Challenges abound for credit unions in the months ahead, according to the more than 100 respondents to Callahan’s 2016 Executive Outlook Survey.

Those challenges and opportunities they present range from global economics to developing a strong team to compete in the local market.

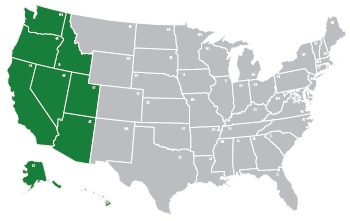

For the fifth installment of the online survey, Callahan asked respondents to summarize their local market conditions looking ahead through 2016. We then culled through the responses and are presenting a selection of excerpts according to the NCUA region in which the credit union is headquartered.

Credit union leaders from across the United States were generous enough with their time to offer thoughtful insight. As in past years, there are commonalities in the responses to this year’s survey. Two, in particular, stand out:

- Global and local economic conditions are requiring credit unions to fight harder for wallet share. As one respondent from a Virginia credit union nicely summed it up: There is a strong local economy and tough competition from banks and large credit unions. Lending demand is strong and property values are high. Members adopt new technology early and push on us to innovate.

- And from Oklahoma: The credit union expects heightened borrower credit risk over the next one to two years as layoffs and hiring freezes impact oil industry workers in our field of membership. This could result in slowing loan demand or increased charge-offs and delinquencies, which would negatively impact the credit union’s growth and credit quality goals.

The following answers, which have been excerpted and edited for readability, are a representative sample of the larger survey. The home state and asset size of the respondent’s credit union follow the responses.

To read all the comments from the survey, download the 2016 Economic Outlook PDF.

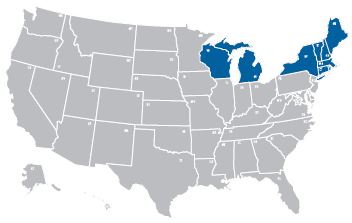

REGION 1

REGION 1

The market looks promising for 2016. With increasing interest rates, we will be able to favorably reprice our short-term indirect auto portfolio and improve our net interest margin.

Michigan, $100M-$250M

We will have to move into new geographic areas, which is very costly.

New York, $100M-$250M

We need additional production in a rising rate environment. A significant amount of production from 2015 was the result of three rate declines that resulted in increased production due to refi business.

Wisconsin, $1B

The economy in the New England region seems to be holding up pretty well. Competition in the financial industry space is quite strong, although we expect a continued trend of consolidation to occur.

Massachusetts, $500M-$1B

In Vermont, our shrinking labor force is causing wage pressures to bubble, making external talent searches difficult. World economic turmoil might spill over domestically, too.

Vermont, $250M-$500M

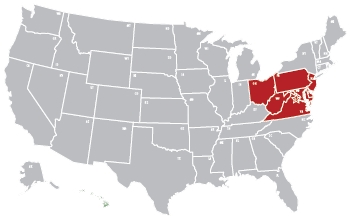

REGION 2

REGION 2

There is a strong local economy and tough competition from banks and large credit unions. Lending demand is strong and property values are high. Members adopt new technology early and push on us to innovate.

Virginia, $100M-$250M

Our local market will see modest growth in economic output, low unemployment, and good housing demand.

West Virginia, $50M-$100M

Our local economy is stagnant. Consumers are cautious.

Ohio, $500M-$1B

Our area has recovered nicely overall. Unemployment is below national and overall state levels. Real estate pricing has increased, although it has not fully recovered from pre-2008 levels. Company layoffs have slowed to virtually be only from merger or buyout activity. Loan delinquencies and charge-offs are down to pre-2008 levels.

Pennsylvania, $1B

The local economy is growing and producing jobs.

District of Columbia, $50M

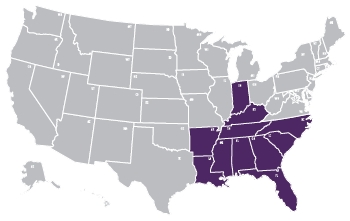

REGION 3

REGION 3

Unemployment is high, 8%, and the average wage for most jobs created is $12/hour. There are no new houses being built.

Indiana, $50M-$100M

Delinquency and net charge-offs are well below national levels. Lending also beats national levels. We are located in a retirement community.

Tennessee, $50M-$100M

We are in a local economic downturn and an aggressive lender has entered our market.

Florida, $250M-$500M

Our local market is stable with modest growth potential. Unemployment here is slightly higher than the national average.

South Carolina, $1B

Our local market is mixed. Some companies are doing really well and adding jobs while others are reducing their workforce.

Kentucky, $500M-$1B

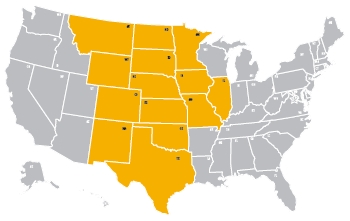

REGION 4

REGION 4

Rising interest rates could increase the cost of gaining deposits.

Iowa, $500M-$1B

The local economy is experiencing a decline primarily due to the oil and gas industry. With members’ uncertainty rising about their personal stability we expect loan growth to taper. Deposit growth will most likely come in short-term products with maturities of one year or less.

Wyoming, $100M-$250M

Utah has a very tight labor market, strong auto loan demand, very competitive credit union market. Credit unions continue to do well in spite of the overall lackluster economic situation.

Utah, $1B

Regulatory relief. Alternative MBL underwriting methodologies that will pass NCUA muster.

Texas, $250M-$500M

The oil industry is in the midst of a downturn related to substantial drops in the price of oil, which in turn has sparked layoffs and hiring freezes. Industry experts seem split on the long-term outlook for the industry, with some saying oil prices have reached the bottom and should trend up, and others saying oil prices could drop even further.

The credit union expects heightened borrower credit risk over the next one to two years as layoffs and hiring freezes impact oil industry workers in our field of membership. This could result in slowing loan demand or increased charge-offs and delinquencies, which would negatively impact the credit union’s growth and credit quality goals.

Oklahoma, $100M-$250M

REGION 5

REGION 5

There’s a major layoff pending for one local manufacturing employer, and the prospects for new, equal-paying jobs are not promising.

Washington, $100M-$250M

Currently, our local market conditions are good.

Illinois, $500M-$1B

The Portland metro area continues to see population growth, innovation, and increasing tax receipts contributing to the state and local coffers. The positive impact on business revenues and activity as well as continued real estate demand create a positive outlook.

Oregon, $500M-$1B

Las Vegas and Nevada have been dragging somewhat during the economic recovery with unemployment still above the national average. We’ve seen improvements, but we still need time to strengthen for consumer demand for loan products to increase.

Nevada, $500M-$1B

Our market is very competitive, with lots of non-traditional competitors. We’re in Silicon Valley, so there’s a huge emphasis on high-tech delivery.

California, $1B