CU QUICK FACTS

Innovations FCU

Data as of 03.31.19

HQ: Panama City, FL

ASSETS: $272.5M

MEMBERS: 20,259

BRANCHES: 6

12-MO SHARE GROWTH: 39.0%

12-MO LOAN GROWTH: 8.2%

ROA: 0.96%

Down in the Florida Panhandle, folks tend not to get spooked by hurricanes that easily.

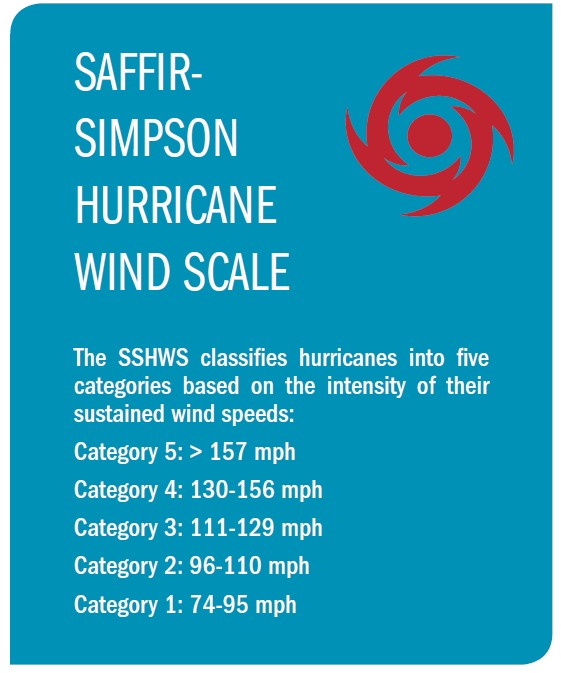

More storms hit Florida than any other state, and since 1851 only 18 hurricane seasons (which runs from June 1 Nov. 30 each year) have passed without a known storm impacting the state. When Hurricane Michael, a Category 5 storm, made landfall on Mexico Beach, some 25 miles southeast of Panama City, it was the seventh hurricane of the 2018 season.

It was also a slow-moving storm. Formed Oct. 1 in the Caribbean Sea, Hurricane Michael wasn’t a hurricane until Monday, Oct. 8 when its average sustained wind speeds surpassed 74 mph.

It was supposed to be a water event, says Karen Hurst, the chief marketing officer of Innovations Federal Credit Union ($272.5M, Panama City, FL), a community-chartered cooperative that only serves Bay County, FL.

That’s not going to scare off many locals, says CFO Jeremy Hinton.

From there, the storm continued to intensify. On Oct. 8, Florida’s governor ordered mandatory evacuations in Bay, Gulf, and Wakulla counties; in total, some 375,000 Floridians were asked to flee before Michael struck.

On Oct. 10, Hurricane Michael hit Florida with maximum sustained winds of 160 mph. It was the first Category 5 storm to hit the Panhandle, and the fourth strongest landfalling hurricane in the contiguous U.S. The hurricane caused 49 deaths and an estimated $25 billion in damage, making it one of the worst natural disasters in U.S. history. Hundreds of thousands of people had their lives impacted in one way or another: lives were lost, houses destroyed, businesses disrupted. On the ground, the affected communities lost electricity and cell service; fuel to power backup generators and vehicles was scarce; tires were easily damaged as people drove through town in the wake of the storm to begin a clean-up process that continues to this day.

When disaster strikes, one thing that everyone needs is access to their money. Innovations knew what it had to do: re-open and provide financial services to members in need. When it did open, four days later, it was the first financial institution to do so. Here, Innovations’ senior team shares the disaster recovery (and teamwork) efforts that made it happen.

Sustainable Business Strategy

Learn more aboutSustainable Business Strategy with Rebecca Henderson, in collaboration with Harvard Business School online. The Callahan Academy combines Harvard teachings and credit union industry discussions to explore:

- Business models that drive change.

- Tactics that demonstrate the competitive advantages of being a purpose-driven firm.

- Why collective efforts are important and how business can be a catalyst for system-level change.

- What you can do to become a purpose-driven leader and how you can develop purpose-driven leaders within you organization.

Oct. 6 – Oct. 9

For Innovations, the story started the weekend before the storm. Michael began as a tropical depression, brewing in the southern Gulf of Mexico, and local newscasters and talking heads believed it would result in a direct hit on Panama City. That’s how Hinton knew not to panic.

When it’s that far away and they say it’s going to hit us, it never does, the Innovations CFO says. It never has.

But the storm was worth monitoring.

