Top-Level Takeaways

-

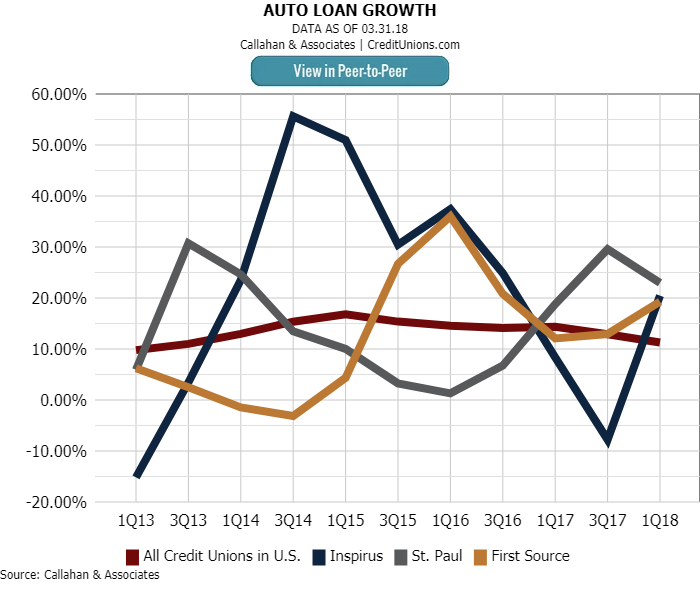

Inspirus, St. Paul, and First Source credit unions all posted auto loan growth sharply higher than the first quarter national average.

-

Flexibility and efficiency helps these credit unions lend more and deepen member relationships.

Since the creation of the American credit union movement more than 100 years ago, this country’s financial cooperatives have provided member-owners with the most favorable credit terms possible — blending core values with loan-to-values and other measures to respond to a changing landscape.

Direct lending remains the lifeblood of many credit unions, and doing it well is a cultural and business imperative. Here, three credit unions offer their insight into how they succeed in the one-on-one auto lending space.

Inspirus, St. Paul, and First Source credit unions all posted auto loan growth sharply higher than the national average of 11.27% in the first quarter of 2018.

Get With The Program

We do not have an indirect lending program, says Amy DeMetri, senior vice president and director of member services at First Source Federal Credit Union ($535.8M, New Hartford, NY), where direct auto lending grew 19.31% in the first quarter. We never have.

ContentMiddleAd

What First Source does have is a program that has approved 3,147 vehicle loans totaling nearly $50 million from its launch in July 2015 through May 2018. The consultative nature of its approach to cross-selling has resulted in another $9 million in other loan types and more than $4 million in new deposit balances, DeMetri says.

CU QUICK FACTS

First Source FCU

Data as of 03.31.18

HQ: New Hartford, NY

ASSETS: $535.8M

MEMBERS: 46,413

BRANCHES: 5

12-MO SHARE GROWTH: 7.2%

12-MO LOAN GROWTH: 12.9%

ROA: 0.87%

Meanwhile, the success of the direct lending program led to the creation of the credit union’s separate Lifestyle Loan Program that offers unsecured loans for funeral expenses, pet care, home improvements, holidays, and health improvement, among other needs. Budgeting, college and retirement planning, and debt consolidation also are part of the program.

The direct lending department began with two lenders who relied on the cooperative’s central underwriting staff. Now, the department includes a supervisor plus three lenders as well as a phone system that routes calls to the lifestyle lending team. The department also has its own underwriter, who works under the supervision of the lending manager in the call center.

Dealers can refer potential borrowers to First Source but do not take applications or make calls on decisioning, pricing, or closing loans. According to DeMetri, this helps the credit union retain personal contact with its borrowers. It also helps First Source retain firm control of the program.

We’re selective when determining which dealers to engage,DeMetri says. They have to have a culture similar to ours.

How Do You Compare?

Are your auto lending strategies working? It takes minutes to compare various aspects of your auto lending portfolio to other credit unions with Peer-to-Peer. Compare against credit unions in your state, asset range, or by business model.

