There were more than 20,000 credit unions in the United States at one time, but not very many of them participated in mortgage lending. Today, there are fewer than 5,900 credit unions, but more than half of them originate first mortgages.

The number of credit unions originating first mortgages has declined. Just in the past five years, according to data from Callahan Associates, 3,556 credit unions originated a first mortgage in 2011. At the end of 2016, that number had fallen to 3,289.

NUMBER OF CREDIT UNIONS ORIGINATING FIRST MORTGAGES

FOR U.S. CREDIT UNIONS | DATA AS OF 12.31.16

Source: Callahan Associates.

Crucially, the data also shows a split in the asset size of credit unions originating first mortgages. The number of credit unions with more than $100 million in assets that originate mortgages has grown 11.7% in the past six years. The number of credit unions with less than $100 million in assets that originate first mortgages has declined 19.8%.

There are two driving forces behind that trend:

- The attrition in the ranks of small credit unions.

- Credit unions once too small to handle mortgage lending now increasingly rely on CUSO collaboration and technology to achieve scale and streamline the application, underwriting, and servicing processes.

According to data from CUSOAnalyzer, a joint project of Callahan Associates and NACUSO, there are more than 400 CUSOs with some association to lending, of which 88 are involved in mortgage lending. Those 88 CUSOs report 742 credit union owners or clients. The average size of a credit union owning or investing in a mortgage CUSO is $401.9 million, with the median asset size of $99.4 million; digging deeper, asset sizes of participating credit unions cover the spectrum, ranging from $1.4 million to $21.3 billion.ContentMiddleAd

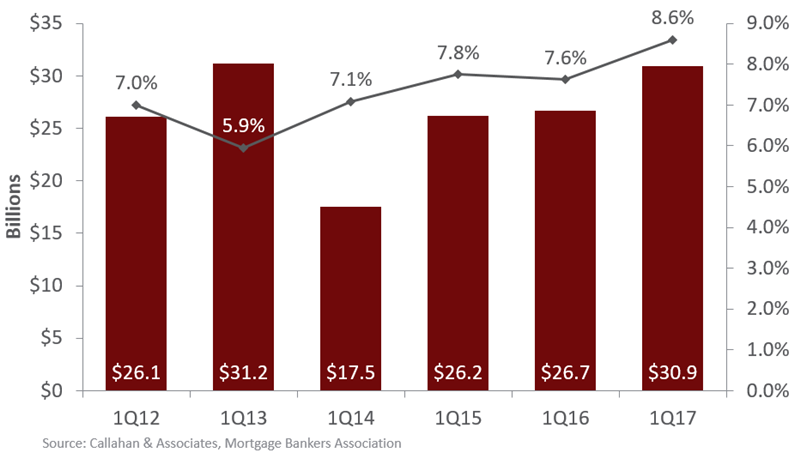

These CUSOs have helped push credit union market share to new heights. First mortgage origination market share was 8.6% as of March 31, 2017. That’s a one-percentage-point increase from first quarter 2016. It’s also the highest level on record.

YTD FIRST MORTGAGE ORIGINATIONS MARKET SHARE

FOR U.S. CREDIT UNIONS | DATA AS OF 03.31.17

Source: Callahan Associates.

This increase in market share is occurring as the number of credit unions is rapidly shrinking. In 2000, 10,847 credit unions originated $19.7 billion in mortgages with a first mortgage portfolio of $81.7 billion. In 2016, 5,859 credit unions wrote $143.3 billion in mortgages with a first mortgage portfolio to $359.1 billion.

That’s 2.5 million individual mortgages held more than 109 million credit union members.

A Deeper Look At Mergers

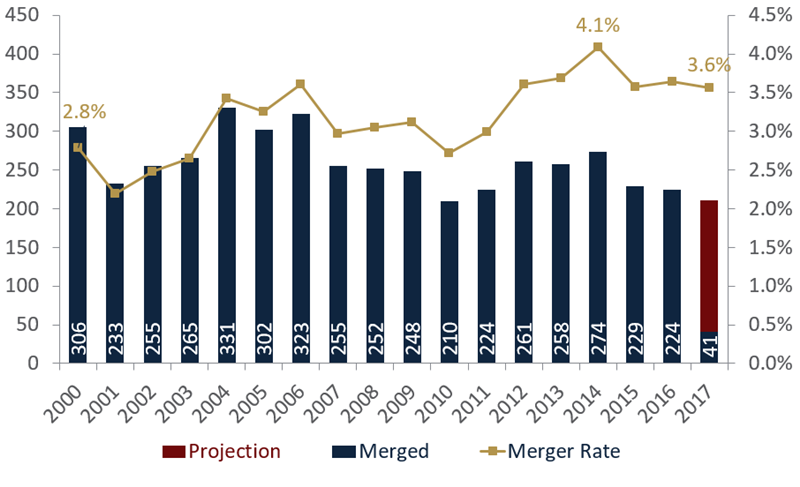

Weak financial condition, the inability to modernize products and services, and succession woes have prompted a steady pace of mergers, which have ranged from 2.2% to 4.1% of the total population of credit unions per year.

