For the past four years, we’ve been living with abnormally low interest rates. Why haven’t rates normalized?

First, it took three years for the economy to establish firm footing after the recession. Second, every time it has appeared rates were ready to rise, something blocked the road. For example, a crisis in Greece (2013), Ebola (2014), the Chinese stock market meltdown (2015), and Brexit (2016).

Most of these caused little to no U.S. economic disruption, but the U.S. Fed-led global central bank coalition responded each time by pumping money into the system and squashing higher rates.

Make Dwight A TRUSTED Part Of Your Day

Read more insights from Dwight Johnston on TrustCU.com or register for his Daily Dose e-newsletter to receive his blogs straight to your inbox.

Read More Register Now

Global bond traders built leveraged positions of bonds, feasting on printed money and central bank promises of low rates. The narrative developed in the bond market to support such a low rate environment, relative to actual data, was a long-term scenario of disinflation/deflation in the U.S.

Traders bet the U.S. inflation rate would eventually fall to less than 1% and possibly 0%. The Fed would then likely drop the funds rate back to 0%.

Longer-term bond yields were rising slowly in August, but the election of Donald Trump changed the dynamic in the bond market and shook the theory of disinflation/deflation.

Trump’s promises of tax cuts and infrastructure spending raised the specter of an economic boost and higher deficits. But the crowning blow to bond traders was the possibility of what Trump’s trade policies would do. His threats on trade tariffs and trade agreements would ignite inflation regardless of the damage to the economy.

Long-term yields in the bond market jumped 40 basis points in three days, and the yield curve steepened dramatically. No longer could traders comfortably assume inflation pressures would never emerge.

As is the nature of fast-money traders, they over-reacted and started factoring four years of a Trump presidency in just a few days. Trump will get some of what he wants, but not all. Members of the House of Representatives, as well as some 26 senators, are up for re-election in two years. No one spoke of budget deficits in this election, but concerns lurk under the surface. Republicans can’t risk letting it get out of hand.

Trump will have more flexibility on trade, but I suspect the reality of his proposals will result in some modest changes. How much? Just enough so he can claim a victory.

The key point is long-term inflation expectations are changing, and rates should return to levels that reflect the economy and actual inflation.

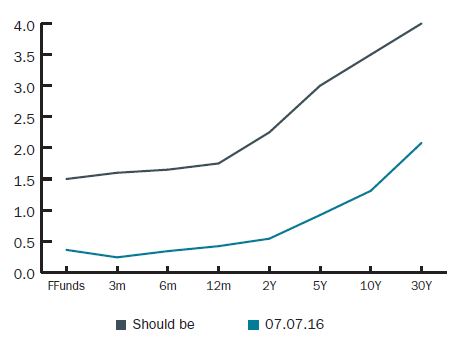

So, what is normal? Normal should look something like the top line in the chart below. I’ve included those alltime low rates in July as a point of reference.

The assumption in the chart is that inflation stays close to 2%, and the 10-year yield rises to historical spreads of the 10-year yield over the rate of inflation. The funds rate should actually be above inflation, but I’m factoring in an overly cautious Fed.

This is where rates should head over the next 12-18 months. But, who’s to say there won’t be other roadblocks in 2017? How about a populist movement in Europe overturns the governments of Germany, France, or Italy, and the European Union heads toward a final unpleasant resolution?

That might be the biggest risk, but no one knows what danger lurks in the weeds of 2017.

Dwight Johnston is the chief economist of the California and Nevada Credit Union Leagues and president of Dwight Johnston Economics. He is the author of a popular commentary site and is a frequent speaker at credit union board planning sessions and industry conferences.

The Normalization Of Rates In 2017

For the past four years, we’ve been living with abnormally low interest rates. Why haven’t rates normalized?

First, it took three years for the economy to establish firm footing after the recession. Second, every time it has appeared rates were ready to rise, something blocked the road. For example, a crisis in Greece (2013), Ebola (2014), the Chinese stock market meltdown (2015), and Brexit (2016).

Most of these caused little to no U.S. economic disruption, but the U.S. Fed-led global central bank coalition responded each time by pumping money into the system and squashing higher rates.

Make Dwight A TRUSTED Part Of Your Day

Read more insights from Dwight Johnston on TrustCU.com or register for his Daily Dose e-newsletter to receive his blogs straight to your inbox.

Read More Register Now

Global bond traders built leveraged positions of bonds, feasting on printed money and central bank promises of low rates. The narrative developed in the bond market to support such a low rate environment, relative to actual data, was a long-term scenario of disinflation/deflation in the U.S.

Traders bet the U.S. inflation rate would eventually fall to less than 1% and possibly 0%. The Fed would then likely drop the funds rate back to 0%.

Longer-term bond yields were rising slowly in August, but the election of Donald Trump changed the dynamic in the bond market and shook the theory of disinflation/deflation.

Trump’s promises of tax cuts and infrastructure spending raised the specter of an economic boost and higher deficits. But the crowning blow to bond traders was the possibility of what Trump’s trade policies would do. His threats on trade tariffs and trade agreements would ignite inflation regardless of the damage to the economy.

Long-term yields in the bond market jumped 40 basis points in three days, and the yield curve steepened dramatically. No longer could traders comfortably assume inflation pressures would never emerge.

As is the nature of fast-money traders, they over-reacted and started factoring four years of a Trump presidency in just a few days. Trump will get some of what he wants, but not all. Members of the House of Representatives, as well as some 26 senators, are up for re-election in two years. No one spoke of budget deficits in this election, but concerns lurk under the surface. Republicans can’t risk letting it get out of hand.

Trump will have more flexibility on trade, but I suspect the reality of his proposals will result in some modest changes. How much? Just enough so he can claim a victory.

The key point is long-term inflation expectations are changing, and rates should return to levels that reflect the economy and actual inflation.

So, what is normal? Normal should look something like the top line in the chart below. I’ve included those alltime low rates in July as a point of reference.

The assumption in the chart is that inflation stays close to 2%, and the 10-year yield rises to historical spreads of the 10-year yield over the rate of inflation. The funds rate should actually be above inflation, but I’m factoring in an overly cautious Fed.

This is where rates should head over the next 12-18 months. But, who’s to say there won’t be other roadblocks in 2017? How about a populist movement in Europe overturns the governments of Germany, France, or Italy, and the European Union heads toward a final unpleasant resolution?

That might be the biggest risk, but no one knows what danger lurks in the weeds of 2017.

Dwight Johnston is the chief economist of the California and Nevada Credit Union Leagues and president of Dwight Johnston Economics. He is the author of a popular commentary site and is a frequent speaker at credit union board planning sessions and industry conferences.

Share this Post

Latest Articles

Fed Leaders Hope To Avoid Repeating The Mistakes Of The 1970s

5 Valuable Governance Guidelines To Adopt Today

Markets Pare Back Pivot Expectations

Keep Reading

Related Posts

Fed Leaders Hope To Avoid Repeating The Mistakes Of The 1970s

5 Valuable Governance Guidelines To Adopt Today

Markets Pare Back Pivot Expectations

Fed Leaders Hope To Avoid Repeating The Mistakes Of The 1970s

Jason HaleyFor Good Governance, Make The Board Aware Of Liquidity Risk

Andrew LepczykInterest Margins Are Up. ROA Is Not.

Trace JerrettView all posts in:

More on: