Top-Level Takeaways

-

Advia converted its digital banking platform in 2017.

-

To ensure a smooth conversion, the marketing team followed a calculated communication plan that clearly outlined both the value and logistical aspects of the change before and after the conversion..

Eight mergers in 11 years prepared the marketers at Advia Credit Union ($1.7B, Parchment, MI) for a daunting new communications challenge: a digital banking conversion.

Communicating such a change to members is critical. At Advia, it began with making marketing an integral part of the conversion from the beginning. The credit union’s marketing team stayed engaged throughout the process, which helped it craft and time the release of member outreaches.

It was important to us that our members experienced as minimal a disruption as possible while also engaging with the new digital banking platform, says Nancy Loftis, vice president of marketing at the Kalamazoo-area credit union since 2005.

ContentMiddleAd

When more than 145,000 members woke up on Tuesday, July 25, 2017, to a new digital interface with their credit union, they were not taken by surprise.

Here, Loftis and Joli Hensley, Advia’s marketing manager since 2009, discuss how they worked across the credit union and with members to ensure a smooth transition to the new platform for Advia’s online channels.

How did marketing engage in the planning process before the live date?

Joli Hensley, Marketing Manger, Advia Credit Union

Joli Hensley:We collaborated with our IT, contact center, and branch experience teams to identify areas of potential impact, timelines, and new innovations so we could create a comprehensive communication strategy for our external membership as well as our internal team members responsible for helping members navigate changes.

We also engaged with our digital banking development team to provide a consistent brand experience within the new platform that represented the look and feel of Advia.

We developed a timeline that allowed us to reach out to members via multiple contact points to prepare for any adjustment. We introduced messaging eight to 10 weeks leading up to the conversion and increased frequency in the week leading up to the actual switch.

Click through to see how Advia used direct mail, email, video, and more to communicate with members during and after the digital upgrade.

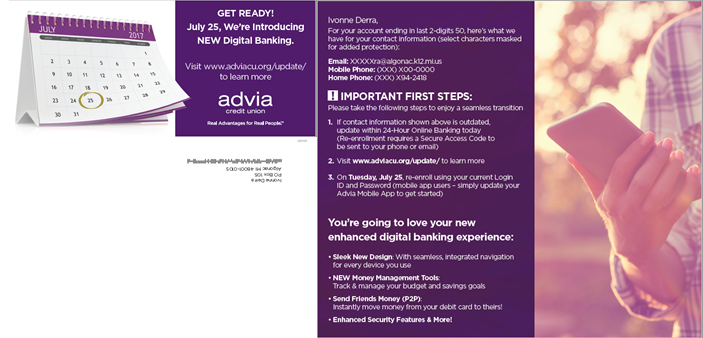

Personalized Direct Mail

Advia sent personalized direct mail to members ahead of the conversion. The notices included detailed steps about how to use the credit union’s new digital tools.

Email Listing Digital Tools

Advia sent an email to members shortly before the digital banking conversion that listed advantages of the digital tools and specific instructions on how to access them.

Facebook Announcement

Advia posted a Facebook announcement one week before the go-live date for its new digital banking presence. It include a link to a webpage that described new features, offered tutorials, and included a login for current users.

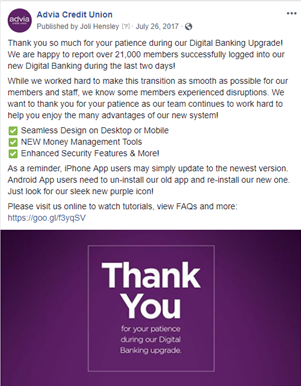

Facebook Thank You

The day after the digital banking platform went live, Advia thanked members on Facebook for their cooperation and patience. The post also included reports on usage, mobile instructions, and links to the go-live webpage.

Facebook Encouragement

Approximately two weeks after the go-live date, Advia used Facebook to encourage members to try new features and download the mobile app.

Facebook Communication

Throughout the digital platform conversion, Advia communicated openly with members, including via Facebook threads.

How has this communication helped member service?

JH: Our comprehensive, multi-channel approach to communicating messages about the conversion over an extended time helped to maintain positive member relationships. It allowed our member-facing team to be advocates for members. Upon conversion, we received little feedback that members felt unaware or ill-prepared.

What social media did Advia use ahead of the live date?

JH: We used Facebook, Twitter, and Instagram leading up to our digital banking conversion. Our largest group of followers are on Facebook, which is also one of their primary channel preferences for contacting us with inquiries, along with 24-hour chat, web searches, and phone calls. We have 19,300 Facebook followers and a combined 1,400 on Instagram and Twitter.

How did Advia use social media afterward?