As the weekend progressed, the depression grew in strength and the community started to prepare; gas tanks were filled, windows were boarded, residents stocked up on batteries and water bottles. The credit union prepared, too. If things got bad, it was ready to switch to its disaster recovery phone line, handled by LSI in Chicago, as well as spool up its core processor to a Jack Henry hot site in Birmingham, AL. And if the core moved, all the systems that fed into the core including online and mobile banking and check processing, among others needed to change their line of communication from Panama City to Birmingham, as well.

While facing the possibility of a storm, the credit union increased its cash order, stocking its ATMs as full as they could get. It also communicated with other area cooperatives to ensure everyone had the cash they needed, and they knew who to ask if more was required.

You never know what’s going to happen, Hinton says. But if the power goes down, they’re going to need access to cash. So it has to be as accessible as possible.

Monday was Columbus Day, so the credit union didn’t open. But when mandatory evacuations were announced that day, Innovations made the decision to open on Tuesday until noon. Members could withdraw cash and hit the roads early, while employees spent a few extra hours after the doors closed preparing its six branches for the storm. That included covering equipment, powering down its server room, and processing its last files for the Federal Reserve.

Some employees chose to weather the storm from their homes. Others, like Hinton, drove late-night to meet their families who had previously evacuated. Innovations’ director of IT drove to Birmingham so he could work near the hot site should problems arise.

I left my house on Tuesday night with a cat, a dog, five dwarf hamsters, and everything else I’m taking with me, Hinton says. There was a zoo in the back of my car.

For those who did evacuate, the expectation was they’d wait the storm out and drive back when the weather was clear to resume business as usual. That didn’t happen.

It’s going to take a long time for people to forget this. I think it’s left us all more prepared.

Oct. 10 – Oct. 11

Hurricane Michael hit Bay County on Wednesday around noon, with the eyewall of the storm soon passing directly over Panama City, leveling buildings, forests, and decimating Tyndall Air Force Base as it moved northeast. On the beach, a 14-foot storm surge and Category 5 winds created catastrophic, apocalyptic damage.

I couldn’t walk down my street, CMO Hurst says. Trees, telephone poles they weren’t just broken and tossed, they were shattered.

It’s going to take me 10 years to clear everything that fell on my property, COO Scott Gladden adds.

By Wednesday morning, Innovations had initiated its disaster recovery plan. Panama City and its surrounding communities had lost power and Wi-Fi, and Verizon Wireless service which Innovations uses for its primary branch communications and internet access was down. The fiber link between its headquarters building and the four branches to the east was severed, as well. For those who didn’t evacuate, communication was impossible.

There was little to no communication with anyone who was down there, Hinton says. That was the biggest concern at the time. Because if you can’t talk with someone you always think the worst.

Of the senior team, only Hinton evacuated. From his hotel room in Troy, AL, he called who he could to make sure employees were OK and systems were up and running. Quickly, the credit union began processing files to the Federal Reserve to post member deposits; however, it made the strategic decision to delay posting debits for five days to better serve members.

We felt it made the most sense to keep members’ money available to them, Hinton says.

We would have refunded them anyway, but it kept them from worrying about it, Gladden adds.

Click to enlarge.

In Panama City, the credit union took stock of the communication channels available to them. There were two radio stations broadcasting from Bay County’s emergency operations center, one of which soon became the primary channel for news dissemination, but without phones Innovations had to get creative.

Knowing one of the first things his executive team would do was check the physical state of the credit union’s branch locations, CEO David Southall went old-school, leaving Post-It notes on each of the brick-and-mortar locations with when and where to meet. The first employees who made it back met at Southall’s condo on Thursday morning, hatching an early game plan.

We did everything possible to get up by Sunday, Hurst says.

Click the tabs below to view the images.

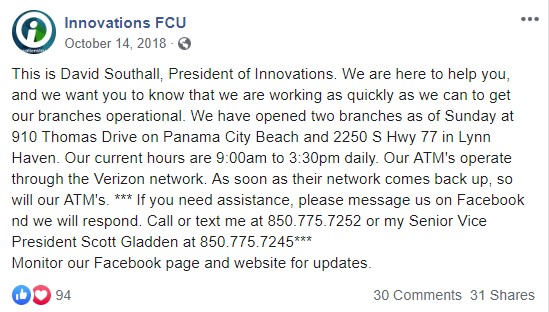

FACEBOOK POST

In the wake of the storm, Innovations communicated through the channels at its disposal, including this Facebook post from Sunday, Oct. 14.

