A pair of Midwest credit unions have gone first with a mobile coupon app that allows them to combine local and national offers under the credit unions’ brand, raising engagement with businesses and members alike, and maybe earning an extra bit of interchange income, too.

MidUSA Credit Union ($202.7M, Middletown, OH) and Frankenmuth Credit Union ($420.9M, Frankenmuth, MI) recently began offering the white-label app through their own mobile apps. The process is simple, with the primary task on the credit unions’ part being to market the deals to local merchants and members.

Both credit unions got the turnkey mobile coupon app from Xtend Inc., a credit union service organization affiliated with core processor CU*Answers.

It doesn’t take a lot of work to manage, says Vickie Schmitzer, CEO at Frankenmuth Credit Union. We get an email notification when a business uploads an offer. We review the offer, approve it, and then it’s live.

Frankenmuth and MidUSA credit unions use Xtend Inc. for the technology behind their mobile coupon apps. Find your next solution in the Callahan Associates online Buyer’s Guide.

CU QUICK FACTS

FRANKENMUTH CREDIT UNION

Data as of 03.31.16

- HQ: Frankenmuth, MI

- ASSETS: $420.9M

- MEMBERS: 33,762

- BRANCHES: 21

- 12-MO SHARE GROWTH: 14.98%

- 12-MO LOAN GROWTH: 17.96%

- ROA: 1.38%

CU QUICK FACTS

MIDUSA CREDIT UNION

Data as of 03.31.16

- HQ: Middletown, OH

- ASSETS: $202.7M

- MEMBERS: 15,951

- BRANCHES: 6

- 12-MO SHARE GROWTH: 4.46%

- 12-MO LOAN GROWTH: 3.54%

- ROA: 0.29%

MidUSA calls its version Star Savings, and Frankenmuth has labeled its Pretzel Dough.

Here’s how the Michigan credit union positions the app on its website: Let us improve your shopping experience. With Pretzel Dough, Frankenmuth Credit Union’s mobile coupon app, you have access to up-to-date coupons from 900+ national chain merchants and offers from local merchants, too. Pretzel Dough is a free app for anyone to use. So save some dough when you shop, compliments of your hometown financial solution that started right here in Michigan’s little Bavaria.

Marketing the offer to local businesses take the most time, Schmitzer says. The credit union’s business development team handles that, reaching out through chambers of commerce in the area and business lanes in the credit union’s extensive network of 21 branches.

Kelly Nugent, vice president at MidUSA, says her main focus right now is developing MidUSA’s local retail strategy for the coupon app. She says the new app is a value-add for current business members and a valuable tool for engaging new businesses in the communities her credit union serves.

We’re keenly aware mobile and other virtual offerings are critical to the way members want to do business, including managing finances and shopping for good deals, she says. Online offers are seen and redeemed more often than traditional print ads, so the coupon app makes sense.

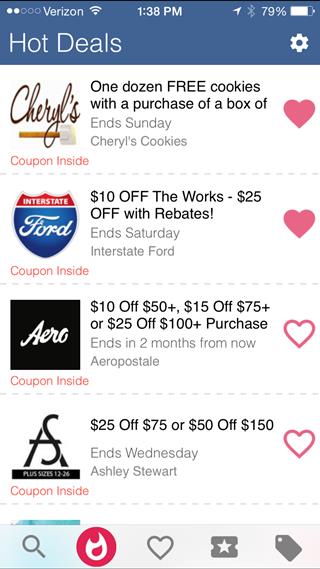

Local and national offers populate this coupon offering from MidUSA’s Star Savings mobile app.

Nugent says response from local retailers and members alike has been good following the solution’s rollout around the first of the year. So far, it has logged 220 registered users and has offered more than 2,100 different coupons.

That’s a lot of savings to market.

Reimagine Retail

Despite the digital revolution, the branch remains a primary point of contact for many members. But changing consumer expectation also means refining the retail experience. This Callahan Collection hopes to provide credit unions with some inspiration along those lines.

We started [marketing] by engaging our staff members, who quickly spread the word to members they serve and to their family and friends, Nugent says.

Website content, newsletters, emails, branch signage, and social media promotions support the power of word-of-mouth.

Within a few weeks of its launch in Frankenmuth, approximately 225 of the credit union’s 4,100 mobile users had downloaded Pretzel Dough. Initial takers on the merchant side included restaurants, a hair salon, and a hardware store.

Online offers are seen and redeemed more often than traditional print ads, so the coupon app makes sense.

Who doesn’t like having fun and saving money? Schmitzer says. And if it’s easy to use, that’s even better. Make sure the coupon app is all those things and marketed that way.

Schmitzer says she hopes in two years, half of her mobile users and hundreds of local merchants use Pretzel Dough.

The credit union also hopes to make some extra interchange income in the process, but the coupon app is part of a wider strategy.

We’re focusing heavily on educating our members on all of our online, mobile, and text touchpoints, Schmitzer says. Stats show nationally that consumers feel credit unions aren’t as cutting edge in technology as banks. We’re proving them wrong.

You Might Also Enjoy

- How Redstone Delivers Fraud Education One Tweet At A Time

- 4 Alternatives To Facebook And Twitter

- Lessons From A YouTube Series

- 3 Social Media Tips To Attract Millennials