<h3″>

Anheuser-Busch Employees Credit Union

Data as of 12.31.16

HQ: St. Louis, MO

ASSETS: $1.6B

MEMBERS: 124,781

BRANCHES: 30

12-MO SHARE GROWTH: 3.4%

12-MO LOAN GROWTH: 10.1%

ROA: 0.74%

Anheuser-Busch Employees Credit Union ($1.6B, St. Louis, MO) has found a comfortable niche for itself and its members with balloon lending for automobiles.

The loans work much like a lease, with lower monthly payments and a balloon payment at a guaranteed future value at the end. But there s a big difference.

The member actually owns the car, says Janice Bruno, vice president of indirect lending at ABECU, which has 2,640 of the loans currently in place.

The balloon notes represent only $71 million of a $646.9 million auto portfolio, but they do attract a certain kind of borrower, Bruno says.

Our Value Plus loan works for the person who is looking for a lower payment, the person who likes to get a new car often, or who wants that more expensive or luxury vehicle but not the large payment, Bruno says. It can also help the person who s upside down on their trade-in.

Like a lease, borrowers choose a maximum amount of mileage a year they plan to drive ― up to 18,000 miles a year for up to five years at ABECU ― and can turn the vehicles back in to the credit union or re-finance at the end of the term.

Like a lease, there s a residual value at the end based on depreciation, but unlike a lease, they can refinance, pay off, sell, or trade in the vehicle, and there s no security deposit, acquisition fee, or pre-payment penalties.

If the member turns in the vehicle at the end of the term, there s a low disposition fee and they might incur cost for applicable wear and tear and going over the mileage they selected, Bruno says.

But along the way, there s a significantly lower monthly payment, as much as 40% compared with a conventional loan, according to Auto Financial Group, the Texas-based vendor ABECU has worked with since 2003. AFG guarantees residual value and disposal of cars that are returned to the credit union.

ABECU uses Auto Financial Group for its balloon lending program. Find your next solution in Callahans online Buyers Guide.

AFG provides the payment-quoting software behind ABECU s online calculator, which shows that, for example, a $25,000 balloon note for 60 months at 12,000 miles a year would cost $491 a month with a 2.34% conventional loan and $348 a month as a Value Plus balloon loan.

The loans are available for new and used vehicles and offered through direct and indirect channels. Members can apply online for the balloon loan or access it at the credit union s network of dealers. According to Bruno, dealers accustomed to working with leasing and comparable products are where ABECU has had the most success with its balloon notes.

They re the ones who best understand how the balloon works and see the advantage of getting the person back in the store, Bruno says.

ABECU s overall loan portfolio of $1.35 billion at the end of fourth quarter 2016 contains 27.08% new car loans compared with an average of 15.03% for credit unions with $1 billion to $10 billion in assets, according to data from Callahan Associates. Its used car loans accounted for 20.96%, right at the peer average of 20.31%.

How Does Your Auto Program Stack Up?

: Callahan s Peer-to-Peer lets you quickly gauge how your auto lending efforts compare to your peers. Use it to find opportunities you didn t know existed.

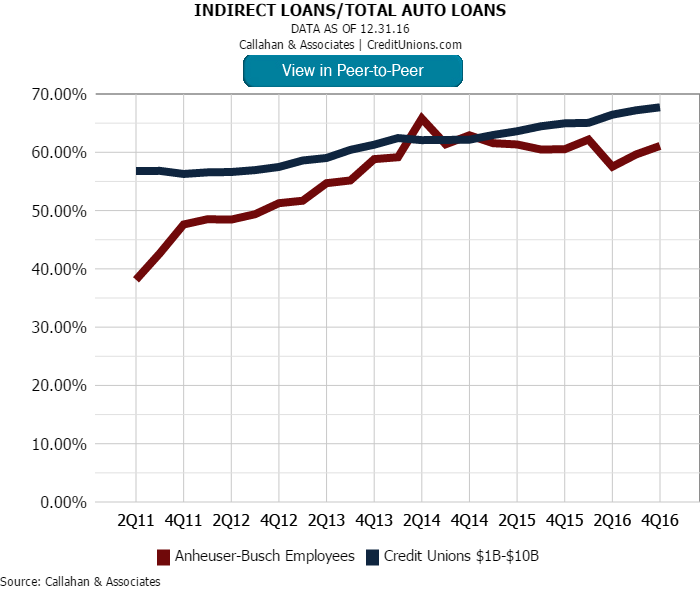

ABECU has 30 branches in 12 states and concentrates its indirect lending in home state Missouri as well as Texas. Indirect lending accounts for 61.09% of its total auto lending, compared with 67.71% for the average billion-dollar credit union.

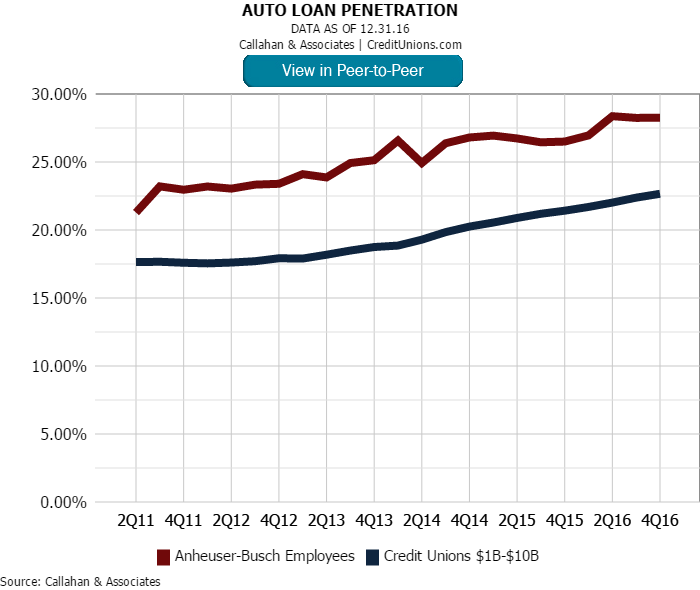

The St. Louis-based credit union s member penetration rate for auto loans overall bests its peer average ― 28.26% versus 22.26% at year-end 2016 ― but the balloon notes aren t heavily marketed, Bruno says.

The Value Plus loan works as another option for our members when it comes to financing their vehicles, the 32-year ABECU executive says.