NUMBER OF CREDIT UNIONS MERGED AND MERGER RATE

FOR U.S. CREDIT UNIONS | DATA AS OF 03.31.17

Source: Callahan Associates.

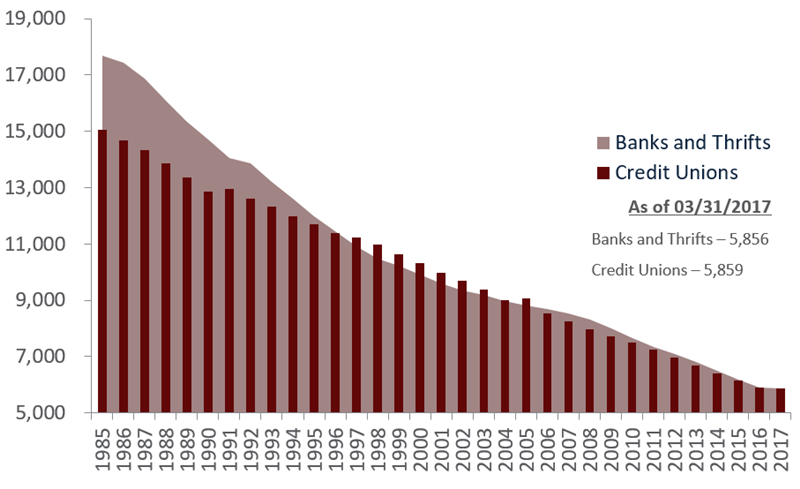

Credit unions are not alone in this. As of first quarter 2017, there were 5,859 credit unions and 5,856 bank and thrift charters, a difference of only three institutions. That’s compared with more than 15,000 credit unions and 17,000 banks and thrifts in 1985.

NUMBER OF CREDIT UNIONS AND BANKS

FOR U.S. CREDIT UNIONS AND BANKS | DATA AS OF 03.31.17

Source: Callahan Associates.

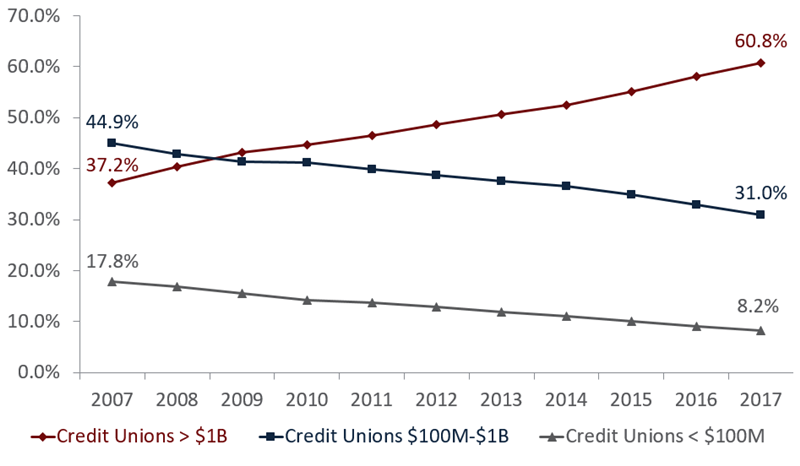

The effects of mergers is evident in the presence of more, larger financial services providers. For example, as of March 31, 2017, there were 281 credit unions with more than $1 billion in assets. That asset peer-group band has posted year-over-year member growth ranging from 3.5% to 7.2% since 2006. For credit unions with less than $100 million, growth has been flat or declining.

Meanwhile, the number of the smallest credit unions ― $2 million in assets or less ― has dropped from 1,422 10 years ago to 513 at the end of first quarter 2017. The number of credit unions with less than $100 million in assets has also dropped sharply, from 2,167 as of March, 31 2007, to 1,738 as of March 31, 2017. Simultaneously, the population of credit unions with more than $100 million in assets increased from 1,282 to 1,605 over the same period and 156 credit unions joined the billion-dollar asset club.

Merger On Your Mind?

Find your ideal merger partner by using Callahan’s Peer-to-Peer to research the performance of potential partners, project the financial impact of merging with other institutions, and identify how your services and technology align.

Those larger credit unions made up more than 60% of industry assets and logged a collective ROA of 0.87% as of first quarter 2017, compared with an ROA of 0.50% for the $100 million to $1 billion group and 0.32% for those with less than $100 million in assets.

CREDIT UNION ASSETS AS A PERCENTAGE OF TOTAL INDUSTRY ASSETS

FOR U.S. CREDIT UNIONS | DATA AS OF 03.31.17

Source: Callahan Associates.

A lot of that is mortgage money, and these larger institutions are positioned to leverage the credit union advantage of competitive rates and personalized service to increase market share while contributing to the financial wellness of their member-owners.

This article originally appeared in the Summer 2017 issue of Pipeline, the magazine of the American Credit Union Mortgage Association.

Check out the new CUSO Analyzer at NACUSO.org/cuso-analyzer.

For Best Practices in Merger Strategy, read this Callahan Collection of articles from credit unions sharing their experiences.