Generation Z, or Gen Z, refers to those born between 1995-2010. Gen Z consists of about 68 million Americans with a purchasing power of close to $44 billion. The oldest members of Gen Z are now graduating college, entering the workforce, and beginningfinancial adulthood. This generation has been described as highly connected, and the most diverse and inclusive generation in history.They also expect fast service, fast results, and overwhelmingly prefer cashless payments such as Zelle and Venmo, compared to all other generations.

In a recent study conducted by Billtrust, 79% of Gen Z reported using person-to-person (P2P) payments at least once per month. GenZ’s everyday activities from shopping to socializing to banking are increasingly happening online.

Shift Toward Digital

It is no secret that branch traffic from every generation from Baby Boomers to Gen Z has been declining over the years.While in-person contact may be preferred for more complicated activities, members want to be able to do much of the application and servicing activities with their credit union online. In fact, only 13% of Gen Z reports caring about conveniently located branches.

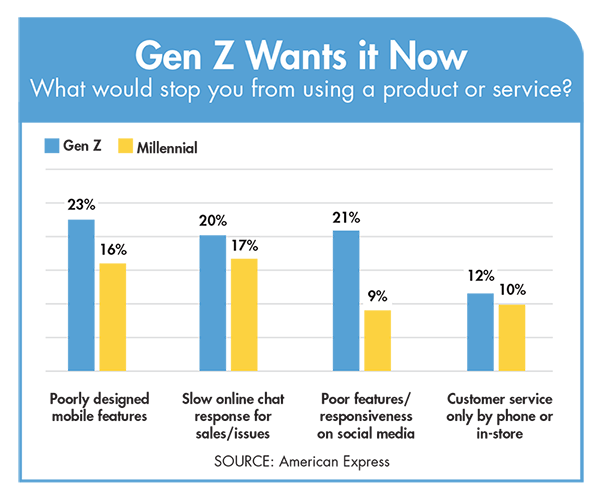

The declining importance of branches means that digital capabilities must perform all activities that used to take place in the branch, and these activities must be user-friendly and effective. Being raised on technology affords Gen Z little patiencefor poor user experiences.

What This Means For Credit Unions

Credit unions must prioritize having a robust website and mobile app with servicing features to meet the expectations of Gen Z. Previous generations may have had more tolerance for lackluster digital experiences, but Gen Z has reported they would stopusing a product due to poorly designed mobile features. They want banking from their phones, tablets, and computers to be a seamless, convenient, and intuitive experience. Failing to provide such an experience will have dire consequences for a creditunion’s member acquisition and retention.

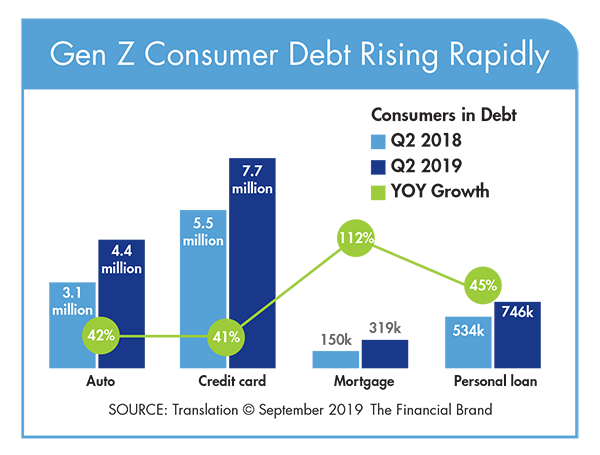

Lending

Though originally resistant to take on debt, Gen Z members are increasingly embracing credit. As of the second quarter of 2019, 31.5 million Gen Z consumers were credit-eligible. About 13 million will become credit-eligible over the next three years. Credit cards are the most common credit product among the Gen Z cohort. According to TransUnion, the percentage of credit-eligible Gen Z members who carry a balance, meaning they have an active credit card, increased 41% between second quarter 2018 and second quarter 2019, reaching a total of 7.75million.

As with other aspects of their financial lives, Gen Z wants effective, intuitive digital experiences when managing their credit cards via mobile apps. Elan conducted a survey about credit card mobile apps in collaboration with PYMNTS.com. The survey revealed:

- Youngest consumers are by far the most enthusiastic adopters of mobile card apps. 90.4% of Gen Z consumers have downloaded mobile card apps, while only 50% of respondents ages 55 and older have done the same.

- Two-thirds of all respondents believe mobile card apps can help them more easily manage their accounts, but interesting generational differences emerge when examining other motivations for using such apps. Younger consumers are particularly interestedin using card apps to manage their spending, as 64.2% of millennials and 60.6% of Gen Z respondents indicated this as a reason for their app satisfaction, suggesting that consumers gaining their financial footing may regard card apps as importanttools to keep their budgets in check.

- Even more dramatic generational differences emerge when we examine certain mobile app features’ appeal. This is particularly evident when analyzing fingerprint-based login interest, as 28.5% of Gen Z consumers view it as the most important featureand just 15.25% of those ages 55 and older say the same. This reflects contrasting attitudes toward privacy and biometric technology, which older consumers may be less willing to trust.

What This Means For Credit Unions

Gen Z is clearly looking for robust credit card management capabilities via mobile apps. Credit unions should offer a full-service credit card program with a user-friendly mobile app and a robust suite of credit cards with reward options. An array ofrewards, including cash-back offers and travel points, will attract Gen Z cardmembers as they expand their credit histories.

Partnering with Elan Financial Services

Gen Z expects to have stellar digital interactions with credit unions. The amount of technological investment required by a credit union to keep up with the latest technological advancements can be daunting. Partnering with Elan allows credit unions tobenefit from Elan’s ongoing technology investments which make member experiences better.

Elan has a mobile app to satisfy Gen Z cardmembers with servicing that is intuitive and convenient to use. Elan takes on the regulatory and compliance burdens associated with running a credit card program so that the credit union can focus on the cardmembers.Elan also has state-of-the-art fraud prevention technologies that keep fraud losses low per event when compared to other industry players.

To learn more, download a complimentary whitepaper titled Gen Z: The Fast and Furiously Cashless from Elan Financial Services.

About Elan Credit Card

As America’s leading agent credit card issuer, Elan serves over 250 active credit union partners. For over 50 years, Elan has offered an outsourced partnership solution, providing institutions the ability to earn a risk-less revenue stream witha competitive credit card program all at no cost. Elan’s base of more than 2,000 employees are dedicated to helping credit union clients reduce costs and risks associated with managing and growing their credit card portfolios. For moreinformation, visit www.cupartnership.com/.