Credit unions seeking to enhance the loyalty and engagement of their members should explore the benefits of branded credit card programs. The value of a credit card relationship with members extends beyond the bottom line, as members who carry your branded card are more likely to have a deeper relationship with your institution, data shows.

|

What We See Banking Relationships

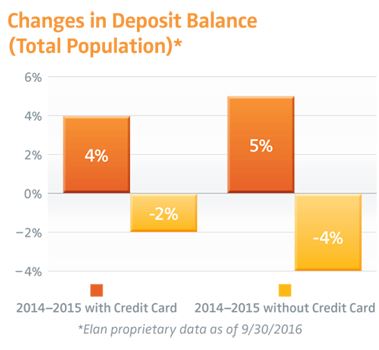

Keeping cardmembers happy should be any credit union’s main priority. Deposit balances are higher when a member has his or her credit union’s branded credit card. The graph below shows 2014 through 2016 data from deposit account members who have a credit union credit card versus members with deposit accounts only. On average members with credit cards at the same institution are growing their deposit accounts as avid savers, while members without a credit card product are less active.

In addition, the average length of relationships with cardmembers appears related to the number of products they have opened with an institution. Successfully providing a second or third product that truly benefits the member can have a significant positive impact on the longevity of the relationship. The graph below shows a direct correlation between average relationship longevity and the number of products a member has.

Having multiple products with the credit union may drive some secondary benefits as well, including lower default and attrition rates. If a cardmember has a credit card and one additional product with a credit union, the default and attrition rates are typically 10% to 12%, according to Wharton School research.

Also a factor in influencing long-term behavior is the channel that members use to interact with those products. Overall, card members who use mobile and digital banking have higher product holdings at 2.3 products, compared with 1.3 products for branch-only card members.If members are engaged with the mobile banking application of a financial institution, they are more likely to think of that financial institution when they need other financial services products.

Engaging members through mobile and digital channels allows for real-time service, while potentially lowering a credit union’s operating expenses. Finally, having multiple products per member better leverages your financial institution’s fixed resources and marketing budget, driving a higher overall return.

It is critical to note that the research conducted was based on the presence of industry-leading card programs with rich rewards programs. A card program that lags the industry in overall value proposition to the member is unlikely to result in such strong loyalty metrics.

Loyalty Impacts Of Cards In Other Industries.

Retail-based general purpose credit card programs are also proven to have a significant impact on the overall loyalty of the cardmember to the retailer’s core business. Retailers do not own or operate these credit card programs in most cases, but due to the selection of the right partner, these retailers realize a number of enterprise-level benefits.

Benefits include the delivery of a value proposition tied directly to the retailers’ core loyalty program, delivery of products with integrated value propositions, and driving increased spending at retail locations. A well-run co-brand credit card program can lead to increased visits to the retail location, increased spending with the partner, and deeper loyalty to the franchise. In recent years, airlines have shined in this arena, boasting record ancillary revenues. In 2013, United Airlines generated $5.7 billion in ancillary revenue, and their credit card program was responsible for more than half of that amount. Delta Airlines also benefitted from its co-brand relationship after generating $2 billion in 2014.

Optimizing Results Through A Strong Value Proposition

Credit cards are the most common financial product for consumers to hold at multiple financial institutions. As of August 2016, the average American consumer has four credit cards, according to Statistic Brain. A credit card product suite that offers options for card members, robust rewards programs, and mobile capability may lead to members considering other products and services, as well as attracting new card members by word-of-mouth from satisfied card members.

On the flip side, credit cards can also lure away members. Card members will be loyal as long they feel rewarded. While robust rewards programs may eat into profit margins, loyal and happy card members will use their credit cards, talk about their cards and can end up seeking out other products you carry.

Where Is The Credit Card Market Today?

The time is right to offer a robust credit card product suite as the credit card market is growing. As of March 2015, credit unions showed a definitive uptick in credit card portfolio sizes with balances increasing 7.6% from the previous year. Balances this year have already increased by 6% compared with 2015 because of new credit card accounts. About $87 billion in new lines of credit were originated in the first quarter alone, according to The Financial Brand. Also in the first quarter, member relationships (loans and shares) hit $17,245 on average a 4.2% from Q1 2015, according to Callahan Associates.

What Should A Credit Card Strategy Look Like To Capitalize On The Benefits?

A credit card portfolio needs to have a card option for every cardmember. According to Creditcards.com, 35 percent of cardmembers say rewards are the most favorable aspect of having a credit card.

Millennials are an optimal target market data shows that 43% of 18- to 29-year-olds have changed credit cards over the past one to three years. Cardmembers who make less than $50,000 annually changed cards in the last three years. About 45% of millennials say they would switch if a better option came along. Also, something to consider is that less of the upper middle class is participating in credit card programs. In 2014, 63% were participating and this year the number of affluent middle-class cardmembers dropped to 48%, according to creditcards.com. Credit unions need to be prepared with top-of-the-line rewards and credit card options to gain the cardmember loyalty of emerging generations to stay ahead of the game to gain this cardmember loyalty that can grow a credit union. Overall, having the right products helps build engagement with members and increases the likelihood they will open additional accounts.

Click hereto download a copy of the white paper, Creating Cardmember Stickiness with an Enriched Credit Card Product Suite.

For almost 50 years, Elan has helped credit unions grow their business and meet the needs of their cardmembers. Along with a robust credit card suite, Elan also offers mobile payment technology and mobile apps for easy payment access. Elan also provides an online and in-person training program for new partners to help them navigate the product suite and match credit cards with individual cardmember needs. Year after year, our partners remain pleased with the Elan solution, as Elan has seen more than a 96% partner renewal rate. For more information, call 1-800-223-7009 or visit cupartnership.com.