Click here to see the 2018 Executive Priorities At-A-Glance word cloud that visually highlights the most-noted priorities.

Survey senior executives from credit unions of all sizes across the country, and you’ll get a lot of different perspectives and insight. Callahan’s 2018 Executive Outlook Survey is no exception.

Some things remain the same in this seventh installment of the annual year-end survey. Growing loans, deposits, and talent are imperatives, as is confronting competition from old foes and new. Credit unions’ place in the local and national economies also continues to provide a backdrop for much strategic contemplation.

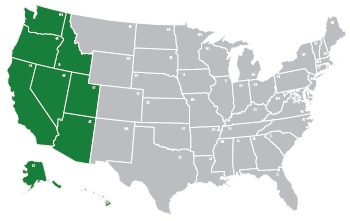

Callahan’s 2018 Executive Survey asked respondents to consider questions about their local market, their 2018 goals, their 2018 challenges, and what they think about the most. Below find a selection of excerpted answers filtered by the NCUA region in which the credit union is headquartered. The state and asset size of the respondent’s credit union follow the responses.

These replies, excerpted and edited for readability, are representative of the larger survey.

To read all the comments from the survey, download the 2018 Economic Outlook PDF.

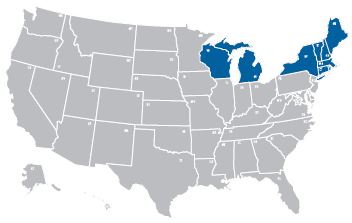

Region 1

Our 2018 goals include deposit growth and more diversified lending with more direct and less indirect loans.

Wisconsin, $100M- $250M

Our challenges include keeping ahead of staffing needs due to limited skilled labor, cost of compliance, and having to add staff to meet compliance demands.

Michigan, $250M-$100M

Increased competition might prevent us from making our ROA and membership targets.

Maine, $250M-$500M

Our market is seeing strong demand for credit cards, auto loans, and purchase mortgages. Refinances will go down as rates continue to rise. Delinquency will continue to decline as the job market continues to improve.

Rhode Island, $250M-$500M

Keeping employees engaged to work on growth when they are in the midst of working on a core conversion.

Michigan, $100M-$250M

Our biggest challenges are competition and a rising rate environment.

New York, $500M-$1B

Our goal for member service is very aggressive. Interest rates on loans will reduce volume. Competition in credit cards is fierce.

Michigan, $500M-$1B

Loan growth. Member growth. FOM expansion.

Michigan, $100M-$250M

Top of mind for us in 2018 are compliance issues, technology expectations, and improving the member experience.

Connecticut, $20M-$50M

We have a strong housing market with sustained auto sales. Jobs have continued to grow and new businesses are launching. Employees are needed.

Michigan, $100M-$200M

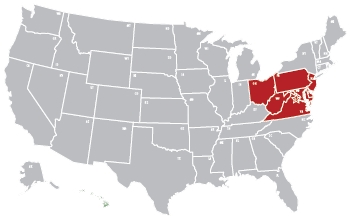

Region 2

The recovery is picking up steam and the tax cuts should help put more money into people’s pockets and improve consumer confidence.

Maryland, $50M-$100M

In 2018, we’re focusing on increasing non-real estate loans, increasing membership, and increasing penetration in our existing membership.

New Jersey, $10M-$20M

Our challenges: Operating expenses rising faster than revenue. Lack of growth in members, loans, and deposits. Resource constraint, primarily in the people area. Do we try to do too much and not get enough done?

Ohio, $1B-$10B

Competition, market conditions, and board reluctance on initiatives will make it tougher to meet our goals for 2018.

Virginia, $1B-$10B

Regulations, litigation, and merger opportunities will be top of mind for us this year.

Maryland, $50M-$100M

We are working to increase share of wallet, increase our loan portfolio, and decrease expenses.

Maryland, $1B-$10B

Increase share deposits. Big staff turnover requires in-depth staff training.

Ohio, $20M-$50M

Increasing membership is always tough due to being a SEG credit union. As to loans, we are too heavy in real estate, but the need for unsecured loans has decreased. As to car loans and credit cards, competition makes it difficult to increase the numbers without bringing down yield.

