Credit unions continued to grow members and loans to record highs in the second quarter and appear to be well-positioned to handle interest rate risk.

On Tuesday, Callahan Associates hosted its quarterly Trendwatch webinar, an event that recaps the industry’s performance trends over the past three months while highlighting credit union success stories and other areas of opportunity.

The nation’s credit unions posted 10.6% year-over-year loan growth in the second quarter, along with 7.5% share growth, and 7.6% asset growth, all according to data collected by Callahan Associates.

Here are three additional takeaways from the company’s Trendwatch webinar.

No. 1. Party Like It’s 2000

Credit unions now serve more than 106.4 million members. That total results from a 4% year-over-year growth rate, the fastest second quarter rate since 2000.

In addition, all but one state posted positive member growth rates, led by Delaware at 10.6%. The one state with a negative growth rate? North Dakota at -0.8%.

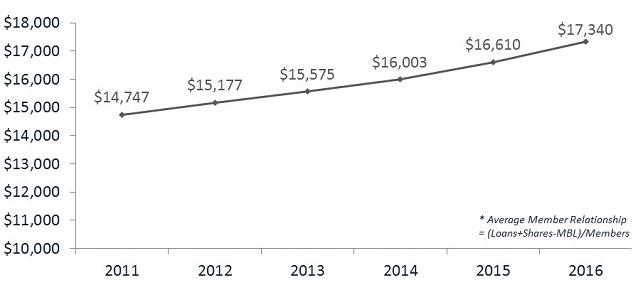

And while members are growing, so are core deposits and average member relationships. Core deposits such as share certificates, money market accounts, share drafts, and regular shares, have doubled over the past 10 years. The average member relationship expanded 4.4% to reach its highest level ever, at $17,340.

AVERAGE MEMBER RELATIONSHIP*

FOR U.S. CREDIT UNIONS** | DATA AS OF 06.30.16

Callahan Associates | www.creditunions.com

**For 5,976 credit unions

No. 2. The Lending Faucet Remains Fully Functional

The credit union industry continued its strong lending engine by posting double-digit growth at second quarter. As a whole, the industry originated more than $220 billion in loans in the first six months of the year, led in large part by consumer originations.

From second quarter 2015 to 2016, credit unions grew consumer originations from $117.4 billion to $133.9 billion, corresponding to a 14.1% rate.

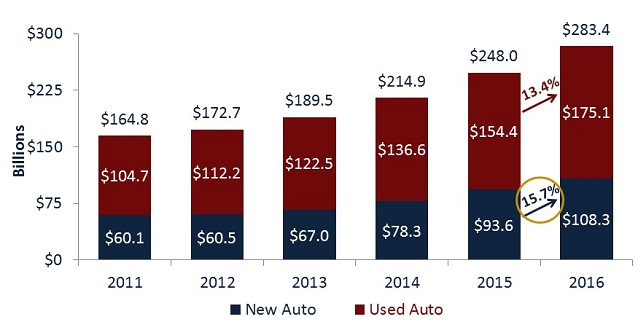

Auto loans continue to drive credit union consumer product offerings. At second quarter, credit unions grew both new and used auto portfolios by double digits, at 15.7% and 13.4% respectively. Total auto loan balances of $283.4 billion represents an approximate 14% growth rate year-over-year, as well as a new all-time high for the industry.

NEW VERSUS USED AUTO LOANS

FOR U.S. CREDIT UNIONS* | DATA AS OF 06.30.16

Callahan Associates | www.creditunions.com

*For 5,976 credit unions

No. 3. Positive Signs From An Interest Rate Risk Perspective

As balance sheets continue to grow in size and complexity, credit unions are facing the regulatory need to evaluate their risk exposure. However, key indicators suggest the industry is well-positioned to manage risk.

Fixed-rate long-term mortgages, as a proportion of total first mortgages, is near a 10-year low at 33.4% which suggests a shifting strategy to minimize long-term exposure. In addition, credit unions sold approximately 37.6% of first mortgage originations to the secondary market. That number reflects a 1.1 percentage point decrease year-over-year, but still a high mark compared with the 32% posted in 2014.

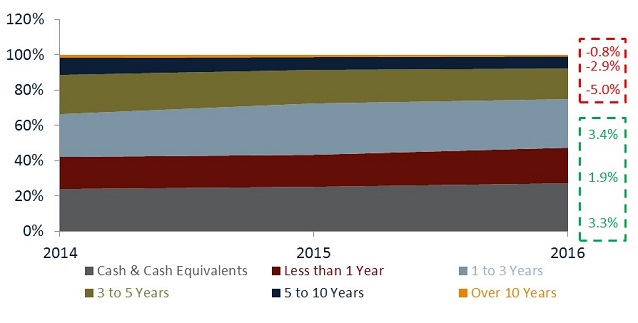

Investment interest rate risk for the industry has declined as well, as investment maturities have shortened. At second quarter, portfolios with durations less than one year and from one to three years both increased, 1.9% and 3.4% respectively. In contrast, credit unions divested portfolios from three to five years, five to 10 years, and more than 10 years by 5%, 2.9%, and 0.8% respectively.

INVESTMENT MATURITY

FOR U.S. CREDIT UNIONS* | DATA AS OF 06.30.16

Callahan Associates | www.creditunions.com

*For 5,976 credit unions

Don’t Miss 2Q 2016 Trendwatch Day 2

If you missed today’s Trendwatch, you still have a chance to catch it tomorrow. Click now to register for the 11:30 a.m. broadcast on August 24.

You Might Also Enjoy

-

How To Create A Culture Of Accountability

-

Member Relationships By The Numbers

-

Why Nusenda Partners With Local Organizations To Vet Small-Dollar Loans

-

Rod Flowers On Leadership