over the period and accounted for 11.9% of total income as of Sept. 30. Other operating income increased at the fastest rate, 17.0%, of any non-interest income account. It surpassed $8.2 billion and accounted for 14.9% of total income.

Although balances declined in every maturity segment of the investment portfolio over the quarter, investments maturing in less than one year and those maturing between one and three years were the only segments to increase their share of the investment portfolio, up 0.9 and 1.1 percentage points, respectively.

In a rising rate environment, short-term investments can be re-invested at higher rates as they mature, leading to an increase in the average investment yield, Johnson says.

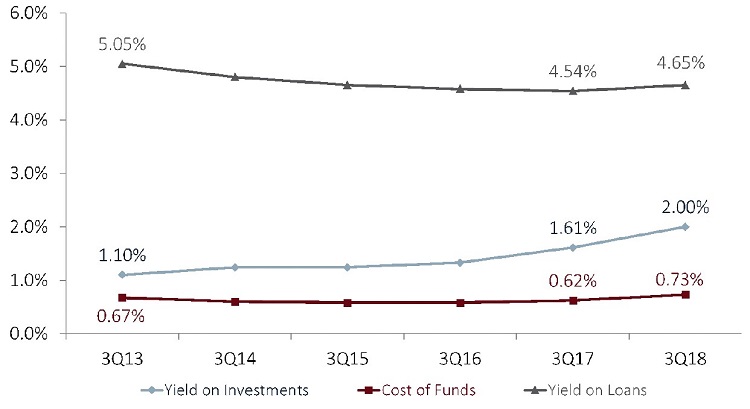

YIELD ANALYSIS

FOR U.S. CREDIT UNIONS | DATA AS OF 09.30.18

Credit unions have generated more interest income as rates rise. Importantly, they are returning that profit to members.

Source: Callahan & Associates.

Up 39 basis points year-over-year, yield on investments reached 2.00% in the third quarter. Yield on loans increased 11 basis points over the same period to 4.65%. These yields will likely continue to move in relative unison with the federal funds rate.

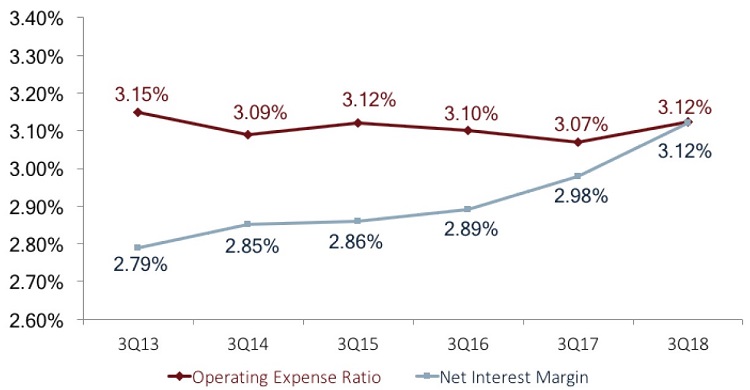

NET INTEREST MARGIN VS. OPERATING EXPENSE RATIO

FOR U.S. CREDIT UNIONS | DATA AS OF 09.30.18

For the first time since 2011, the credit union net interest margin was not below the operating expense ratio.

Source: Callahan & Associates.

As rates rise, funding costs move higher as well. The cost of funds at credit unions rose 11 basis points year-over-year to 0.73%.

The credit union net interest margin has increased 14 basis points year-over-year to 3.12%. Over the same time period, credit unions have stabilized the operating expense ratio, which was up 5 basis points also to 3.12%.

With operating expense growth in line with asset growth, the operating expense ratio has remained relatively steady over the past five years. This is the first time since June 30, 2011, that the net interest margin equals the operating expense ratio and credit unions are covering their operating expenses through profits on interest rate products.

Net income expanded 29.7% year-over-year to $10.3 billion. In turn, ROA increased 17 basis points to 0.96%. NCUSIF rebates accounted for roughly seven basis points. However, an increase of 10 basis points through organic methods is still a considerable feat and shows credit unions are balancing income and expenses.

ROA

FOR U.S. CREDIT UNIONS | DATA AS OF 09.30.18

ROA increased 17 basis points year-over-year, a direct impact from both the federal funds rate increases and NCUSIF rebates.

Source: Callahan & Associates.

Although liquidity continues to be an area of concern, today’s financial cooperatives are fulfilling the growing loan demand of members. Credit unions are also sharing the profits gained from increasing yields and efficiently managed expenses. As of Sept. 30, 2018, credit unions have paid $5.2 billion in dividends to their members, an increase of 25.9% from one year ago.

Third quarter performance shows that credit unions are first and foremost serving their members, Johnson says.

Moving forward, the industry is well-positioned for the likely rising rate economy.

This article appeared originally in Credit Union Strategy & Performance.