Read the full analysis or skip to the section you want to read by clicking on the links below.

LENDING AUTO LENDING MORTGAGE LENDING CREDIT CARDS MEMBER BUSINESS LENDING SHARES INVESTMENTS MEMBER RELATIONSHIPS EARNINGS SPECIAL SECTION: EMPLOYEE ENGAGEMENT

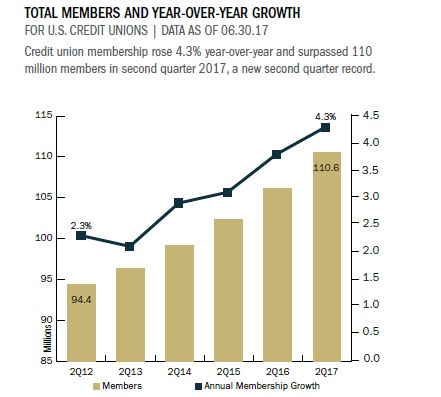

Credit union membership exceeded 110 million in the second quarter of 2017, and the movement wrapped up June with 110.6 million members. This is a 1.2% increase over first quarter and a 4.3% increase year-over-year.

In the past year alone, U.S. credit unions have attracted more than 4.5 million net new members. Credit unions with more than $1 billion in assets posted the highest member growth 7.3% year-over-year.

On average, credit unions spent an annualized $335 per net new member on educational and promotional expenses this quarter a 32.9% YOY decrease. At $456, credit unions in the NCUA’s Central Region reported the highest marketing expense per net new member. Mid-Atlantic credit unions reported the lowest expense at $228.

Larger credit unions, on average, spent less on educational and promotional expenses per net new member. For example, credit unions with more than $1 billion in assets spent $223 per net new member in the second quarter of 2017. By comparison, credit unions with $50 million to $100 million spent $1,250.

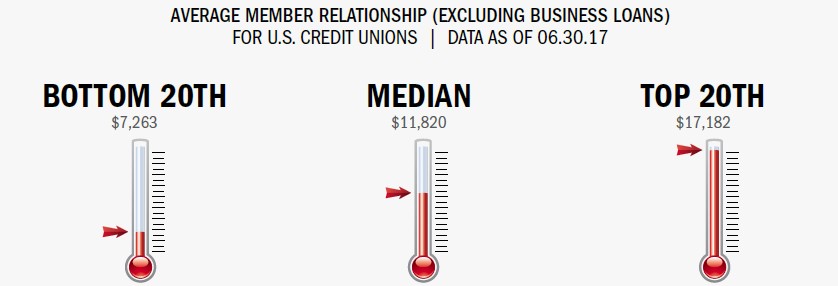

The average member relationship calculated by taking the average dollar amount of savings and loan products a member holds with their credit union, subtracting member business loans at U.S. credit unions was $18,149 as of mid-year. That’s a 19.6% increase over June 30, 2012.

Credit unions in the NCUA’s Western Region posted the highest average member relationship, $20,649, this quarter. And although Southeast cooperatives posted the lowest average relationship, $16,054, that region also posted the strongest YOY growth in relationships 4.9%.

Callahan’s Peer-to-Peer quickly shows how your credit union stacks up against peers for key member-centric metrics. Learn more today.

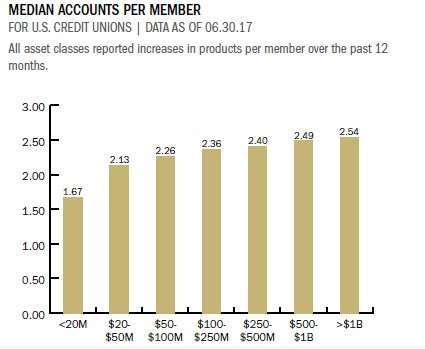

There is a strong correlation between credit union size and accounts per member. Members at credit unions with more than $1 billion in assets have a median 2.5 accounts, whereas members at credit unions with less than $20 million in assets have a median 1.7 accounts. For all credit unions nationally, the median is 2.08 accounts per member; the average is 2.5 accounts.

Click the graphs below to enlarge and then continue reading to see how Patelco Credit Union is using a homegrown tier system to improve the member experience for check holds.

The average member relationship for the credit union industry increased 4.5% year-over-year to $18,149 per member, on average, as of June 30, 2017.

CASE STUDY

PATELCO CREDIT UNION

Patelco Credit Union is using a homegrown tier system to improve the member experience for check holds.

Called Co-Relate, the system uses relationship scoring to create five levels of funds that are immediately available to members presenting checks in a branch.

Scores are based on factors such as the number of deposit products and loans a member has, how active checking accounts have been, and how long the depositor has been a member. Scores can change based on delinquencies or newly adopted products and services.

Patelco refreshes tier levels which range from $5,000 to $50,000 for members every month. And because it does this through its core processing system, there is a consistent member experience across the organization.

It takes away some of the judgment calls, so we don’t have members getting immediate funds at one branch but not at another, says Lani Apolonio, Patelco’s vice president of operations.

The Co-Relate tiers also apply to checks members deposit from elsewhere in the country.

We want to ensure equitable treatment to members no matter where they are and give them predictable access to their funds, Apolonio says. That helps them have better control of their finances.

However, a different set of relationship rules do apply for mobile deposits.

Depending on the image, a check might end up on risk review, Apolonio says. Certain dollar amounts automatically go to risk review. If we have reason to believe a check will not pay, we delay it and email the member.

The new hold system might reduce non-interest income in the form of fees for returned checks, but the credit union says the payback comes in deepening the member relationship.

More member trust leads to more member participation in our other products and services, Apolonio says.

Read The Whole Story

Strategy & Performance 2Q 2017

Credit unions are indeed having an outstanding 2017 right on the heels of a very strong 2016 and 2015. Eliminating barriers and connecting with members distinguishes credit unions from other financial institutions and makes the movement stronger than it’s ever been. Learn what the industry’s most successful credit unions are doing in this issue of Strategy & Performance.

Read More

RETURN TO INDUSTRY PERFORMANCE BY THE NUMBERS 2Q 2017