Top-Level Takeaways

-

DCU’s dive into digital car dealership relationships has blossomed during the pandemic.

-

The big cooperatives relationship with Carvana offers general lessons on how to work in the digital realm.

Credit unions aren’t alone in facing digital disruption, new competition, and unexpected surprises in the marketplace. Traditional auto dealers, for example, felt the pinch as U.S. consumers opted to avoid in-person lots during the height of thepandemic. The move added to the already growing momentum of virtual shopping for one of the most important items many people possess their cars and trucks.

Rather than lose business to a new way of buying, Digital Federal Credit Union($9.9B, Marlborough, MA) is riding that wave and now finances more than a thousand loans a year directly for members through Carvana.

Although that’s a small piece of the pie for a credit union with an auto loan portfolio of $2.5 billion more than $1.9 billion of it in used vehicles its a growing trend DCU is embracing.

Carvana gained attention with its vending machine approach to used car buying, but its direct-to-consumer sales have soared and it has become a serious rival with CarMax as the largest seller and buyer of used cars in the country.

Caleb Cook, Vice President of Consumer Lending, DCU

That’s notable because the used-car market has been on fire.According to Cox Automotive, U.S. sales in April 2021 were anestimated 69% higher year-over-year. Prices also have soared. The Manheim used vehicle value index rose 4.55% in the first 15 days of Mayalone and was up 48% from May 2020.

Although rising prices make it even more important for credit unions to offer members beneficial rates on automotive purchases, choice remains crucial, too. DCU is doing what it can to offer that in off-lot and on-lot settings, says Caleb Cook, the big cooperatives vice president of consumer lending. Here are five more ways the credit union is working with Carvana to offer a modern car-buying experience.

Tip 1: Make The Most Of Any Situation

DCU began its relationship with Carvana in 2019. When the pandemic struck the United States in 2020, the credit union showed members it was ready to embrace a new socially distanced reality.

We highlighted it throughout the past year as one of our many tools to help members get through the challenges created by the pandemic,Cook says.

Off-lot auto sales aren’t relegated to vending machines, however. According to Cook, CarMax also is ramping up its online business.

Our members use a variety of car buying and trading options throughout the country,the VP says.;We’ve seen increased use of competitors like Vroom and Shift, along with online vehicle buyers like ALgo.

Tip 2: Offer A New Take On A Proven Strategy

To ensure members can get the best rate possible and to incent business, DCU offers rate discounts based on a variety of terms. For example, there are discounts for members who have a checking account with direct deposit or who are purchasing a fuel-efficient vehicle. These perks apply regardless of the dealer.

Carvana is just a piece of our virtual car buying and trading strategy, Cook says.We continue to expand virtual buying and borrowing experiences with the goal of making the auto loan the easiest part of the transaction.

DCU doesn’t offer a special loan rate for buying a car with Carvana, but it does promote the online service, directs members to a co-branded website, and offers promotions that are beneficial to members.

We’ve done promotions with Carvana where our members saved several hundred dollars when buying a car during a select period of time,Cook says.

As part of the business relationship, DCU hosts a co-branded webpage with Carvana.