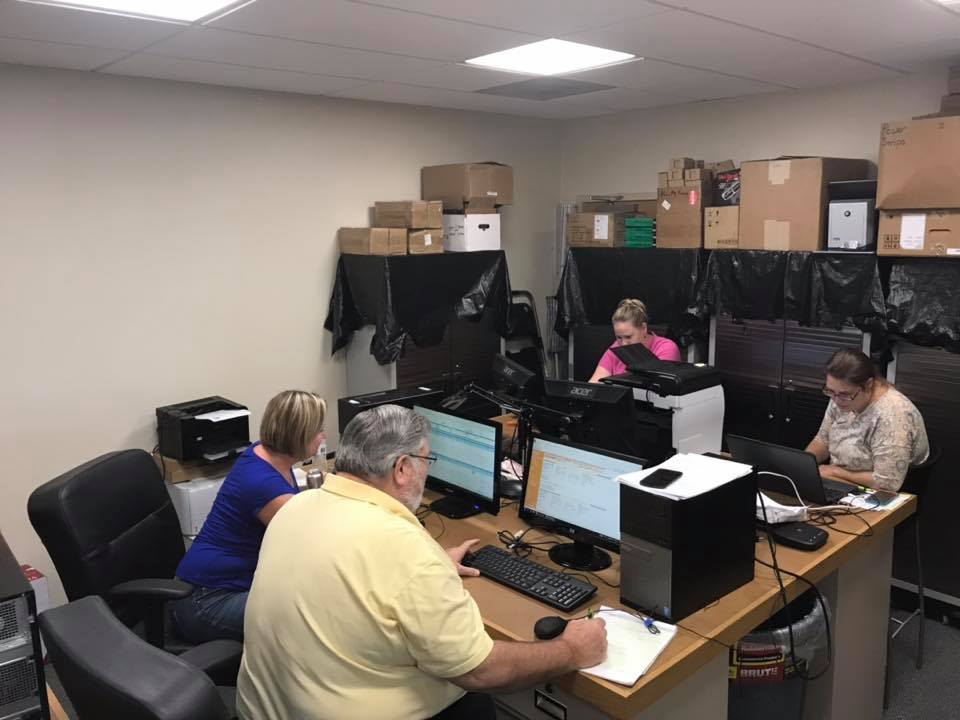

WAR ROOM

By the Sunday after Hurricane Michael, Innovations had set up two war rooms in its headquarters building, where the team was able to process transactions through ATT cell phone hotspots with tethered laptops.

PEN AIR TEMPORARY BRANCH

Pen Air provided Innovations a temporary mobile branch to serve members in the days after the storm.

HARRISON AVE. TEMPORARY TRAILER

The credit union’s Harrison Ave. branch is back online, though as a temporary trailer as it assesses damages to its affected location.

DRIVE THRU LINES

When Innovations first re-opened, branch lines were long. Some employees stepped up by noting withdrawal amounts on clipboards so they could be processed and prepared by the time members reached the window.

Oct. 12 – Oct. 13

Verizon Wireless service runs on Verizon’s fiber optic cables; if those cables are cut, there’s no service. But not all cellphone networks work that way.

On the radio, Southall and Hinton listened as Bay County’s superintendent of schools advised residents to use Cricket Wireless, a prepaid service that works by buying extra wireless capacity from the major providers, such as Sprint, T-Mobile, and ATT. Though Verizon’s fiberoptic capability was down, other networks that ran on towers were more quickly able to re-establish service.

We told people, if you can, get a prepaid phone it’ll work, Hinton says. Everyone had a burner phone with a different number, so when you saw anyone the first thing you did was give them your new phone number.

With working phones, Innovations was able to get updates from staff, whether through calls, texts, or social media messages, to learn who was affected and to what degree. From an operational standpoint, phones allowed Innovations to post its own updates to social media and its website, which included publishing its Cricket numbers in case concerned members needed to get in touch.

I was talking to members at 10 p.m. who were worried about a loan payment that was due two days ago, Gladden says. I had to reassure them not to worry about it. We’re going to take care of it.

TIRE TROUBLE

Vehicles are necessary after a storm, but with poor road conditions drivers had a rash of tire issues. Local service stations, tire centers, and car dealerships offered free repairs. Everyone lent a hand. I did a tire repair for an IT employee, CFO Jeremy Hinton says. Without a car you can’t accomplish anything.

As the week progressed, internet and electricity became available, albeit spotty. Clean up had begun, though roads remained treacherous with the amount of debris that remained. Still, Innovations was able to assess branch impact, finding two severely damaged while its other four were relatively unscathed.

In fact, one that had no damage was in the middle of one of the hardest-hit areas, Gladden says.

On Saturday morning, seven credit union employees met, including the four-person senior team, to finalize its go-live plan. It rolled out its 5%, $3,000 Hurricane Assistance Loan, introduced 90-day loan deferments, and waived fees. It decided which branches to open, and in what order, starting with its headquarters location, closest to Panama City Beach.

