Consumers are known to increase spending during times of economic expansion, although increased deposit rates in recent times have also incentivized savings. According to FRED Economic Data, the personal saving rate in the United States has grown from6.8% in 2010 to 7.6% at year-end 2019. Earlier in the year, macroeconomic headwinds from global trade tensions and four 2018 Federal Reserve rate hikes resulted in a consumer cut back on borrowing. This led to deposit balances increasing, which subsequentlyprompted the Fed to make three mid-year 2019 rate cuts in an effort to encourage spending. Although cheaper credit did cause loan production to rebound, consumers continued to inundate financial institutions with new deposits in the fourth quarteras savings products remained attractively priced.

Key Points

- Share balances increased $100.6 billion in 2019 surpassing $1.3 trillion at year-end, an annual growth rate of 8.2%. Balances grew $27.6 billion in the fourth quarter alone, the largest fourth quarter increase since2001.

- Balances for share certificates were up 20.5% year-over-year and continued to drive share growth.

- Share drafts increased 9.2% annually to $210.5 billion. The percentage of members with a share draft account increased 1.0 percentage point annually to 58.8% at year-end.

- The average share balance at U.S. credit unions increased to an all-time high of $10,861 at year-end.

- Non-member deposits crossed $13 billion for the first time following 30 straight quarters of annual growth.

SHARE GROWTH BY TYPE

FOR U.S. CREDIT UNIONS | DATA AS OF 12.31.19

Callahan & Associates | CreditUnions.com

Relatively high-dividend share certificates have spurred deposit growth as members look to lock-in savings rates.

DEPOSIT PORTFOLIO

FOR U.S. CREDIT UNIONS | DATA AS OF 12.31.19

Callahan & Associates | CreditUnions.com

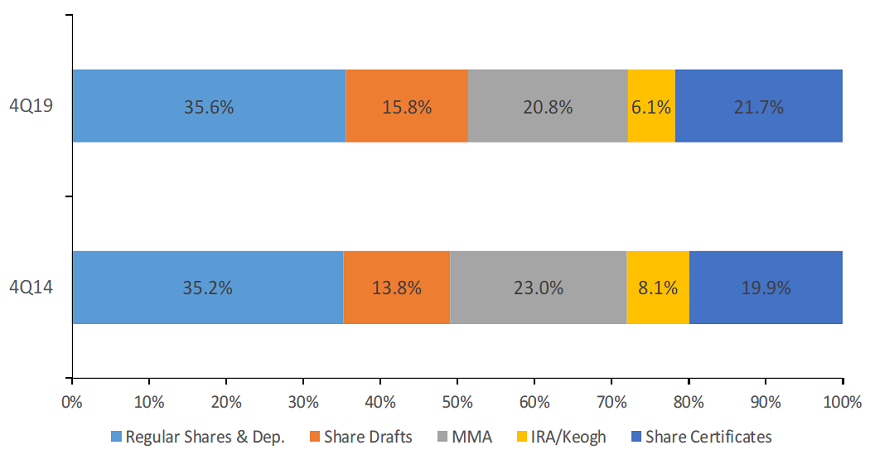

Although certificates account for the majority of recent share growth, core deposits composed of regular shares, share drafts, and money market accounts still comprise 72.2% of the share portfolio.

AVERAGE COST OF FUNDS

FOR U.S. CREDIT UNIONS | DATA AS OF 12.31.19

Callahan & Associates | CreditUnions.com

The cost of funds has risen substantially over the past two years as credit unions are slow to reprice deposits after the Fed’s rate cuts.

The Bottom Line

Despite membership gains across the industry, share draft penetration reached an all-time high of 58.8% as more members made credit unions their primary financial institution. With increased liquidity and member loyalty, credit unions have the flexibilityand opportunity to continue serving their members financial needs into the new decade.

This article appeared originally in Credit Union Strategy & Performance..