The credit union monitors culture via in-person visits as well as educational breakfasts and luncheons, plus phone and email communications. It also monitors interactions between the direct auto lending team and a dealer’s staff. It seems to work.

Our team is a great judge of character,DeMetri says. Of the 22 dealers added to the program during the past three years, only one was terminated.

DeMetri credits First Source’s work with Lending Solutions Consulting for guiding the creation and continuing development of the lending program but attributes the team’s ultimate success to friendly, accommodating, and knowledgeable staff that are member-centric.

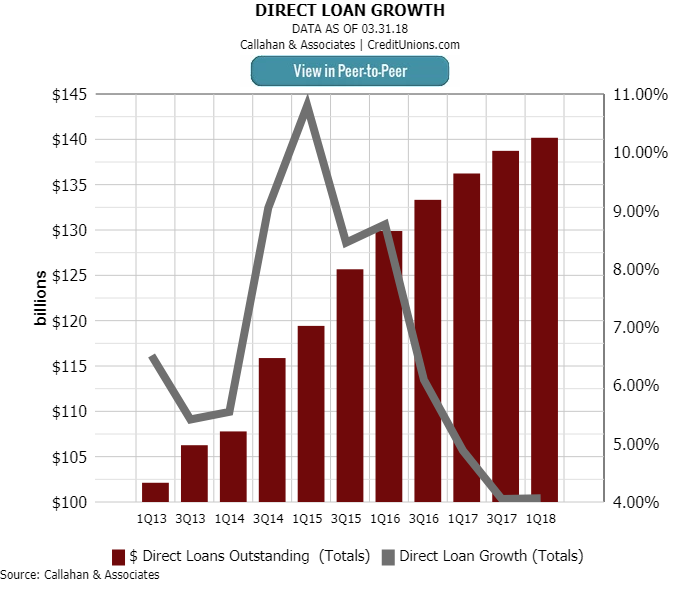

Direct auto loan growth was 2.9% year-over-year in the first quarter of 2018, boosting that industry portfolio to $140.2 billion.

ROM For The Money

St. Paul Federal Credit Union ($173.8M, St. Paul, MN) reported first quarter growth of 22.99% in its auto lending channel with 100% of that growth attributed to direct lending.

We’re 90% loaned out,says Tom Glatt, who came aboard the Twin Cities credit union as CEO in 2014. We’re sticking with what we’re good at, and what we’re good at is building longtime relationships with our members. It’s hard to foster that in an indirect environment.

CU QUICK FACTS

St. Paul FCU

Data as of 03.31.18

HQ: St. Paul, MN

ASSETS: $173.8M

MEMBERS: 12,228

BRANCHES: 3

12-MO SHARE GROWTH: 10.0%

12-MO LOAN GROWTH: 17.1%

ROA: 1.37%

What St. Paul FCU does foster is flexibility. The credit union allows its lenders to look at a member’s specific situation and determine what would make a deal work; for example, going up to 130% LTV for a creditable borrower upside down in a loan.

We see a lot of lenders advertising up to 100% in our market,says Chris Petersen, the credit union’s chief financial officer and chief information officer. We go beyond that. Some might offer a lower rate, but we make that up with lower prices on GAP policies and extended warranties.

The credit union also offers debit account rates that can go as high as 4.99%, depending on use, and brings in loans via targeted email and snail mail campaigns.

6 Tips To Succeed At Direct Lending

Credit unions held $140.2 billion in direct loans on their books at the end of the first quarter of 2018. To up your lending game, try one of these practices embraced by the credit unions profiled here.

- Make sure the credit union’s rates and terms are competitive.

- Give proven lenders the flexibility to match rates and other conditions, such as LTV.

- Use technology to make the process fast and efficient. Online applications and instant decisions are good places to start.

- Communicate with members about how to buy a car, including what they can expect at the dealership.

- Train staff members about the credit union’s products and member-first philosophy, which includes listening to members.

- Set goals and create dashboards to monitor progress and pitfalls.

Instead of sending 12,000 mailers to members, we send 1,200 to non-members who we’ve identified through credit bureaus as having vehicle loans that we can save them money on,Petersen says.

