As a result of the financial crisis, regulations have evolved to encompass stress testing, capital requirements, and other measurements of financial soundness. The Financial Accounting Standards Board (FASB) joined the effort in 2014, proposing all financial institutions should adopt the current expected credit loss (CECL) model as the single standard to establish their allowance for loan and lease losses. The financial sector anticipates final guidance on the CECL model sometime in the first half of 2016, with transition timelines to extend throughout 2019.

Touching upon regulations within the broader economy and the credit union industry specifically, CECL was a topic during various sessions at this year’s National Association of Credit Union Service Organizations (NACUSO) conference, and for good reason: Its requirement to more quickly recognize credit losses will impact financial statements and technology at credit unions and CUSOs.

Financial And Data Implications

Under CECL, financial institutions will have to combine their historical payment information with today’s market conditions, reasonable forecasts, and other qualitative data to determine loss over the life of each loan product. This is a distinct departure from calculating loss when events disrupt future cash flows, better known as the incurred loss model.

Panelists at NACUSO projected lenders would increase reserves 20% to 50% as a result of this new accounting standard, which might damper loan volume and additional services that credit unions provide.

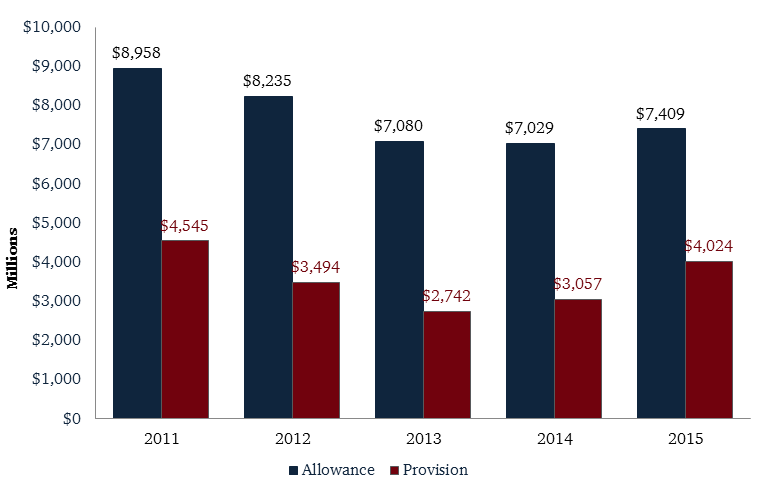

ALLOWANCE AND PROVISION FOR LOAN AND LEASE LOSSES

For all U.S. credit unions | Data as of 12.31.15

Callahan & Associates | www.creditunions.com

Source: Peer-to-Peer Analytics by Callahan & Associates

Although the impact to the financial statement is still unknown, there will be data implications within the credit union industry, including technology investment and know-how. To uphold financial and regulatory requirements, institutions must build systems that allow them to aggregate, process, and push financial data into working accounting and reporting models.

Data silos prevent many credit unions from connecting critical dots, making the CECL model fairly complex to implement across multiple product types and platforms. Labor constraints also dampen data collection efforts. Increased demand within the industry coupled with the rising cost to hire top data talent is putting pressure on financial institutions, especially those with limited assets.

Possibilities With Predictive Analytics

Despite CECL’s initial hurdles, credit unions can transform accounting challenges into predictive possibilities to create profitable margins. With the added benefit of operational and system streamlining under CECL, credit unions can begin testing assumptions and turn data into actionable insights.

For example, with data capability enhancements, credit unions can manage pricing in real time to maximize revenue and profit based on trends within a portfolio. Additionally, analytics allow financial institutions to track demand and behavior to better serve members and reduce attrition.

Want access to tested technology and financial resources? Callahan’s Executive Resource Center (ERC) offers credit union-donated and Callahan-created examples of tactical documents, policies, and templates. Peers give and receive information from one another, creating a cooperative effort in improving processes within the credit union industry.