When Credit Union of America ($596.7M, Wichita, KS) rolled out its new mobile app in September 2013, it became one of the first financial institutions in the country to offer a digital safety switch that allows users to completely deactivate and activate their debit card, change ATM and point-of-sale limits, and block foreign transactions.

The CardLoc feature in the credit union’s mobile app was used nearly a thousand times in January, says Richard Logan, CUA’s senior vice president/chief information officer. The ranks of mobile bankers at CUA swelled last year from 4,920 to 10,620 and today represent more than one-third of the credit union’s 29,035 checking accounts, Logan says. But app usage only tells half the success story of CUA.

Richard Logan is senior vice president/chief information officer at Credit Union of America in Wichita, KS.

Selling Security

Nobody was doing it yet when we launched it, Logan says. But we thought it was an interesting idea that made a lot of sense from a security standpoint. The rising usage has confirmed that notion, as members use CardLoc to control access to their debit card accounts for reasons ranging from controlling a teenager’s spending to the cardholder going out of the country for a few months.

The CardLoc launch also generated positive feedback and public relations, including news coverage by two local television stations, helping to prove that the venerable institution was hardly stodgy.

We’ve been able to market it effectively as a differentiator in our market, Logan says. Implementing and advertising our CardLoc feature encourages the idea that we are a forward-thinking, cutting-edge technology credit union.

That matters in a tech-savvy town synonymous with the aviation industry. Logan adds that his credit union also is working with its vendor partner to become one of the first to go live on Apple Pay. We think of ourselves as a progressive company, and we want to project that to our members and to our prospective members.

How It Works

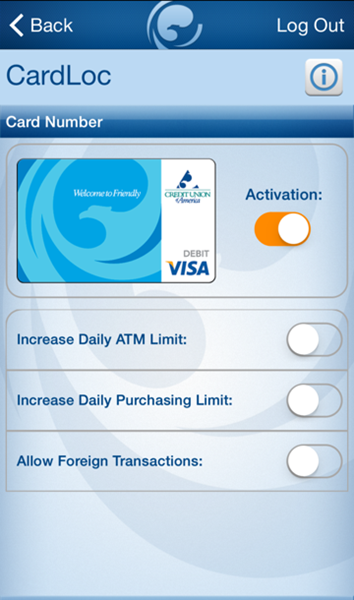

The CardLoc feature is built into both the Android and Apple versions of CUA’s mobile app as well as its platform-agnostic tablet app and offers four areas of card management:

The CardLoc on/off switch feature now in use at the Credit Union of America allows users to block and restore access to their debit cards through their smartphones or tablets.

-

- Debit on-off.Just like it sounds, this function turns the card off until the user turns it back on. Logan says 262 members used this feature 762 times in January 2015 alone.

-

- ATM limits. This feature allows the user to double the existing withdrawal limit as set by the credit union. One hundred and twenty-one people used it 161 times in January.

-

- POS limits. This feature doubles the POS limit of transactions and amounts during the day. Eighty-six people used it 105 times in January.

- Foreign transactions. Thirty-one members used this feature 33 times in January to block access to their checking accounts from their debit cards while, apparently, they were going overseas, Logan says.

Strong Layer of Security

Logan says some members double down on their debit card security by turning on access only when they need it.

They normally leave it off, but when they’re at the store, they go into their mobile app, turn the card on, swipe it, and then turn it back off, Logan says. That’s a strong layer of security.

The POS option, meanwhile, has proven valuable in situations like that of a do-it-yourselfer going to the hardware store multiple times over a weekend and using the card more often than usual.

Added security has lead to a few unintended consequences, such as when a member complains that their debit cards is being rejected only to find out they, or another authorized user, turned it off.

We’ve heard some shoots, I forgot,’ Logan says. And we’ve heard spouses blamed more than once.

The Learning Curve

CU QUICK FACTS

Credit Union OF AMERICA

data as of 12.31.14

- HQ: Wichita, KS

- ASSETS: $596.65M

- MEMBERS: 55,003

- BRANCHES: 12

- 12-MO SHARE GROWTH: 10.78%

- 12-MO LOAN GROWTH: 16.34%

- ROA: 1.33%

End-user and staff education along with a technical tweak or two has been integral in making the on-off switch work smoothly for everyone. For members, for instance, the website includes a YouTube video on using CardLoc. And for staff, a CardLoc icon on the member screen alerts service reps to consider whether the account may actually be turned off and the member doesn’t know it.

The product itself has been great, but there were things that we didn’t think about until they happened, Logan says.

Going forward, CUA would like to extend CardLoc to its credit cards but is finding that to be a bit more difficult. Whereas the credit union manages its debit card functionality primarily off its core processing system, which made for an easier integration with its third-party mobile banking app, a third-party processor manages the debit channel.

But the success with the debit version may make doing it for credit cards worth the effort, the CUA CIO says, given member response.

It’s an interesting product, and people who like it really like it, fancy it, and use it, Logan says.