That kind of efficiency spreads across the operation, helping St. Paul FCU achieve top rankings among its asset-based peers in metrics such as as loan originations per employee and per member. Its efficiency ratio is 69.5%, compared with the 86.1% average its asset-based peer group reported in first quarter 2018. And in Callahan’s proprietary measure of member value, Return of the Member (ROM), the credit union currently has a score of 98.59% overall and 99.11% in Return to Borrowers.

We don’t have a large staff, but we’re efficient,Glatt says. ‘Our lenders work hard, and it’s important for us to make sure the member has a good experience through reasonable prices and great service. That’s how we give back to the member.

A Constant State Of Pre-Approval

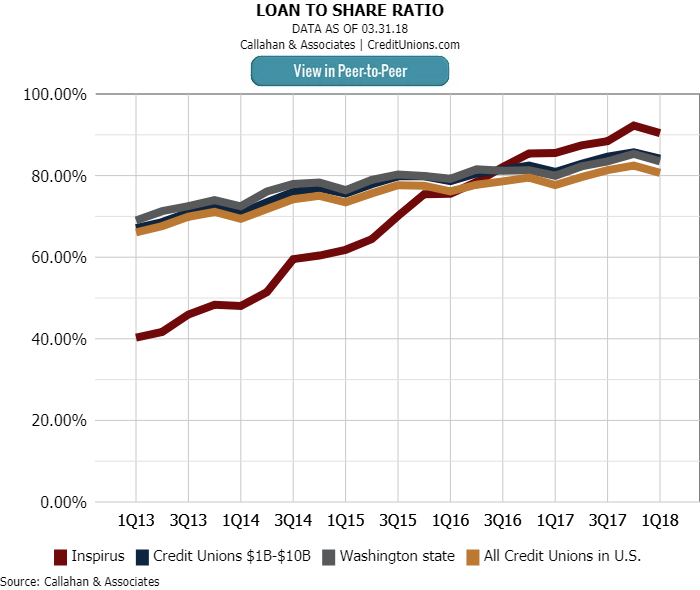

In 2012,Inspirus Credit Union ($1.3B, Seattle, WA) had a loan-to-share ratio of 42%. With the help of new management, that ratio is now 90.39%.

We’re in a constant state of pre-approval,says senior vice president Doug Grout.

The loan-to-share ratio at Inspirus Credit Union has steadily increased in the past five years. It hit 90.39% in the first quarter of 2018 and now exceeds its asset-based peer group as well as all credit unions in Washington state and the country.

The credit union reported a 20.49% year-over-year gain in direct lending in the first quarter of 2018. It got there, partly, through its ongoing evaluation of member profiles to get to members before they need a loan and let them know that they’re approved. The lending balance sheet also has been bolstered by loan participations.

CU QUICK FACTS

Inspirus Credit Union

Data as of 03.31.18

HQ: Seattle, WA

ASSETS: $1.3B

MEMBERS: 78,750

BRANCHES: 3

12-MO SHARE GROWTH: 4.4%

12-MO LOAN GROWTH: 10.4%

ROA: 0.89%

We’ve never done that here,Grout says, adding that the Seattle credit union has just begun an indirect lending program that draws on its success in direct lending. ‘Competing without indirect lending can be challenging because of the convenience that indirect gives borrowers at the dealership.’

Inspirus is a former teachers credit union and the organization still has deep relationships with that community, bolstered by the credit union’s volunteer time in schools and donation of up to 5% of its income for classroom supplies and more.

But Grout says the credit union’s loan model is changing because of the challenges to growing organic loans quick enough.

Inspirus has now become an indirect lender with a twist. It focuses on borrowers with credit scores of 680 or lower, those in the B-C-D tiers. And its new indirect lending program generated $1 million in its first month.

We launched it from a different perspective,Grout says. ‘We’re taking on more risk, but we’re also looking to bring in more households as members. Higher credit tier buyers tend to shop on rate, but riskier tiers are more grateful to get the loan. We can build on that feeling of reciprocity to build deeper relationships.’