The COVID-19 pandemic is drastically impacting the global economy. Behavioral shifts propelled by a concerted effort to flatten the curve have impacted almost every aspect of daily life, including how people pay and how they receive payments. From the perspective of a credit union, concerns arise about how the payments industry will recover in the near and longer-term. Credit unions should keep an active eye on these three primary areas of the payments industry in the coming months: spend, risk, and technology.

Consumer Spending Has Shifted Dramatically

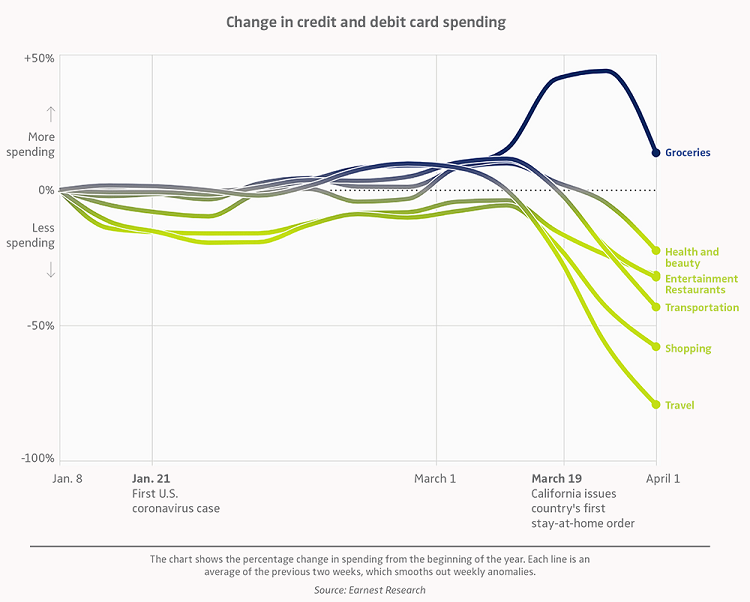

Year-over-year spend on credit cards is down approximately 30% industry-wide. Changes in spend reflect the fact that people are staying home and social distancing. Spending on categories like groceries, online purchases, and food delivery has increased while spending on travel, apparel, and out-of-home entertainment is down. The question facing issuers is, as the economy moves towards a new normal, how will the pandemic change consumer card spend behavior?

Travel is likely the category most reliant on a vaccine to drive increasing spend. It will take time for consumers to be comfortable being in a confined airplane or surrounded by thousands of other people on a cruise ship again. A survey by the International Air Transport Association found 40% of recent travelers anticipated waiting at least six months after the virus is contained before flying again.

Entertainment will see a drop in spend. While many restaurants have relied on take-out orders to at least sustain operations, people returning to dining out is critical for the recovery of this segment. In an April 2020 study, 65% of consumers who have used order-ahead, or who’ve increasingly ordered food from aggregators since restaurants closed in mid-March, have said they will continue to use these options just as much, even after restaurants reopen. People may also hesitate to return to close-contact venues like movie theaters, concerts, and sports arenas.

Retail has shifted as the pandemic has pushed people into virtual shopping. In an April 2020 study, three out of 10 consumers reported that they made their most recent clothing purchases on Amazon. Additionally, 53% of respondents said they used their mobile devices to help them complete their most recent purchases. It will take time for shopping malls to return with busy traffic levels of in-store shopping resembling that of 2019.

Credit unions should pay close attention to these consumer spending behaviors to help work with their members. The current payments landscape is changing rapidly, and consumer habits will play a large part in the economic recovery.

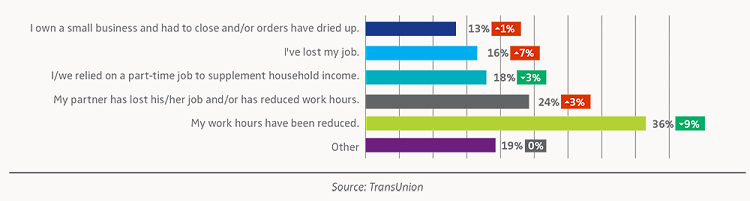

Increased Risk: Unemployment And Credit Losses

The pandemic has impacted household income in many ways, including lost jobs, furloughs, wage reductions, and record-level small business closures. The survey below shows the degree of impact, and week-over-week changes:

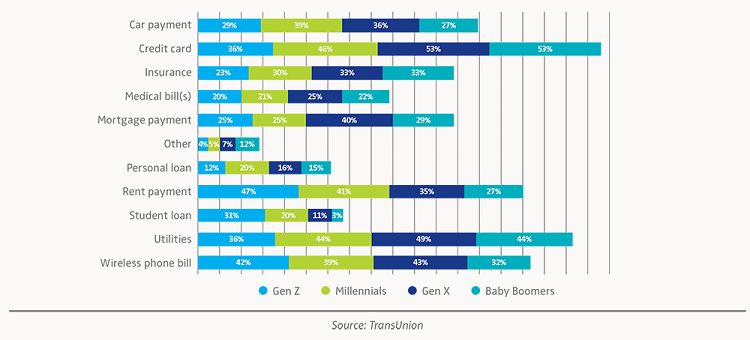

Consumers have significant concern about their ability to pay bills, with credit card bills representing the highest level of concern across most every generation (except Gen Z).

