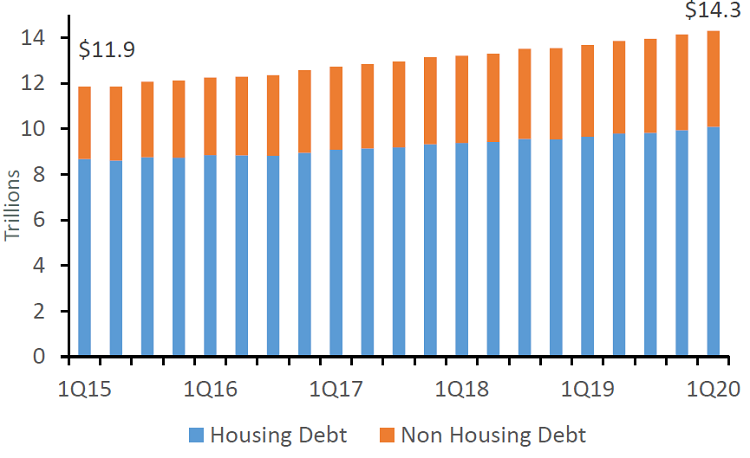

Total household debt climbed higher in the first three months of 2020 to $14.3 trillion, according to the Federal Reserve Bank of New York. The increase in borrowings since year-end 2019 was driven almost entirely by an uptick in mortgage balances, which gained $156 billion while non-housing debt held flat over the quarter. Total loans and leases at commercial banks was up 9.7% year-over-year and surpassed $10.6 trillion at the end of the first quarter of 2020, according the Federal Reserve Bank of St. Louis. Despite slowing consumer lending, balances trended higher in March as institutions increasingly drew on lines of credit and stockpiled cash in the face of the COVID-19 pandemic.

Key Points

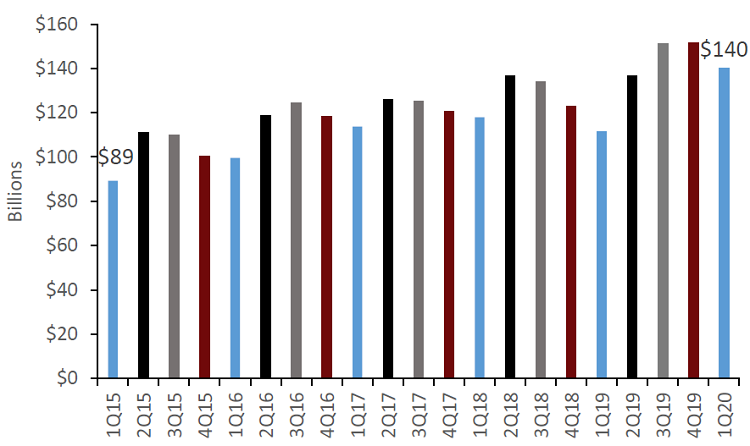

- In the first three months of 2020, loan originations at credit unions nationwide totaled $140.0 billion. This marked the third-largest origination quarter on record.

- First mortgage originations increased 94.3% from one year ago. Record low interest rates incentivized buyers to purchase homes and homeowners to refinance existing loans.

- Annual outstanding loan growth at credit unions nationwide was 6.4% in the first quarter. That’s down 1.5 percentage points from the first three months of 2019.

- Total delinquency increased modestly year-over-year. It was up 5 basis points to 0.63%. Credit card delinquency continued to climb and was up 10 basis points annually to 1.36% in the first quarter. This is the largest annual change of any loan product.

- /li>

HOUSEHOLD DEBT

FOR U.S. CREDIT UNIONS | DATA AS OF 03.31.20

Callahan & Associates | CreditUnions.com

Driven predominantly by new mortgages, total household debt in the United States increased 4.6% annually.

QUARTERLY LOAN ORIGINATIONS

FOR U.S. CREDIT UNIONS | DATA AS OF 03.31.20

Callahan & Associates | CreditUnions.com

Credit unions originated $140.0 billion in loans across the first three months of 2020. It was the largest first quarter on record.

LOAN GROWTH BY TYPE

FOR U.S. CREDIT UNIONS | DATA AS OF 03.31.20

Callahan & Associates | CreditUnions.com

First mortgage growth surged 10.9% in the first quarter of 2020. Aggregate mortgage growth offset weakening consumer lending and pushed total loan balances 6.4% higher year-over-year.

The Bottom Line

Following one of the most productive lending years in the history of the credit union movement, the first quarter of 2020 was full of challenges. A strong first quarter of mortgage originations helped negate a pullback in consumer lending and push overall loan balances higher. In the short-term, asset quality appears to be manageable and in line with historical norms. However, credit unions should carefully monitor this given the global health pandemic and ever-developing economic conditions.

Without official data from the NCUA, Callahan is reporting first quarter data trends from institutions that represent 99.7% of the industry’s assets.

This article appeared originally in Credit Union Strategy & Performance. Read More Today.