Although 90% of financial institutions believe digital transformation will fundamentally change the services they offer and completely transform the industry, most lack a digital strategy. This oversight puts credit unions at risk of losing members and profits in the coming years. With the shifting market in mind, credit unions must be prepared to put digital efforts at the forefront of their member acquisition and retention strategy.

While aspects of digital transformation are continuously evolving, current areas of strategic focus could include multichannel and omnichannel offerings. Multichannel offerings allow members to access banking services through multiple devices and locations. For example, a member can view their credit card balance via a mobile app. Omnichannel offerings take things to the next level with on-demand support and services wherever and whenever the member chooses. Therefore, a member can view the status of their credit card application online and then use a chat feature on your website to inquire about other services.

The Rise Of Digital-Only Competitors

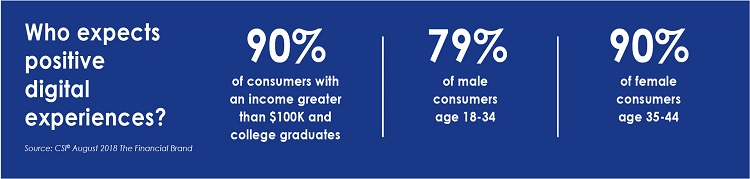

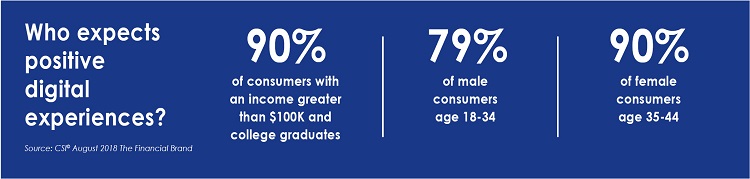

Members expect a seamless digital experience and, if their credit union can’t provide one, they may turn to a competitor. Today, credit unions are competing against any organization that can offer a loan or a deposit solution. This increasingly includes not just the usual competitors, but digital-only financial services organizations. These digital players are effectively disrupting how credit unions meet member needs.

In 2017, loan originations through digital lenders reached $41.1 billion and are expected to reach $73.7 billion by 2022. Digital lending growth is enabled by platformification. Platformification is a distribution model that bundles multiple services onto one online platform and provides an efficient, automated, and integrated member experience. Digital lenders may have an advantage when it comes to providing a responsive digital experience, but many Millennials and Gen Xers still cite convenient branches as the number one factor they consider when evaluating banking products and other retail financial services, suggesting that most members still desire an element of human interaction.

Obstacles To Digital Transformation

A sound digital strategy requires nimble technical and operational frameworks that can adjust to meet members’ changing needs. Lack of integration between new and old technologies, inflexible processes, and missing employee skill sets are common obstacles to digital transformation. Overcoming these challenges often requires money, time, dedicated employee resources, and technical expertise.

One way to overcome obstacles and access needed digital tools, digital marketing campaigns, and cutting-edge payment products is to outsource solutions. Outsourcing allows credit unions to reap the benefits of digital initiatives without the burden of implementing costly technological advancements. Successful outsourcing partnerships allow each organization to focus on its strengths while guiding members through their digital journeys. Credit unions that effectively leverage partnerships can improve this member journey while growing deposit and loan bases.

Partnering With Elan Financial Services

A partnership with Elan Financial Services allows credit unions to offer a credit card program with state-of-the-art technology driving a full suite of robust consumer and business products. Credit unions also benefit from desirable fraud prevention features, as well as marketing, promotional, and training materials for members and staff. Elan assumes much of the liability of providing credit card solutions, as well as the compliance and regulatory burdens associated with running a credit card program.

Click here to download a whitepaper titled Digital Transformation: What’s Your Strategy? from Elan Financial Services.

This article originally appeared on CreditUnions.com in February 2019.

About Elan

As America’s leading agent credit card issuer, Elan serves over 250 active credit union partners. For 50 years, Elan has offered an outsourced partnership solution that provides credit unions the ability to offer a competitive credit card program. Elan has developed industry-leading technologies to improve cardmember satisfaction and drive growth all while sharing the program economics with our partners. For more information, visit www.cupartnership.com.