The city of Spokane is located in northeastern Washington, approximately 20 miles west of the Idaho border, 270 miles east of Seattle, and 100 miles south of Canada. It is the second-largest city in Washington population is just shy of 209,000 and the largest metropolitan area between Seattle and Minneapolis.

Spokane is positioned geographically in a somewhat remote location, says Tom Johnson, CEO of Spokane Teachers Credit Union ($1.7B, Spokane, WA). Yet we’relarge enough that we need and want and invest in the resources a community of this size needs.

The city is home to the Spokane Symphony Orchestra and the Spokane Jazz Orchestra as well as a professional theater company. In 1974, it hosted the World’s Fair. Today, it hosts the world’s largest timed road race, the Bloomsday Run, and theworld’s largest

3-on-3 basketball tournament, Spokane Hoopfest. Sports fans that are satisfied sitting on the sidelines can attend minor league events in hockey (Spokane Chiefs), baseball (Spokane Indians), or arena football (Spokane Shocks).

The Spokane River winds through downtown Spokane and along Riverfront Park, which occupies 100 acres in the downtown district. Visitors and residents that want to get a bird’s-eye view of the Spokane Falls, which ebb and flow according to the season,can hop on one of the aerial gondolas that take passengers for a suspended ride above the river. The modern flair of The Joy of Running Together, a series of cast steel sculptureshugging the edge of the park, at first appears tobe out of sorts with the 100-year-old carousel that still takes riders on a whirl, but they’re both part of this active city that encourages residents and visitors to take advantage of its many recreational activities, from biking to boating,hiking to skiing, golfing to fishing.

We are a four-season culture, says Ren’ee Robertson, vice president of finance at PrimeSource Credit Union ($49.8M, Spokane, WA).

Economic Drivers

Spokane is surrounded by many natural resources, says Jennifer Lehn, chief operations officer of Numerica Credit Union ($1.2B, Spokane, WA).

That has played a large role in the Spokane economy, historically. We have lumber, agriculture, and mines in the immediate outlying areas, so particularly in the earlier days, those features were key to the economic environment.

Today, the areas major economic drivers include education, medicine, and the military. There are several colleges and universities in the area including Gonzaga University and Whitworth University and campuses for Eastern Washington Universityand Washington State University and people from all over eastern and central Washington as well as from Idaho, Montana, and the Dakotas travel to Spokane for healthcare needs. Nearby Fairchild Air Force Base, offers solid employmentopportunities and keeps our economy going, Robertson says. All in all, the area benefits from a diverse economy and does not suffer from a concentration in anyone industry.

But like the rest of the United States, Spokane felt the bite of the economic downturn, although the area lagged six to 18 months behind. The unemployment rate hit 10.6% in March 2011 but has since dropped to 9.9% as of March 2012. Anecdotal observationof the activity in the housing market, startups, and commercial building suggest life is returning to area businesses.

I’d say Spokane has hit bottom, and there are some small signs that things are getting better, Lehn says.

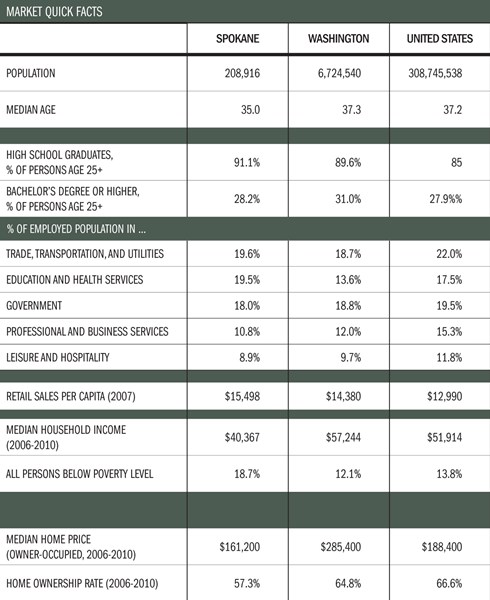

In a normal economic environment, Spokane lags Washington State in many census metrics. The average household income in Spokane is $40,367 versus $57,244 for the state. The number of people living below the poverty line is also above average 18.7%of the population in Spokane versus 12.1% in Washington. The median home value is $161,200 while the state as a whole has a median home value of $285,400.

Dealing with lower incomes, lower home values, means we have to work hard to grow, Lehn says. We have to work hard to make a profit. There are some challenges from an economic standpoint, but from a benefit standpoint, this is a fabulousplace to live and fabulous place to do business.

Financial Services

The Spokane area is a great model for credit unions, says Anthony Tschache, market research analyst with Numerica Credit Union. We have more than 19 credit unions, many with several branches, and a lot of them are involved in thecommunity in one aspect or another.

Indeed, Spokane County has 90% of all the credit unions in Eastern Washington. There are 20 credit unions in the 12 counties that make up Eastern Washington; Spokane County has 18 of them. Two of the largest credit unions in the state of Washington No. 3 Spokane Teachers and No. 4 Numerica are headquartered in Spokane.

We’re not a big metropolitan area, but there’s an appeal for credit unions, says Cindy Leaver, chief financial officer at Numerica. Some of it might have to do with the tradition of the employer groups and blue collargroups that started a lot of the credit unions.

But it’s not just credit unions that are drawn to Spokane. The term underbanked does not apply to this community.

There’s quite a few financial institutions headquartered here in Spokane, which I always thought was interesting from an employment standpoint, Leaver says. AmericanWest Bank, Bank of Fairfield, Inland Northwest Bank, Sterling Bank,and Washington Trust Bank are all based in Spokane. And national banks such as Wells Fargo, Chase, and Bank of America also have a presence. In all, there are 17 banks and 94 bank branches in the city of Spokane.

Despite the intense competition, area credit unions turn out an impressive financial performance quarter after quarter. Spokane’s credit unions held 11.55% of the mortgage market share as of December 31, 2012. Nationally, credit union’s mortgagemarket share at that time was closer to 5%. For deposits, credit unions in Spokane held 25.3% of the market, as of June 30, 2011, that’s a stunning 2.5 larger than the nationaldeposit market share.

We’re not so large that we’re inundated with the major national players beating down the doors, says STCU’s Johnson. They’re here, but they don’t invest in this market like they do in Seattle or Minneapolisor Chicago or Washington, DC, so we have a chance to make a difference by investing in the community, being an employer, and getting our brand out there. This community embraces the concept of the cooperative, and that is manifested in the numbers.

Credit Union Cooperation

There is a sense of camaraderie among many of the credit unions in Spokane.

We share successes and failures, says Margaret Burkholz, CEO of PrimeSource Credit Union. We lean on one another, and that’s unusual.

In a pinch, the city’s credit unions have even been known to share staff when a credit union is short an employee.

I’ve had staff come over here because I was short somebody, and we have sent staff to other credit unions, Burkholz says. It doesn’t matter what side you’re on, that’s how we play. We play fair.

Stronger together

Stronger together

7 ways Spokane credit unions come together to support one another and the industry.

It’s a cooperation that is in stark contrast to for-profit business models. And although they realize, and enjoy, the local competition, these institutions understand the benefits shared by all when a community embraces its credit unions.

They are aware they are competing, but they are focused on the idea that credit unions need to be focused on serving members, says Greg Smith,CEO of Spokane-based CUSO CU*NorthWest. What’s good for one is good for all. Regardless of brand, if a credit union is successful, it perpetuates the entire credit union movement.

We are committed to the movement, agrees Johnson. We conduct ourselves in a collegial way and find those places where we can work together as credit unions to enhance the movement.