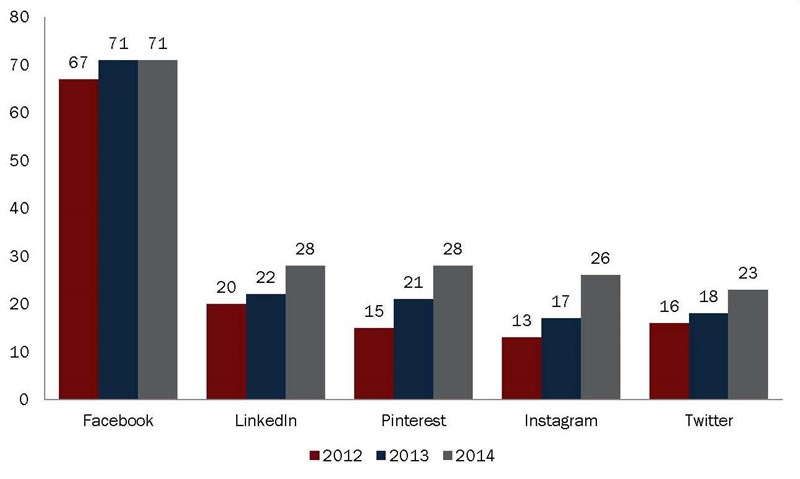

The use of social media platforms among adults in the United States is rising at a steady clip. Facebook holds the title of most popular platform; however, a survey conducted by the Pew Research Center in September 2014 shows other options in the socialmedia landscape are blooming.

percentage of online adults who use social media sites

Data Collected From 2012-2014

Source: Pew Research Center

Some highlights from the survey:

- 52% of online adults 18 years or older use two or more social media sites, up from 42% in 2013.

- 56% of all online adults 65 and older use Facebook; thats 31% of the entire U.S. population of senior citizens.

- 53% of online adults ages 18 to 29 use Instagram; 49% of all Instagram users use the site daily.

- The share of college-educated Internet users that use LinkedIn reached 50%.

- 42% of online women use Pinterest; 13% of online men use Pinterest.

As use and engagement levels continue to increase, social media channels remain a marketers dream a large and diverse arena in which to promote a brand. But the return on investment for smaller companies has proved elusive. Some companies, credit unions among them, focus less on finding a quantifiable financial return from social media marketing and instead look at it as a tool to engage potential memberswith interesting branded content.

Here are three strategies from three different credit unions who take an engagement approach to social media marketing.

Save This, Buy That

In 2012, Member One Federal Credit Union($680.5M, Roanoke, VA) noticed a pattern in the responses to its annual member experience survey. Members were interested inlearning more about budgeting and saving strategies, and the credit union knew it could help. By early 2013, Member One had launched a social media brand called Save This, Buy That, which now includes a micrositeas well as Facebook, Twitter, Pinterest, and Instagram pages.

CU QUICK FACTS

member one federal Credit Union

data as of 12.31.14

- HQ: Roanoke, VA

- ASSETS: $680.5M

- MEMBERS: 83,249

- BRANCHES: 14

- 12-MO SHARE GROWTH: 10.91%

- 12-MO LOAN GROWTH: 16.12%

Our goals were to gain exposure, engagement, and new followers and to drive potential new members to the credit union, says Tara Lilly, marketing supervisor. The whole concept behind it is to build relationships and trust with peopleand relate to them in a new way.

On SaveThisBuyThat.com, the credit union posts once a day on average. Posts focus on saving money but can also include things such as recipes, restaurant reviews, and garden tips. Member One plans topics two weeks in advance and writes content one weekout. In the event an unexpected cultural event occurs, the credit union can comment as well. (Remember the dress?).

WHITE + GOLD or BLACK + BLUE You tell us. #TheDress #whatcoloristhisdress #whiteandgold #blackandblue pic.twitter.com/oIrX9u9GBd

Member One FCU (@SaveThisBuyThat) February 27, 2015

Member One produces all of its content in-house; most of it comes from the credit unions marketing coordinator, Kim Kufel. The credit unions graphic designer, Sean Beaubien, stylizes and creates images. The marketing team meets monthly tobrainstorm ideas for content, taking into account credit union priorities, promotions, holidays, and special or local events. In March, Save This, Buy That included posts about St. Patricks Day, March Madness, and Easter.

Member One launched SaveThisBuyThat.com in August 2014. By January, according to Lilly, engagement across all channels increased 88% and followers jumped 100%. For example, Twitter followers grew 500%, from 300 to 1,500.

Lilly and the rest of the four-person marketing department expected 5,000 page views for the microsites first month. Traffic doubled expectations, reaching 11,000 page views.

Theres a great audience, and we want to reach them in a way thats not all about Member One, Lilly says. Its about them and their goals in life.