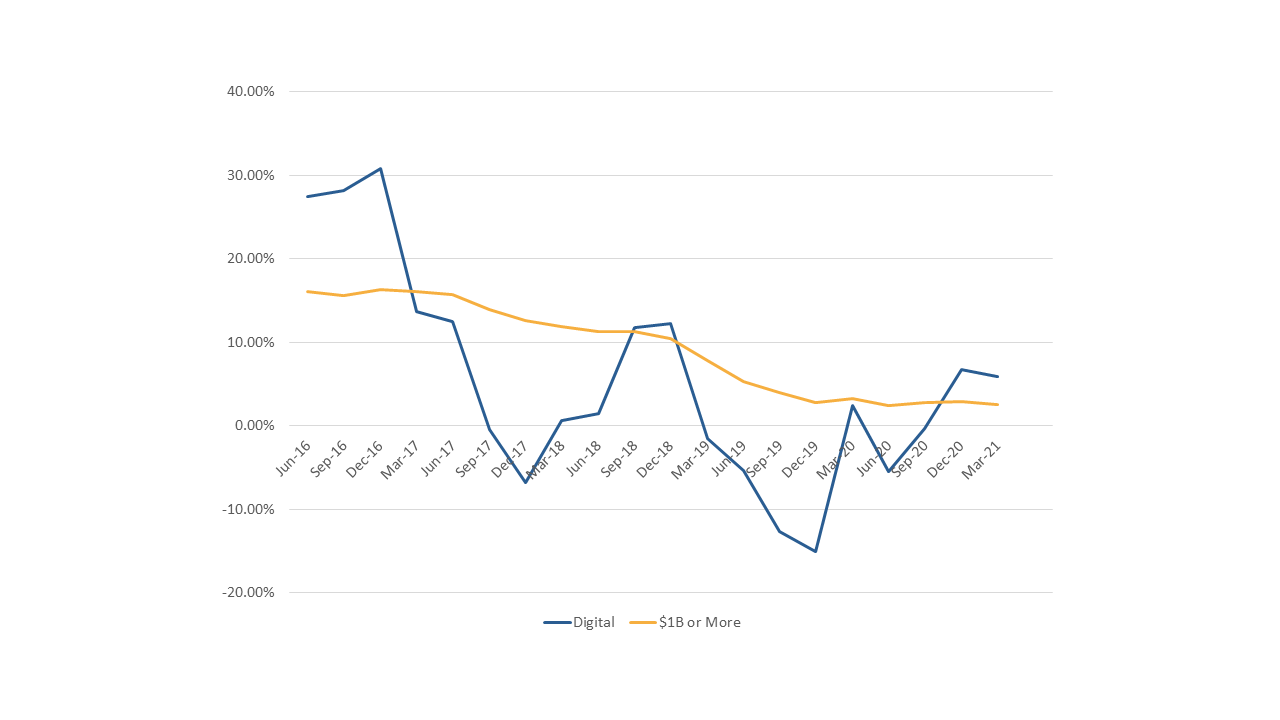

NEW VERSUS USED AUTO LOAN GROWTH

FOR DIGITAL FEDERAL CREDIT UNION | DATA AS OF 03.31.21

CALLAHAN & ASSOCIATES | CREDITUNIONS.COM

Used car loan growth has consistently outpaced new car loan growth at DCU, including 10.58% compared with 7.73% year-over-year in the first quarter of 2021.

TOTAL AUTO LOAN GROWTH

FOR DIGITAL FEDERAL CREDIT UNION | DATA AS OF 03.31.21

CALLAHAN & ASSOCIATES | CREDITUNIONS.COM

After dipping below the average pace for credit unions of $1 billion or more, DCUs overall auto loan growth grew sharply during the pandemic.

Tip 3: Dont Worry About Online Versus On The Lot

For members, digital car buying is much the same as buying from a car lot. The buyer negotiates a purchase price if and when it can be and the credit union takes it from there.

The process is the same for online retailers except, of course, the wheeling and dealing takes place online rather than on a lot. And, in the case of Carvana, the retailer delivers the car to the buyer.

For lenders like DCU, whose portfolio of hundreds of thousands of car loans is roughly 90% direct and 10% indirect, the entry of online retailers into the auto market is not unlike the addition of another brick-and-mortar dealership. So, it treats themas such.

We knew our indirect dealer partners would not like our partnership with Carvana but it hasn’t changed how we lend to members or work with any of our dealers,Cook says. We treat Carvana just like any other dealership and wework with thousands of franchise and independent dealers across the country.

CU QUICK FACTS

DCU

DATA AS OF 3.31.21

HQ:Marlborough, MA

ASSETS:$9.9B

MEMBERS: 932,444

BRANCHES:24

12-MO SHARE GROWTH:5.6%

12-MO LOAN GROWTH:-8.5%

ROA:0.20%

Tip 4: Understand, And Embrace, Reputational Risk

According to Cook, DCU hasn’t recorded significant member growth as a result of its work with online car sellers.

They offer financing just like any other dealership,the DCU consumer lending executive says.In the case of Carvana, we drive current members to our co-branded site. We do promote via social media and pick up some new members thatway, but thats not our focus.

He also sees little reputational risk in attaching DCU’s name to an online dealer like Carvana.

We treat Carvana just like any other car dealership when it comes to complaints,Cool says. Carvana stands by its vehicles with a seven-day trade-in policy, which gives members peace of mind when buying a vehicle virtually. We surveyall of our members after they close on a DCU auto loan, and we follow up on every less-than-perfect experience.

Cook also says DCUs overall experience with online auto buying has been positive.

It is an innovative option for our members looking for an alternative experience to the traditional tire-kicking and negotiating at a car lot,Cook says. Its had a positive impact in the past year especially as social distancingguidelines forced dealers to reconsider their approach

Tip 5: Approach It From The Members Perspective

Based on DCUs experience, Cook says credit unions should treat digital dealers like any other direct dealer in terms of lending processes and operations. He advises against focusing on profitability, member acquisition, or disruption response.Instead, consider the bottom line, which is that there are few additional costs or resources needed to lend in the digital car-buying realm.

Approach it from the member experience perspective,Cook advises.Listen to your members. Be open to trying new things, especially when the stakes are low. We’re always exploring ways to serve our members buying needsfor generations to come.

Dig Deeper Into Your Auto Numbers

Are your auto lending strategies working? It takes minutes to compare various aspects of your auto lending portfolio to other credit unions in Peer-to-Peer. Let us create a scorecard for your credit union.