PSECU had only $10 million in assets when it shifted its strategy from brick and mortar to a virtual operation more than 35 years ago.

The board and management were concerned that our statewide charter would be beyond the limits of what a branch network could sufficiently cover, says Greg Smith, who has been CEO since 1991. If PSECU had invested in a branch network instead of pursuing the virtual model, it likely would not have been able to develop the fee-free benefits it offers today in the majority of its products and services, including for foreign transactions on any ATM in the world.

Adopting a branched strategy would mean that our cost structure would be the same as every other institution and would necessitate us charging the same rates and fees, Smith says. Instead we’re utilizing technology and our ability to work from a central location to offer something better.

In the 1970s, PSECU began building out an expansive ATM and call center operation, which were later complemented by home banking and a diverse mobile platform that includes remote deposit capture (RDC) It has a headquarters that houses its various departments, two backup locations with around 50 employees in one and 15 employees in the other, and a small smattering of on-campus locations designed for new member on-boarding. But other than that, PSECU now has no physical presence in the communities it serves.

Increasing loans without face-to-face contact with members is a challenge for any institution. But as consumer preferences continue to shift toward convenience, credit unions need to learn how to move products effectively through electronic channels even if they have a substantial branch preference.

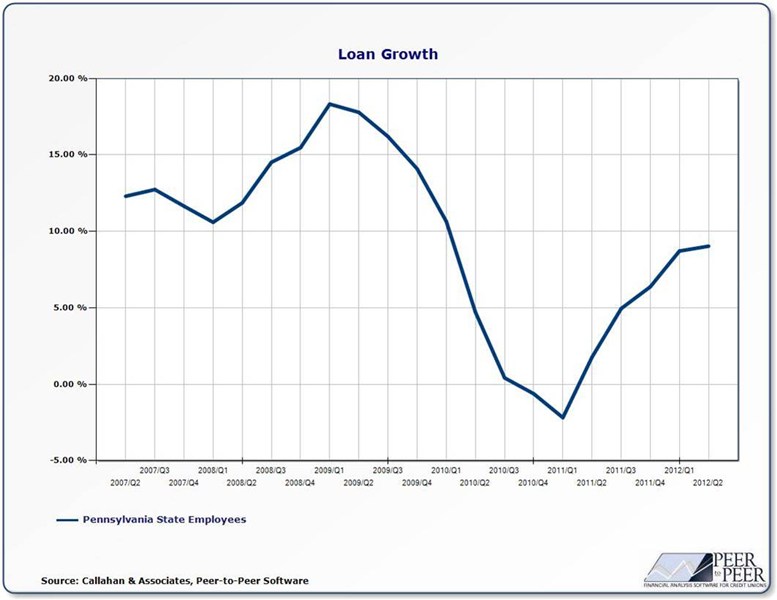

PSECU started ahead of many peers with technological investment, and it has continued to leverage this network and its resulting fee structure to mitigate the problems of have such a small physical presence. While only about 10% of membership have ever set foot on one of PSECU’s facilities, the institution has still achieved 9.03% annual loan growth in 2Q 2012, according to Callahan & Associates data.

Roughly 65% of consumer credit requests today come through the online channel without any engagement from PSECU staff. And in real estate lending, that number tops 90%.

If you walked into our branch and said you were here for a mortgage, we’d guide you to the PC in the corner, says Smith. We’re helping our members understand they don’t need to come here to do these activities. And they eventually do figure out that they really can take care of everything from home.

The credit union writes about 500 first mortgages per month and 300 to 400 card loans every day, with the majority of that activity from the online channel.PSECU’s annual auto growth was 9.65% in the second quarter, but around 25% of that activity came from the indirect channel, including a CUSO -linked program and an additional network of dealers the credit union built from the ground up.

We don’t even tell members about our indirect program, because that’s like telling members to go to the dealership so we can pay them $400 of your money, too,says Smith We prefer when members get their financing arranged with us so they can just hand an auto draft across the table to the dealer.

The credit union jointly developed a new online lending program with an Atlanta software company to further streamline the channel, allowing members to apply for a car loan in as little as three minutes.Members answer seven to eight questions and the credit union prepopulate’s the information it already has about them. Then, it pulls their credit scores and provides an answer for them in about 30 seconds.

In the past six months, PSECU has added a targeted cross-sell feature to its call center and online interactions. When the member is done with their primary request, the program uses pop-ups to alert the representative to solicit additional business based on the member’s credit report and the loans that they have elsewhere. Around 65% of members going through online channels trigger the pop-ups. Representatives can also see specific cross-sell information for about 35% of the members who dial in to the call center.

If you have a credit card balance somewhere else, we offer you our 2.9% transfer fee to our credit card, says Smith. If you have a car loan somewhere else, we calculate the interest rate savings if you’d move that loan to us. We’re getting a significant lift on activity from this.

For a deeper look into the varied branching and operational strategies of PSECU and three other successful credit unions, look for your copy of the 2Q 2012 edition of Technology@CU.