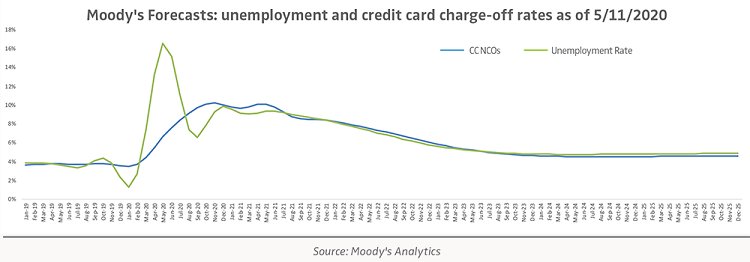

Historically, credit card losses and unemployment are highly correlated and follow a very similar trend line. Unemployment and card losses are forecast to peak in the second to third quarter of 2020, with a two- to three-year recovery to a new normal industry loss rate.

There remains a high level of uncertainty as to how the pandemic and quarantining measures will affect unemployment and correlating loan loss rates. CUNA has modified its peak unemployment rate from 6.5% (as published March 24) to an updated peak of 15% in 2020 (as published April 8). Industry experts are now stating that comparisons to the recessionary period of 2007 2009 are no longer deemed viable as forecasts are now pitting the economy below levels during that period.

Credit card issuers should be stress-testing their portfolios and evaluating strategies to mitigate risk while effectively servicing the cardmember needs. Issuers should also consider past recessions and the impacts of economic shifts to their overall risk exposure. Many issuers leveraged increased credit limits coming out of the 2008 crash to stimulate usage. However, that strategy produced minimal benefit then and may have added to the burden now with increased risk exposure entering the current recession.

Issuers need to create a robust and fluid approach to risk management while balancing cardmember servicing and stress.

Transition To Technology

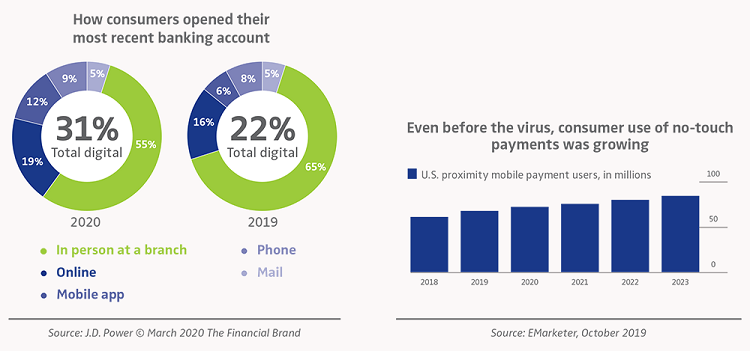

Quarantining has forced credit unions to leverage digital capabilities across many platforms. A survey of U.S. consumers in late March found that 52% of those who regularly visited a bank branch prior to the COVID-19 pandemic are now avoiding them and 39% are reducing their visits. Only 8% are visiting branches as normal.

Many members have learned to perform their routine banking transactions digitally. If branch volume remains suppressed as we move into recovery, credit unions that rely on in-person interaction to cross-sell payments products and maintain a strong level of customer service will have to learn to do the same thing via digital channels. Credit unions must build out effective digital marketing strategies and capabilities to drive card cross-sell into their digitally engaged member base.

The pandemic has also pushed for the adoption of other technologies that focus on contactless payments and mobile wallets. For example, Visa’s overall tap-to-pay payments are up 40% year-over-year. This could create a longer-term card payment interaction trend requiring a cohesive digital strategy to capture top-of-digital-wallet usage, virtual card capabilities, and an enhanced suite of digital servicing functionality.

Moving Forward To A New Normal

One thing is certain, we are living in unprecedented times and no one really knows what our new normal will look like and how this will impact long-term credit card usage behavior. Credit unions must remain flexible to address our ever-changing environment. Elan advisors are available for complimentary consultations on your credit union’s credit card portfolio, to discuss current and expected industry trends, their potential impacts on your card portfolio, and the strategic alternatives your credit union has to support its goals and objectives.

About Elan Credit Card

As America’s leading agent credit card issuer, Elan serves over 250 active credit union partners. For over 50 years, Elan has offered an outsourced partnership solution that provides credit unions the ability to offer a competitive credit card program. Elan has developed industry-leading technologies to improve cardmember satisfaction and drive growth all while sharing the program economics with our partners. For more information, visit www.cupartnership.com.

to offer a credit card program with state-of-the-art technology driving a full suite of robust consumer and business products. Credit unions also benefit from desirable fraud prevention features, as well as marketing, promotional, and training materials for members and staff. Elan assumes much of the liability of providing credit card solutions, as well as the compliance and regulatory burdens associated with running a credit card program.

Click here to download a whitepaper titled COVID-19’s Impact on the Payments Industry from Elan Financial Services.