In 2005,BECU($13.6B, Tukwila, WA) turned a longstanding credit model on its head.

Typically, if a consumer wants to reduce the rate on a loan, they have one of two options. First, they must demonstrate they can make consistent, on-time payments and then specifically ask their financial institution for that reduction. Second, they canrefinance with another institution and hope their positive payment history will help them earn a better rate.

On the contrary, when a consumer’s credit starts slipping, a financial institution can raise the interest rate on their consumer credit products automatically.

CU QUICK FACTS

BECU

Data as of 12.31.15

- HQ: Tukwila, WA

- ASSETS: $14.6B

- MEMBERS: 940,654

- BRANCHES: 42

- 12-MO SHARE GROWTH: 10.74%

- 12-MO LOAN GROWTH: 12.90%

- ROA: 1.42%

I remember there was a lot of negative press about consumers’ rates increasing because of changes in their credit score, says Bob Stroup, vice president of product management at BECU.

That trend was a call to action for the fourth-largest credit union in the nation, and BECU responded by implementing the opposite program.

We wanted to reward our members for their responsible use of credit, says Scott Strand, chief lending officer and senior vice president of member lending, business, and wealth.

A Responsible Reward

BECU automatically provides the best rate it can for credit cards and lines of credit, no matter how long a member has had the product.

We look at member credit reports on an annual basis, Stroup explains. If their credit score has increased such that it qualifies them for a better rate, we automatically move them to that rate.

According to Stroup, when the credit union implemented the automatic rate reduction, it was not aware of any financial institutions proactively lowering rates on an annual basis. Today, the strategy simultaneously serves member interests and gives BECUa competitive advantage.

This is a good representation of the credit union philosophy of returning more to members, Stroup says. It also helps us be proactive in retaining our accounts.

A Shift In The Auto Loan Paradigm

After experiencing positive outcomes in its rate reduction program for credit cards and lines of credit, BECU extended the repricing program to its auto loan portfolio in September 2015.

The auto lending industry is highly competitive, Stroup says. This was a great way for us to differentiate ourselves. At the same time, it prevents another lender from recapturing one of our loans.

Strand says introducing the rate reprice to auto loans was a natural extension, but the credit union’s larger goal is to balance what it returns to members for being part of the cooperative with its goals for net income and capitallevels.

We’re in a financial position to deliver more value to our members through this mechanism by adding auto onto a practice we’ve had for 10 years, Strand says.

Balances And Penetration

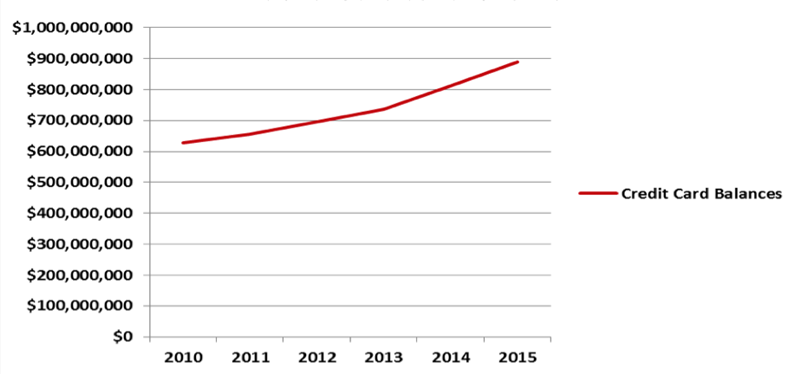

In the 10 years since implementing the credit card rate reduction program, Strand says BECU’s credit card balances have doubled from $385 million to slightly less than $900 million.

There are a lot of reasons for that, explains the chief lending officer, pointing to the credit union’s competitive rates and good rewards program.

CREDIT CARD BALANCE GROWTH

For BECU | Data as of December 30

Callahan & Associates | www.creditunions.com

Source: Peer-to-Peer Analytics by Callahan & Associates

According to the credit union, its credit card penetration rate has also increased 25% in active card users compared to an industrywide rate of approximately 14%.

For autos, it’s too early to tell if BECU has retained loans by adopting the practice, Stroup says.

In 2015, the credit union with almost 930,000 members provided rate reductions on 22,000 credit cards, 9,000 lines of credit and 5,000 auto loans. Of its approximately $9 billion loan portfolio, BECU repriced $100 million last year.

Save Time. Improve Performance.

NCUA and FDIC data is right at your fingertips. Build displays, filter data, track performance, and more with Callahan’s Peer-to-Peer analytics.

Benefits, Risks, And Challenges

Adding auto loans to this practice of automatic rate reductions wasn’t without its risks and challenges.

The primary risk associated with the reprice program is that we are basing the reprice [lower rate] on a credit score at a point in time, Stroup says. We do not increase rates when credit scores decline, so if a member’s scoredeclines after we have lowered their rate, we are no longer pricing appropriately for the risk.

It took time to determine how to lower the rates and by how much without looking at each individual loan.

The credit union considers it a risk worth taking, though, because of the quality of relationships it builds with members.

The loyalty we build by proactively lowering a member’s rate offsets the risk, Stroup says. That member is more likely to maintain their account in good standing.

Second, repricing an auto loan is a bit different from repricing a credit card or line of credit, no matter how solid the existing repricing structure is.

There are a lot of variables in determining the rate for auto loans, so it was a little more challenging to implement, Stroup says.

According to the vice president, the auto loan repricing program tested the structure in place to reprice lines of credit and credit cards. For example, auto loan rates fluctuate based on timing, loan terms, and a borrower’s loan-to-valueratio.

It took time to determine how to lower the rates and by how much without looking at each individual loan, Stroup says.

Third, the manual processing required by each transaction is challenging. The Washington state credit union hopes to implement an automated process going forward to increase internal operational efficiencies. Although the process is largely invisibleto members and members aren’t adversely affected, Stroup says automation will help eliminate the potential of errors and optimize operations.

But none of this was unexpected.

We anticipated the challenges on the auto side and we weren’t disappointed, Stroup says.

Credit Union Communication, Member Enthusiasm

Turning a longstanding credit model on its head doesn’t do any good if members don’t understand the benefit. So BECU modified, and simplified, its messaging strategy.

In its 2015 rate reduction notices, BECU included the change in terms and the member’s new, lower loan payment to make the benefit clear. It also combined reduction notices from multiple credit products into one annual letter.

Stroup says the streamlined strategy made for a pretty compelling communication.

We definitely heard from our members that they were delighted and surprised when they received it, he says.

BECU expected its members to be pleased by the changes in rates and communications. But the amount of positive social media feedback came as a surprise.

When you can get your members talking with one another about you, that’s even better, right? Strand says.

You Might Also Enjoy

- 3 Ways To Offer Auto Draft Pre-Approvals

- Lending Highlights From Third Quarter 2015

- How To Make Lending Easy For Members

- Tips To Make Better Automatic Loan Decisions