Lower interest rates and overall economic uncertainty pushed the investment portfolios of commercial financial institutions nationwide toward shorter allocations. The yield curve, which inverted for a period in the second half of 2019, normalized in the first quarter of 2020. As cheap cash infused the markets in the falling rate environment, institutions prioritized liquidity, usually opting for overnight accounts in lieu of moderately higher yielding products. Total assets at the Federal Reserve increased 39.2%, to $5.8 trillion, in the three months ending March 31.

Key Points

- Total investment and cash balances at U.S. credit unions increased 13.0% year-over-year to $446.5 billion as of March 31, 2020.

- The Federal Reserve decreased the range of the effective federal funds rate to between 0.00% and 0.25%. Correspondingly, average investment yields fell to 1.55% in first quarter from 2.37% at year-end 2019.

- Credit unions are sitting on record levels of cash. Cash and equivalents grew at the fastest pace of all investment types, up 24.2% in the past year to $165.1 billion. As a result, this segment’s share of the portfolio increased 3.3 percentage points annually to 37.0%, largely via gains in cash at the Federal Reserve.

TREASURY YIELD CURVE RATES

FOR U.S. CREDIT UNIONS | DATA AS OF 03.31.20

Callahan & Associates |CreditUnions.com

Although interest rates fell broadly across the yield curve, its slope normalized in the first quarter of the year.

INVESTMENT COMPOSITION

FOR U.S. CREDIT UNIONS | DATA AS OF 03.31.20

Callahan & Associates | CreditUnions.com

Cash at the Federal Reserve increased 35.3% year-over-year and made up 22.6% of total credit union investments. That’s up 3.7 percentage points.

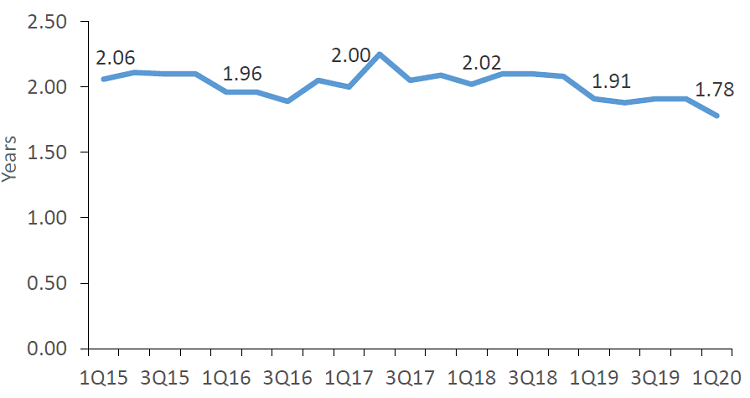

WEIGHTED AVERAGE LIFE OF INVESTMENT PORTFOLIO

FOR U.S. CREDIT UNIONS | DATA AS OF 03.31.20

Callahan & Associates | CreditUnions.com

Increases in cash balances, particularly at the Federal Reserve, pushed down the average life of the credit union investment portfolio by 0.13 years.

The Bottom Line

The economic uncertainty in the wake of the COVID-19 pandemic pushed members to seek a safe haven for their assets. Consequently, credit unions reported an increase in share inflows, which, combined with a softer demand for consumer loans, contributed to rising liquidity at credit unions. As investment rates fell across all time horizons, credit unions favored overnight accounts in place of longer-term investments, where moderately higher rates might not compensate for the added liquidity risk. This resulted in a larger allocation of investments in cash. Cash balances in the past three months grew dramatically at the Federal Reserve and corporate credit unions as credit unions funneled their new liquidity into these short-term channels.

Without official data from the NCUA, Callahan is reporting first quarter data trends from institutions that represent 99.7% of the industry’s assets.

This article appeared originally in Credit Union Strategy & Performance. Read More Today.