By then, neighboring (but less affected) credit unions and business partners had delivered aid. Pen Air FCU provided a mobile branch; Gulf Winds FCU brought in generators; Route 66 Warranty also brought in generators, as well as Cricket phones and other essentials; Heckman Law Group provided other necessary supplies.

We had truckloads of generators for our team members, Gladden says. Our partners provided the generator, the gas, the electrical connections, everything, so our employees could have power and come serve our members.

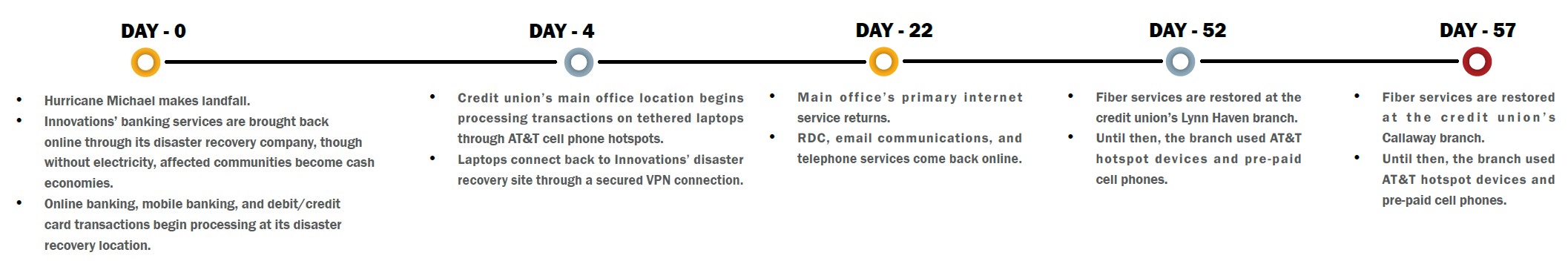

A Timeline Of Banking Services

Click to enlarge.

Oct. 14 – Today

By Sunday, Innovations’ headquarters had power, but for security reasons, only its drive-thru windows could open for members in need of cash, disbursing the funds through a functioning drive-thru tube and deal-drawer system.

As lines were long, employees were stationed outside at the drive-thru, taking down member withdrawal requests on a clipboard so they could be processed and prepared by the time members reached the window. When other branch locations came back online, the same process occurred.

Also by Sunday, Innovations had set up two war rooms in its headquarters building, where the team was able to process transactions through ATT cell phone hotspots with tethered laptops, including handling the paperwork for emergency loans over email and DocuSign.

ATMs were another question, entirely. Innovations ATM communications are run through independent Verizon wireless devices, which meant that while Verizon service was unavailable, ATMs were offline. It wasn’t until ATT allowed Verizon customers to roam on their towers that its ATMs came back online.

For two weeks after the storm, Innovations used its disaster recovery hot site in Birmingham as the base of its operations. On Oct. 22, internet service returned to its main office, which allowed it (and a second branch) to open with near-full operations. Remote deposit service, as well as primary email communication and telephone service, came back online, too.

In the following weeks, additional branches re-opened, and service returned to its previous capacity. As of late May, five of the credit union’s six branch locations were open with the sixth running out of a temporary trailer for the time being. At that time, Innovations recouped approximately $956,000 in insurance for the damage at four of its branches and is currently working to determine the impairment on its two remaining locations.

We still don’t have a value yet on what it’ll cost to fix, Hinton says.

Innovations is slowly regaining its sense of normalcy in the aftermath of the storm. The event changed everything for Bay County and its surrounding communities, and the credit union has effectively remained in recovery mode putting other strategic initiatives on the backburner.

We’re ready for a more positive shift, says CEO Southall. And I think it’s coming.

There’s years of construction and repair ahead, and billions of dollars required for the effort, but progress (and promises) are being made. Some 31 million cubic yards of debris has been removed, and in mid-May, President Trump surveyed the damage to Tyndall Air Force Base, promising officials it will be rebuilt better than ever.

Innovations has learned several lessons as well, perhaps none so striking as to thank the strength and resiliency of its friends and family: the folks who provided its disaster recovery systems and its employees.

For our disaster recovery folks, this is what they do on the day-to-day, Hinton says. For us, it’s an apocalyptic event that’s never happened before.

From its people, the credit union saw a willingness to pitch in and help those more disadvantaged and helped many recognize what’s important both personally and from an operational standpoint. After all, the 2019 Atlantic hurricane season is underway.

It’s going to take a long time for people to forget this, Southall says. I think it’s left us all more prepared.

Wait, There’s More!

This is just one section of the Anatomy Of Innovations Federal Credit Union series that appears in Credit Union Strategy Performance. Read the whole discussion today.

READ MORE