New Jersey, $10M-$20M

ContentMiddleAd

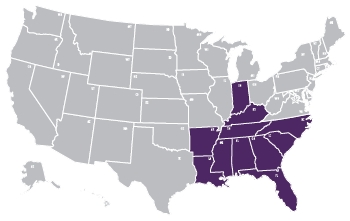

Region 3

Cybersecurity and fraud prevention, and industry best practices, will be top of mind for us in 2018.

Georgia, $1B-$10B

Our main goal is to move from providing great member service reactively to providing it proactively. We are hiring a full-time marketing person to help accomplish this.

Louisiana, $150M-$250M

We’re facing CD rate wars, unprecedented loan/mortgage payoffs, and finding out core deposits weren’t core but artificially inflated deposits during the low point in the interest rate cycle. Demand pent-up for many years could be combustible.

Indiana, $250M-$500M

Our market is heating up and new entrants ? including credit unions ? are moving in.

Florida, $1B-$10B

Interest rate sensitivity is big for us in 2018. So are low-balance consumer accounts and how to best manage the serving underserved versus the profitability of those members.

Indiana, $1B-$10B

Top of mind for us in 2018 will be data analytics. And the five generations in the workforce. It’s crazy to think we will be hiring staff who were born after 9/11. Plus, finding membership that will join because they are choosing’ the credit union versus simply unchoosing’ their bank. I see a difference in their level of engagement.

Indiana, $250M-$500M

For us in 2018, it’s compliance, always regulatory expansion.

Mississippi, $10M-$20M

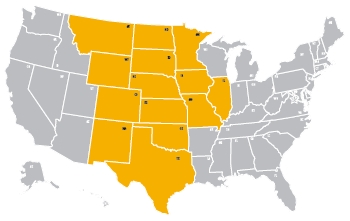

Region 4

Digital. Digital. Digital. We’re trying to become best of breed.

Texas, $500M-$1B

We’re building infrastructure to support increased dependence on technology in retail banking as an expectation by our members.

Illinois, $100M-$250M

Our primary focus is restoring our net worth above 7%. To do this, we have to manage our expenses by staying within our 2018 budget.

Kansas, $20M-$50M

Increase deposits to accommodate loan growth. Increase member and employee engagement. Continue to attract younger members and prepare for a core conversion.

Iowa, $1B-$10B

Rising interest rates could discourage some borrowers from borrowing. We also experience delayed product enhancements due to regulatory and core system limitations.

Montana, $100M-$250M

Industry and tax changes will have their impact; however, we’re looking at ways to overcome them ahead of time, such as mortgages and HELOCs. We’re going to find new ways to make a negative into a positive and continue our growth.

Kansas, $100M-$250M

ADA accessibility lawsuits, reduction in compliance issues, and small credit union survival. Those are top of mind for our credit union this year.

Texas, $50M-$100M

Top of mind for us in 2018 are fintech-based delivery channels, regulation reform, tax exemption challenges, lawsuit challenges (ambulance chasers), cybersecurity and attacks.

Colorado, $50M-$100M

Region 5

Stop membership decline and grow consumer loans.

California, $50M-$100M

Our 2018 goals are to serve more low/moderate income members, maintain capital ratio, and grow income.

Arizona, $100M-$250M

Top of mind in 2018: Membership retention. Digital-first best practices. Proactive organizational agility in preparation for inevitable disruptions in the financial marketplace.

Arizona, $1B-$10B

Our ERM initiatives have identified most reasonable risks within our tolerance. We’ve also positioned ourselves to be nimble and able to minimize the impact of the unknown.

Arizona, $1B-$10B

We face loss of key management in a market where it’s too expensive for most to buy a home. Those coming into the organization must rent, and this leads to instability. We also face unexpected losses in lending.

California, $100M-$250M

We face fierce competition and a failure to differentiate credit unions from other financial institution options.

Washington, $500M-$1B

Top of mind to us in 2018 are the NCUA’s chokehold that still remains in many areas of the country (subjective examining), cannabis banking, and income generation opportunities versus risk.

California, $100M-$250M

For us in 2018, it’s regulation, new products and services, and credit union successes. I would like to see a DIY column for small credit unions that do things themselves and not through a third party (regulation, technology, marketing, personnel, development, etc.)

California, $10M-$20M