistently offers cards, sweep accounts, and other merchant services to existing borrowers to strengthen their business bond with the credit union.

We can serve the majority of businesses in our market, says Jamie Gray, Mazuma’s vice president of business partnerships. We just have to do our due diligence, ask the right questions, and provide the services they need.

To do that, Gray and his team spend their days making calls, linking up on LinkedIn, and generally making themselves visible throughout the organization’s market.

Double Down

When Mazuma hits a wall in its normal lending approach, it looks to its many outside credit union service organizations (CUSOs). To date, Mazuma boasts partial or total ownership in XtraCash LLC, SimpliFast LLC, InsureKC LLC, MemberInsure LLC, TruHome Solutions, TruHome Title Solutions, and the BYM Agency LLC, a well-established industry marketing outfit housed at the credit union’s headquarters.

Most of Mazuma’s CUSOs fall directly under the umbrella of its CU Holding Company, of which Larry Hayes is president and CEO.

People might say, payday loan users should be more financially responsible.’ But then they end up with more month than money and use a credit card to cover it. It’s the same behavior, just stigmatized differently.

The credit union’s market is a mix of low-, middle-, and high-income areas, yet many of its borrowers reside on the D-paper credit tier. These individuals in particular are good candidates for the payday lending alternative offered through Mazuma’s XtraCash CUSO, which patrons can access both online and at Mazuma branches. Then there’s SimpliCash, also a CUSO, which offers credit lines ranging from $200 to $1,500 as a next step beyond the $400 XtraCash limit.

Mazuma doesn’t hold loans from these organizations on its books, but that doesn’t dampen its service standards.

People might say, payday loan users should be more financially responsible,’ Hayes says. But then they end up with more month than money and use a credit card to cover it. It’s the same behavior, just stigmatized differently.

In light of this fact, serving those who would be a no-go for most mainstream financial organizations is a crucial part of Mazuma’s mission. That’s why both the credit union and its payday lending CUSOs are working on a way to identify E-grade paper consumers those with credit scores in the low 500s determine whether that number is rising or falling, and then help those on an upward trajectory continue their success.

We have the tools, and we’ve made investments in technology so we know when we can take this risk, CFO Mouzoukos says. You can price it right. You can.

A human touch is still needed, particularly in sensitive borderline cases, but for the CUSOs that serve the general membership, automation can help lenders keep better pace with growing demand.

For example, Mazuma is using CU Direct’s Lending 360 solution to ramp up its previously low automatic approval rates of 15-20%.

On the real estate side, Mazuma uses its own TruHome CUSO for origination support. TruHome’s inside sales team are CUSO employees and handle general mortgage inquiries, primarily from phone traffic, while its outside team employees of Mazuma handle branch traffic and originate new business through realtor and builder connections.

Originations from both channels funnel in to the TruHome loan origination system, where the CUSO’s support services process, underwrite, and service the loans.

The last of Mazuma’s CUSOs focuses on insurance.

It’s the most profitable business you can be in, Mouzoukos says. We’re offering our members a good product they need anyway.

Overall, Mazuma’s CUSOs were in a growth pattern in 2014, including the creation of two new service organizations. Altogether, these CUSOs provided $82,000 in net income in 2014 and now are on target to earn $671,000 in 2015.

CUSOs are a natural extension of the credit union philosophy of collaborating for the benefit of the organizations and the members they serve, Hayes says. We’re excited about the future here.

Creativity On Tap

Mazuma frequently counts on the creative services of an outside marketing agency that operates within the credit union’s own walls. Formerly known as Beyond Marketing LLC, the CUSO which is 90% owned by Mazuma changed its name to BYM Agency last year. It has its own space inside Mazuma’s headquarters building and specializes in serving credit unions, CUSOs, and other financial services organizations. It has handled merger communications for clients such as FedChoice FCU in Washington, DC, and developed a new media strategy for myCUMortgage. Back home, the agency provided much of the colorful creative associated with Mazuma’s own rebrand.