Reach Out And Touch Someone

On social media, consumers are trying to engage with family and friends, look at sports or news items, and share photographs of children or vacations. According to Todd Feldman, vice president of marketing at Virginia Credit Union ($2.6B, Richmond, VA), this is not the time to present a product offer.

CU QUICK FACTS

virginia Credit Union

data as of 12.31.14

- HQ: Richmond, VA

- ASSETS: $2.6B

- MEMBERS: 237,016

- BRANCHES: 16

- 12-MO SHARE GROWTH: 2.97%

- 12-MO LOAN GROWTH: 13.12%

Its a little bit out of context to try and sell out of social media because the behaviors of being in a buying mode and engaging with family and friends are different, he says.

Prior to joining the credit union in 2012, Feldman was the head of Circuit Citys social media program. During his tenure at the credit union, VACU has not tried to prove a return on investment from social media and instead has focused on translatinginformation into a deeper member relationship.

Can we take some learning we get from social media the comments we get on posts, the ratings we get on our Facebook page and see that were doing some things right? Feldman asks. From there, if we are doing thingsright, we should see some kind of positive return on our investment in our other marketing channels.

On Facebook, its primary platform, the credit union currently has a 4.4 star rating and nearly 13,300 likes which puts it among the 50 highest for all U.S. credit unions. More to the credit unions liking, according to the Financial Brands Power 100, a quarterly rating of the social media presence of banks and credit unions, VACU has the highest engagement rate for the fourth quarter 2014, at 80.24%. The listing calculates Facebookengagement by dividing the number of users talking about a brand by the number of likes the brand has. According to Feldman, VACU increased its Facebook likes by 42% year-over-year in 2014.

Facebook is a tool to engage with our members, Feldman says. Its not necessarily an acquisition channel; its more of a way we keep in touch with our members.

The credit union has one marketing employee who oversees the Facebook page as a part of a larger set of duties, though others in the department have input as well. VACU posts 3-4 times per week, says Feldman. On What Would Our Member Say Wednesday,VACU posts a picture of a credit union member with their personal testimonial. A random member who comments on this Facebook post wins $10 deposited into the account of their choosing. On Fun Friday, the credit union gives away anything,Feldman says, from an ice scraper to concert tickets.

Although posts dont have a sales-focused message, VACU does fold calls to action within the posts. Because it is prioritizing engagement over sales, the credit union doesnt expect Facebook to drive much traffic to its website. But accordingto Feldman, the actual numbers do show a fair amount of referral traffic from Facebook.

Its always kind of an eye raiser when we see it, Feldman says.

The Part-Time Social Media Expert

Commonwealth One Federal Credit Union ($316.0M, Alexandria, VA) has a three-member marketing department, says Suzie Cook, chief marketing officer. And withlimited resources, the credit union was not managing its social media channels to the degree it would have liked.

CU QUICK FACTS

Commonwealth one federal Credit Union

data as of 12.31.14

- HQ: Alexandria, VA

- ASSETS: $316.0B

- MEMBERS: 33,369

- BRANCHES: 7

- 12-MO SHARE GROWTH: -0.32%

- 12-MO LOAN GROWTH: 0.84%

Previously, the marketing team brainstormed potential postings at the beginning of every month and one employee would be responsible for the actual execution time permitting.

If other things came up there might not [have been] any postings, Cook says.

In December 2014, the credit union outsourced the management of its social media channels Facebook, Twitter, and LinkedIn to Canoe Media Services, a Northern Virginia-based social media services firm. Now, Canoes founder, Beth Lawton,works on the credit unions social media presence for 10 hours every week. In addition to Facebook and Twitter, the credit union asks her to write blogs about spending and saving money.

I was looking to get someone who had some journalism experience, Cook says.

She brings a fresh perspective to Commonwealth Ones marketing messages, Cook says, and pushes for greater clarity on what can be complex topics. She helps to improve SEO by optimizing meta- and alt-tags, analyzes Facebook Ad Buys and other socialtrends to determine the best way to promote content, and tracks online comments positive and negative. She also jump-started the credit unions LinkedIn page.

Most important, perhaps, she also changed the tone of the credit unions advertising. Now, posts feature engaging content members are more apt to read rather than sales-oriented messages, although the credit union hasnt totally eliminatedcalls to action in its messaging.

Our messaging now asks, How we can help you? Cook says. Articles and posts arent just saying, We have this great car loan rate.

According to Cook, there has been an uptick in non-employee Facebook users liking posts.

Not in large droves, she says. But some people are better than none, which it was before.

Such engagement suggests the new tone is more successful and underscores the value of this part-time employee. Cook declined to provide exact figures, but she did say the hiring cost was not prohibitive and the entire credit union was impressed with thesocial media managers work.

Nobody else can have her, Cook says.