Economic uncertainty in the wake of the COVID-19 pandemic resulted in consumers saving money in safe-haven deposit accounts at higher rates than they have in recent history. According to FRED Economic Data from the Federal Reserve Bank of St. Louis, the personal savings rate in the United States was 13.1% as of March 31, 2020, the highest it’s been since 1981. Despite the prospect of interest rates falling on deposits following multiple Federal Reserve rate cuts, consumers remain attracted to the safety of savings accounts for the time being.

Key Points

- Total share balances increased $102.8 billion over the past 12 months and neared $1.4 trillion in the first quarter of 2020.

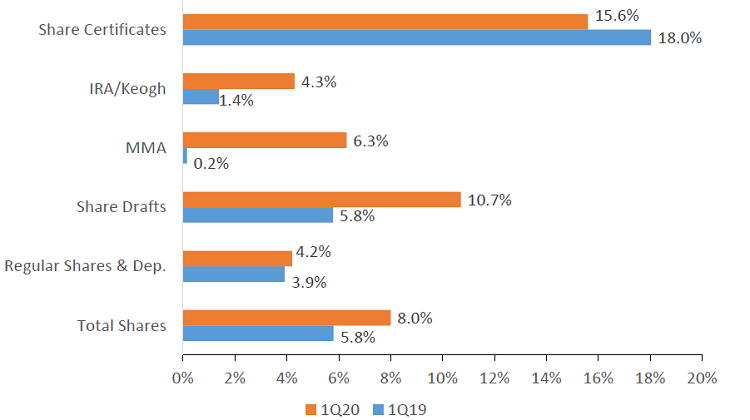

- Total share growth accelerated 2.2 percentage points to an annual growth rate of 8.0%, the highest reported growth rate since the first quarter of 2017.

- Balances for share certificates increased 15.6% year-over-year, the most of any product, to $297.3 billion. Share draft balances increased 10.7% annually to $229.9 billion.

- At $497.5 billion, regular share balances comprised the largest portion 35.8% of credit union deposits in the first quarter. However, this percentage of the portfolio has declined since 2015 as other share types have proven more popular.

- Average share balance per member increased 4.4% to $11,233 as members moved assets into low-risk deposit accounts.

SHARE GROWTH BY TYPE

FOR U.S. CREDIT UNIONS | DATA AS OF 03.31.20

Callahan & Associates | CreditUnions.com

Driven primarily by growth in certificates and draft accounts, total share growth accelerated 2.2 percentage points, annually, to 8.0%.

DEPOSIT PORTFOLIO

FOR U.S. CREDIT UNIONS | DATA AS OF 03.31.20

Callahan & Associates |CreditUnions.com

With balances nearing $500 billion in the first quarter, regular shares made up the largest portion of the credit union deposit portfolio.

AVERAGE COST OF FUNDS

FOR U.S. CREDIT UNIONS | DATA AS OF 03.31.20

Callahan & Associates |CreditUnions.com

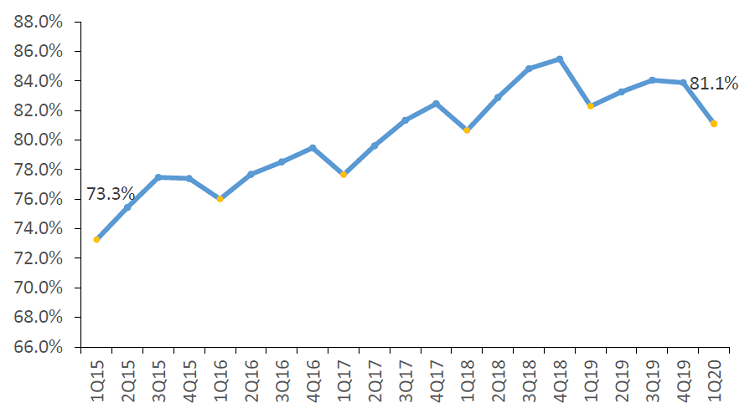

The loan-to-share ratio decreased 1.2 percentage points over the past year as credit unions reported higher deposit inflows than lending outflows.

The Bottom Line

Despite the Federal Reserve’s monetary policy pushing interests rates lower, credit unions are experiencing an influx of deposits as members look for safe channels to park their savings. As a result, the average cost of funds increased 5 basis points annually to 0.98%, and the loan-to-share ratio decreased 1.2 percentage points over the past 12 months to 81.1% as of March. Concerns about liquidity following a decade of record loan growth have been put to rest by this influx of cash, but capital levels must be monitored closely moving forward.

Without official data from the NCUA, Callahan is reporting first quarter data trends from institutions that represent 99.7% of the industry’s assets.

This article appeared originally in Credit Union Strategy & Performance. Read More Today.