Top-Level Takeaways

-

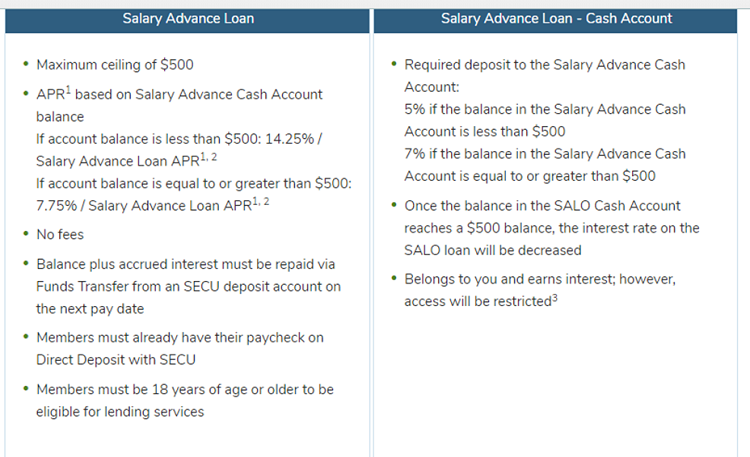

SECU’s salary advance loan allows members to borrow up to $500, which must be repaid with accrued interest on the next pay date.

-

The credit union automatically deposits a portion of the loan balance into a special deposit account to help the member gradually build a savings nest egg.

-

SECU estimates the program saves members who use it $830 annually and delivers $80 million a year in value to the overall membership.

CU QUICK FACTS

State Employees Credit Union

Data as of 03.31.19

HQ: Raleigh, NC

ASSETS: $40.3B

MEMBERS: 2,403,404

BRANCHES: 269

12-MO SHARE GROWTH: 4.6%

12-MO LOAN GROWTH: 4.6%

ROA: 0.58%

State Employees Credit Union ($40.3B, Raleigh, NC) has offered a salary advance loan program since 2001. During that 18 years, the credit union has automated processes to make it easier for members to access funds and added a savings component to help members break out of the payday loan cycle.

The self-service component has been critical because of the repeat nature of these loans, senior vice president of lending development Mark Coburn says of the program, which has an open-ended component but is structured as a closed-ended loan with a specific due date. We create the initial loan, but members can request automated online advances after they repay it.

The salary advance loan at SECU provides cash members need between paydays while the accompanying deposit account helps them build emergency savings.

The loan’s starting APR of 14.25% is higher than SECU’s other unsecured products. For example, its standard open-ended signature loan is currently priced at 10.75% APR. But the credit union doesn’t intend for members to use the program ad infinitum.

Lending With A Savings Twist

Mark Coburn, SVP of Lending Development, State Employees Credit Union

The North Carolina cooperative led the charge to combat payday lending in the Tar Heel State. After launching the salary advance loan in 2001, the cooperative watched the program’s activity closely for the first few years. It soon recognized that members were in a recurring cycle of borrowing and needed help breaking out.

We were saving them a lot of money if they had to borrow, Coburn says. But we asked ourselves how we could help them break the cycle.

So, in 2003, SECU incorporated a savings component that helps members gradually build emergency funds to break the cycle of payday lending. Most members who take out a salary advance loan are not in a position to pay back the $500 balance all at once. When payday rolls around, they payoff the balance but then need to take out another loan when their funds run low before the next payday hits. There’s no room for the borrower to cover expenses much less build a savings.

To combat this, SECU automatically moves 5% of the total cash advance loan balance up to $25 if the member takes out the $500 maximum into a deposit account. The more a member uses the loan, the more of a savings nest egg they build. If a member regularly takes out the $500 maximum, for example, they’d build a savings of $500 after 20 months of recurring salary advance loan usage and earn interest at the same rate as the credit union’s regular share savings accounts. With that kind of savings, there’s no need for a salary advance loan.

Curious About Your Lending Portfolio?

Are your lending strategies working? It takes minutes to compare various aspects of your lending portfolio to other credit unions with Callahan Analytics. Let us walk you through your numbers.

The Results

SECU has 237,000 outstanding salary advance loans and approximately 100,000 regular program users. As of mid-April 2019, those accounts totaled $34 million, but SECU notes this fluctuates as paydays hit and members repay loans.

Perhaps even more notable, the accompanying cash account currently has $54.5 million in total balances. That’s a significant amount of accumulated aggregate wealth for members, many of whom live paycheck to paycheck.

We noticed a phenomenon we didn’t expect, Coburn says. As members started saving for the first time in their lives, many decided not to break the cycle.

After accumulating $500, a number of members kept using the salary advance loan but kept saving, too. Today, many of the deposit accounts have balances exceeding $1,000 or $2,000. One member has accumulated more than $11,000 in their cash account.

The unexpected behavior prompted the credit union to make one more change to its salary advance program.

When we began offering the loans, they were unsecured and priced as such, says Coburn, noting that SECU requires members only have a direct deposit with SECU and not be in bankruptcy to qualify for a salary advance loan. As members accumulated $500 or more in their cash accounts, we reduced the interest rates on their loans to a secured product.

Today, the credit union automatically lowers the rate from 14.25% APR to 7.75% for members who have $500 or more in their cash account. SECU also expedites the growth of savings by automatically depositing 7% $35 based on the $500 loan maximum into a member’s cash account.

Advance Advice

In my 18 years of experience with this product, I’ve learned that you can offer a salary advance loan with a reasonable interest rate, Coburn says. When you look at our losses, there is no need to charge a large fee for this.

However, the recurring nature of these loans can make processing them costly. According to Coburn, automation is critical, and credit unions must prepare for a large volume of loans.

When we initially launched this, members would come into branches and it caused a log jam on paydays, he says. You need to anticipate continual volume.

SECU now offers self-serve solutions, including the ability to request an advance through an automated phone system or online banking. An instructional card with easy self-serve directions saves members time visiting a branch every payday to request a new advance.

Coburn also advises credit unions to avoid stereotyping members who use payday or salary advance loans. Although some members might have lower credit scores or repeatedly use the program, others use the loan only on occasion.

Overall, SECU estimates the program saves borrowers $830 per year on average when compared to traditional payday lenders. This results in a grand total of $80 million the cooperative is saving its total membership annually. That’s money you can take to the bank.