Top-Level Takeaways

-

Truity Federal Credit Union set a 2.5% deposit growth goal for 2018.

-

To try and meet this, the credit union introduced a high-yield savings account in January of last year.

CU QUICK FACTS

Truity FCU

Data as of 09.30.18

HQ: Bartlesville, OK

ASSETS: $795.9M

MEMBERS: 169,235

BRANCHES: 8

12-MO SHARE GROWTH: 2.8%

12-MO LOAN GROWTH: 7.4%

ROA: 0.42%

In the low-rate environment of the past 10 years, credit unions have opened the lending spigot. Although loan and share growth rates have differed slightly in the past decade, at 95% and 90%, respectively, the difference in the past five years is much starker. The industry’s five-year loan growth has been strong at 65%, but deposits haven’t been so easy to come by. The industry’s five-year share growth is 37%.

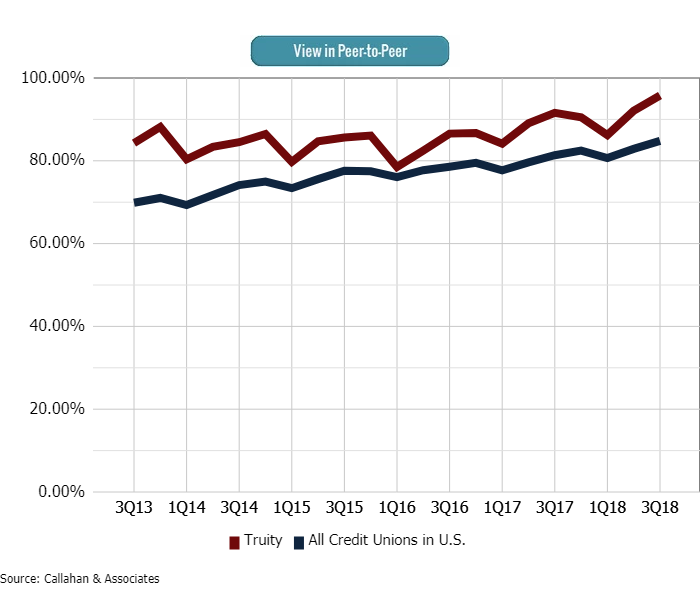

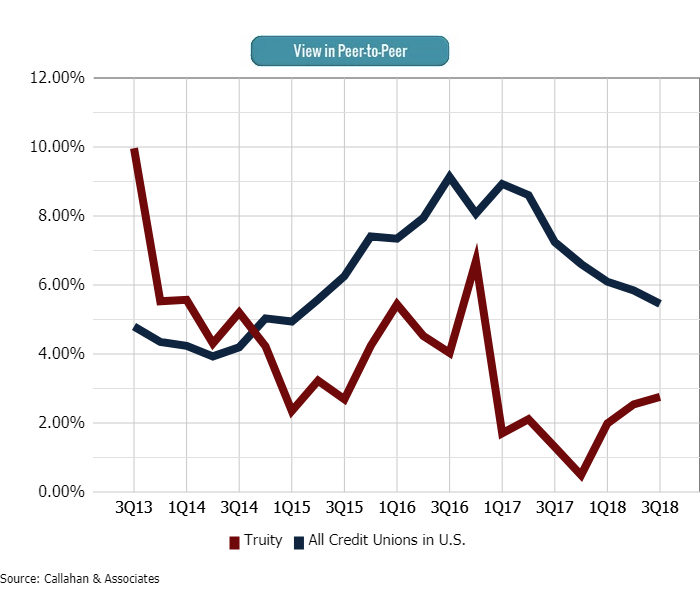

ruity Federal Credit Union ($795.9M, Bartlesville, OK) has felt the same pressures as credit unions nationwide. Across 2016 and 2017, the credit union’s share growth declined from 6.7% in the fourth quarter of 2016 to 0.5% one year later. Lending growth continued to trend up, resulting in a loan-to-share ratio of 95.1%, nine percentage points higher than national average.

Truity had a clear need to grow deposits. So, the Sooner State cooperative set a 2.5% deposit growth goal for 2018. In January, the credit union launched Name It, Save It. A hybrid between a savings account and a certificate, the product allows members to name the account based on its purpose and start saving. For example, College Fund or Vacation Fund. The product remains active to this day.

In this QA, Amy Grose, vice president, marketing director at Truity, discusses the product’s genesis, its design, and the response thus far.

ContentMiddleAd

What made you launch Name It, Save It?

Amy Grose: Like all other institutions, practically, we had a need for deposits. Our loan-to-share ratio is high, and we needed deposits to continue our loan volume.

At the end of 2017 and into 2018, we started to more aggressively seek deposits.

LOAN TO SHARE RATIO

FOR ALL U.S. CREDIT UNIONS | DATA AS OF 09.30.18

Truity’s loan-to-share ratio historically has outpaced the industry’s. In recent years, the credit union has made further strides to increase deposits to fund its loan growth.

Source: Callahan Associates.

DEPOSIT GROWTH

FOR ALL U.S. CREDIT UNIONS | DATA AS OF 09.30.18

After several quarters of slowing growth, Truity’s portfolio started to rebound over the course of 2018.

Source: Callahan Associates.

What was your growth goal for deposits? Did you hit it?

AG: Our goal was 2.5% across 2018. We didn’t hit it entirely. We wanted to end at $712,660,000 in deposits and we ended up a few hundred thousand dollars short.

Talk more about the design of Name It, Save It.

AG: It is a savings account, although it’s structured a bit differently. It has the traditional Reg D restrictions

as it relates to the number of withdrawals and transfers you can make, but the idea was to encourage members to start saving and build a savings habit.

There’s no minimum deposit required, and no minimum to earn dividends, but we limit deposits to $50,000. The interest rate is higher than other savings accounts we paid 2% APY across 2018. We allow account holders one withdrawal per 12-month period. Additional withdrawals are $10. So, it’s like a cross between a savings account and a certificate, but we call it a savings account.

Why design something that is a cross between those two products?

AG: Our theory was that our members would keep their money in the product longer. We don’t have the security like we do with a certificate product with a defined term, but we did add restrictions on how often they could move money out.

Amy Grose, Vice President, Marketing Director, Truity FCU

And you designed it so members are saving for a purpose?

AG: Yes, we gave members the ability to name their account, whether it’s for a vacation, a rainy day, a college fund, a home improvement, or more. Prior to this, our members could name their accounts and those names would be visible to them in their online banking, but our retail staff couldn’t see it. Our staff can only see Share-20. Now our retail staff can see Share-20-Vacation Fund. This helps us move the member’s money exactly where they want it to go and gives them a motive to keep saving.

What was the promotional period?

AG: We promoted it longer than we typically do for several reasons. We get an influx of deposits from our employee groups from February to April, but between April and July things slow down. With Name It, Save It, we were able to maintain growth during that slower period because people were still adding money to their accounts rather than taking it out.

You launched this account more than 12 months ago. How have members received it?

AG: It was received well. We don’t have year-end totals available at this time, but in our first six months we brought in more than 2,400 accounts and $41 million, with $29 million of that as new money.

Have you identified any best practices from this rollout?

AG: Rate is always easy to sell. And the liquidity or perceived liquidity this product provides has added value. For younger members, signing up for this product is not as daunting as locking in money for 60 months.

Additionally, it’s more challenging to encourage younger members to take out CDs. There’s a higher point of entry and a longer-term minimum. For us, this is one of the appeals of promoting our account as a savings product that members can open with as little as $1, whereas a minimum deposit for a certificate is $500.