7 Steps To Conversion Success

Digital banking platform conversions occur with regularity in credit union land as institutions work to keep up with the competition and member expectations. Here, Advia Credit Union’s marketing leaders share tips for preparing for a digital conversion.

- Understand all of the changes members will experience and a clearly communicate those changes.

- Overcommunicate both internally and externally. Do this well ahead of time.

- Develop a consistent set of messages.

- Use multiple channels including social media, website, video, email, direct mail, in-branch, and outbound calls.

- Bring in additional assistance to prepare for increased call volume.

- Provide ongoing communications immediately and well after the conversion.

- Incorporate success metrics leading up to and post conversion.

JH: We were very active on social media, particularly Facebook, following the digital banking conversion. We used it to troubleshoot login issues and to communicate when we re-introduced select features. Even though we increased our contact center phone team to help field inbound calls, members appreciated that we could also respond to inquiries via social media.

Conversions of any type typically include some level of unanticipated factors. Being authentic on social media and empathizing with those who experienced any type of disrupted access was a critical component to providing the best member service.

We also took opportunities to celebrate the overall successful re-onboarding of members onto the new platform, which helped illustrate the ease of access for the largest percentage of our active online members.

Following the conversion, we shared tips to navigate the system and celebrated new financial tools such as free, instant, person-to-person payments.

What other channels did Advia use?

JH: We also communicated via direct mail, email, website, phone calls, and in-branch collateral to confirm members were well aware of the conversion. We worked with media partners to produce digital e-books and videos highlighting new features and steps for re-enrollment. We posted these on our website, pushed them via email, and featured them as links on social media. We also placed alerts on member accounts if contact information such as email and/or phone was missing.

What channel was the most effective, and why?

JH: It’s difficult to determine which channels are the most effective in providing information to members. We enjoy a high rate of website views, email open rates, and in-branch transactions. The most powerful strategy is one that uses a multi-channel approach, using similar imagery and messaging to build consistency around the message and provide multiple avenues to review information.

What were some strengths and weaknesses of the various channels?

JH: Some members prefer to receive information electronically, whereas others prefer traditional methods such as direct mail or in-branch messaging. The website is a great outbound digital channel to post updates. Similarly, email is effective when related to a member notification-type message. Open and click-through rates are much higher for these types of messages.

However, in both these cases, the message is one-way and might be difficult to humanize. Social media provides more of an immediate two-way conversational platform that allows us to share information and respond quickly to members who comment with questions.

Who crafted the messages, and how did you come up with them?

Nancy Loftis, Vice President of Marketing, Advia Credit Union

Nancy Loftis: Our internal marketing team worked together to craft messages based on updates provided by our digital banking conversion team. We took more of an informative important update approach to the tone of our messaging rather than one that could be construed as heavily promotional in nature.

Our primary goal was to cut through any message clutter, direct the member’s attention to the importance of the conversion, and provide clear instructions. Our secondary goal, nearly just as important, was to build excitement about the new features and added convenience that our new digital banking experience offered.

Was there a down time when digital banking wasn’t available?

NL: We went offline briefly in the very early morning the day we introduced the new platform. Some secondary programs within the system, such as bill pay, were known to have a slightly delayed re-onboarding timeline, so proactively communicating that planned outage to members ahead of time was important.

How did the conversion itself go?

NL: Our digital banking conversion went very well. Within the first 24 hours, 40% of previous users were successfully back online. These were our very frequent users. Within a short time, all 60,000-plus active users had logged back in.

How much activity did Advia see from members before and after?

NL: In the past three years, we’ve experienced continued year-over-year growth in active online banking users, including 17% since our conversion in July 2017. We’re excited to see this increased momentum and certainly contribute this past year’s growth to the introduction of our new digital banking platform. A great feature of our new system is that members can self-enroll. This has also contributed to increased usage and new member onboarding in general.

Eight mergers in 11 years helped Advia Credit Union develop best practices in mapping core data. Learn more in How To Map Member Data During A Merger.

How did this digital banking conversion compare with Advia’s core processing conversions that accompany mergers?

NL: The fact that we had gone through multiple core conversions during mergers and acquisitions prepared us well for this type of communication. We understand the importance of helping people navigate change, both internally and externally. It’s important to have a communication strategy that clearly outlines both the value and logistical aspects of any change.

Whereas a core conversion might affect how an account is structured, it is mostly an intensive back-end operation. A digital banking conversion is highly visible to members and has a significant impact on member experience and how they access their account information.

Any type of conversion requires clear and concise communications and collaboration among teams to share knowledge and provide feedback. Our goal was clear to everyone make the transition smooth for members while providing financial advantages.

This interview has been edited and condensed.