Perhaps more so than years previous, 2017 represents the strongest potential to be the year of large changes to the status quo, according to the more than 80 respondents to Callahan’s 2017 Executive Outlook Survey.

For the sixth installment of the online survey, Callahan asked respondents to look ahead through 2017 and summarize their local market conditions as well as department goals. The answers here represent responses from credit unions across the country and across all asset sizes and it sounds like everyone has a busy year ahead.

Credit union leaders were generous enough with their time to offer thoughtful insight. In their responses, several key themes surfaced again and again, including the new presidential administration’s potential impact on regulations and employment, the interest rate environment, and competition from banks and other credit unions.

The following answers, which have been excerpted and edited for readability, are a representative sample of the larger survey.

Credit union names are withheld; however, the home state and asset size of the respondent’s credit union follows the response.

To read all the comments from the survey,download the 2017 Economic Outlook PDF.

Region 1

We are located in a slow growth state, but loan demand continues to be satisfactory. Home values are still below 2006 levels and a higher rate environment could stall some demand.

Connecticut, $1B

Our market is hyper competitive. We have large regional banks and credit unions and a shrinking population, especially for those under 30 years old. There is full employment and a very tight labor market.

New Hampshire, $1B

In 2017, we’re interested in strategic growth, whether through mergers or the expansion of our field of membership.

New York, $250M-$500M

We need to hit the pause button on regulations.

New York, $10M-$25M

We’re looking at upgrading an aging general ledger system and our facilities infrastructure as well as modernizing our employee performance evaluation system.

Vermont, $500M-$1B

Region 2

We’re hopeful the new administration in DC will help American manufacturing and mining companies expand their employment rolls.

Pennsylvania, $50M-$100M

Our local market continues to be challenged. More consumers are leaving than coming in, causing challenges to overall membership growth.

New Jersey, $1B

Top of mind for us are liquidity, deposit promotional opportunities, loan profitability, channel profitability, and opportunities to continue to control operating costs.

Maryland, $1B

We’re seeing continued heavy competition from banks, insurance companies, other credit unions, and fintech companies.

Ohio, $100M-$250M

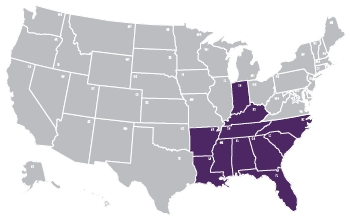

Region 3

We’re in the midst of a highly uncertain regulatory/compliance environment with new requirements for HMDA, CECL, and others we must work on. But we might also see major rollbacks of the Dodd-Frank Act, Durbin Amendment, and Affordable Care Act that could be beneficial.

Indiana, $1B

We serve the oil and gas industry, and job growth and new business is coming to our community. We also have large tech players building new business in our area.

Louisiana, $100M-$250M

We compete in a heavily saturated market in which our many of our competitors both on the bank and the credit union level enjoy greater name recognition than we do. As far as economic/market conditions, we expect a growing need for loans while we struggle to focus on deposits.

Arkansas, $25M-$50M

Our market is growing rapidly. We have strong employment and competition for members and team members.

Georgia, $1B

We’re watching how the interest rate increases will affect housing loans.

Louisiana, $250M-$500M

Region 4

Overall, we have a positive outlook. Low unemployment is causing challenges; housing starts are slow and demand is high; agricultural is rocky; business revenues are strong.

Iowa, $1B

We have limited resources for compliance and advertising.

Nebraska, $50M-$100M

A rather affluent membership always impedes loan demand. Asset growth continues to limit our ability to grow the net equity ratio.

Illinois, $250M-$500M

The low commodity prices in our area will keep overall business investment at a slower pace this year. The competition for the higher quality loans will be more intense than in the past.

North Dakota, $500-$1B

Taxation is coming, what with the banker lawsuits and NCUA pushing the envelope on member business loans, field of membership, and secondary capital.

Minnesota, $100M-$250M

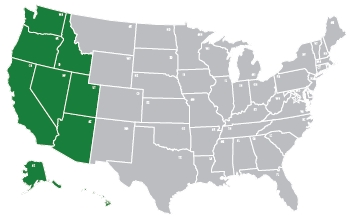

Region 5

We see continued pressure from competition with low interest rate loans and possible increases in costs for funds.

California, $50M-$100M

Top of mind for us are the adverse impacts of tax/economic policy changes, recruiting and retaining high performing staff, and increasing competition from financial firms that don’t have a long-term strategy.

Washington, $250M-$500M

The economy in Hawaii continues to grow. Real estate prices are increasing and auto sales are strong. However, we are cautious about Trump’s changes that could impact our economy. The current Federal hiring freeze effects large employers.

Hawaii, $1B

We’re seeing higher levels of competition among credit unions.

Utah, $25M-$50M

Employment is picking up in anticipation of reduced regulation and ACA repeal.

Oregon, $100M-$250M