Top-Level Takeaways

-

In response to the COVID-19 pandemic, PCM has shuttered lobbies and sent staff home.

-

According to its president, the credit union’s commitment to employee groups drives strategy and priorities, which are focused on members rather than profits.

CU QUICK FACTS

PCM Credit Union

Data as of 12.31.19

HQ: Green Bay, WI

ASSETS: $269.3M

MEMBERS: 13,075

BRANCHES: 3

12-MO SHARE GROWTH: 4.4%

12-MO LOAN GROWTH: 2.8%

ROA: 0.80%

PCM Credit Union ($269.3M, Green Bay, WI) is banking on 100 years of credit union history to do its best for its tight-knit membership during the COVID-19 pandemic.

Founded in 1958 as Paper Machine Converting Company Credit Union, PCM has added only a handful of SEGs to its original field, maintaining a common bond focus that its president of more than 30 years says has served it and its members well.

We’ve never been about growth, Dan Wollin says. We’ve always been about service. That’s as important now as ever.

PCM has taken a number of steps to respond to the pandemic. It has sent staffers home to work and closed the lobbies of its two full-service branches while maintaining drive-thru service. It also has temporarily shuttered its third branch located insidea SEG’s facility.

Additionally, the credit union has removed early withdrawal penalties for all savings accounts except certificates and is offering 90-day deferrals on most of its installment loans. It doesn’t need to waive late fees because PCM hasn’t imposedthem in years. And its overdraft fee?

Dan Wollin, President, PCM Credit Union

It doesn’t need to waive late fees because PCM hasn’t imposed them in years. And although it is still charging an overdraft fee, that is only $8 and might be among the lowest in the country, according to Wollin.

Prepare your credit union’s response to COVID-19 using the Ideas In Action: Pandemic Response page, a hub for all of our articles, webinars, and policies concerning the COVID-19 outbreak.

Although old school in a lot of respects, PCM which Wollin says has stood for People Caring More since a 2011 rebrand to its current name is no digital dinosaur. Instead of going into a branch, members can avail themselvesof online banking, two mobile apps, three mobile wallets, and remote deposit checking. New members can also join online.

Still, Wollin is keenly aware of his credit union’s challenges.

The local economies in Green Bay and Marinette a community approximately 50 miles away where PCM completed its only merger ever a few years ago to add a group of county employees are already showing the strain of pandemic-driven shutdowns.Wollin predicts PCM’s s old-school approach to cooperative business will help it handle the new viral threat, and he’s not particularly worried about the credit union’s bottom line at the moment.

The Chief Historian Officer

Dan Wollin has penned several articles for member communications, including one that compares the history of credit unions and the Green Bay Packers. Read it here.Other articles include: Living For A Higher Purpose; What Is A SEG?;

One of the cooperative principles is giving back excess, and for us in this case that means if we’re at 14% reserved, we can go to 12% or 13% or so if that’s what’s needed to put money back in our members’ pockets at thiscritical time, Wollin says. Our board is committed to that philosophy. We’ve got to take our lending and charge-off and net income goals and toss them away. That’ can’t be the driver of decisions. We have to do what’sbest for members.

In turn, members take PCM at its word. The credit union has a perfect 100 score in Callahan’s Return of the Member calculation, which takes into account savings and borrowing rates as well as member product usage.

We’re proud of that ranking because it’s such an indicator of the balance we have here, Wollin says. You can’t be just about borrowers or just about savers or just about the ancillary things. You have to be goodat all three.

For Wollin, ROM also harkens back to the 1920s and the beginning of American credit unions.

I have a picture of Edward Filene in my office, Wollin says. He used to say, Do the best you can today and then tomorrow do it better.’ I believe that, too.

Numbers Tell PCM’s Story, Too

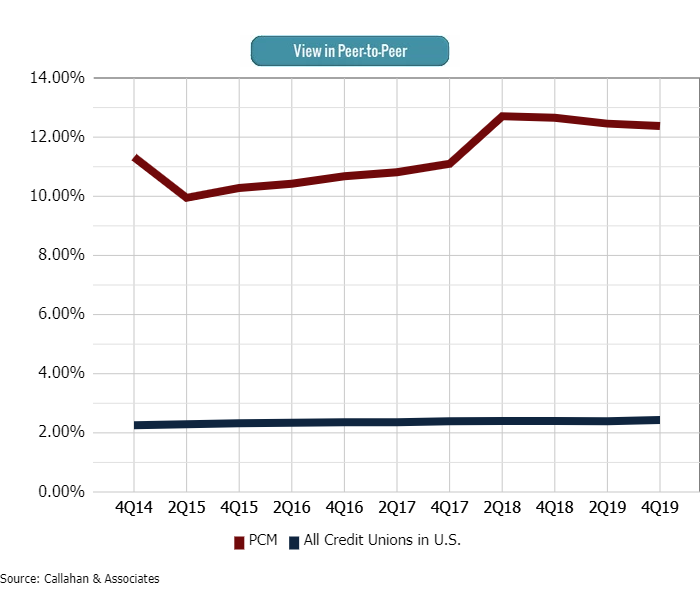

MORTGAGE PENETRATION

FOR PCM CREDIT UNION | DATA AS OF 12.31.19

Callahan & Associates | CreditUnions.com

Subsidizing closing costs and lowering the down payment threshold for property mortgage insurance has helped PCM post some of the highest first-mortgage penetration rates in the movement, including 12.37% in the fourth quarter of 2019.That’s 50th among the nation’s 5,349 credit unions.

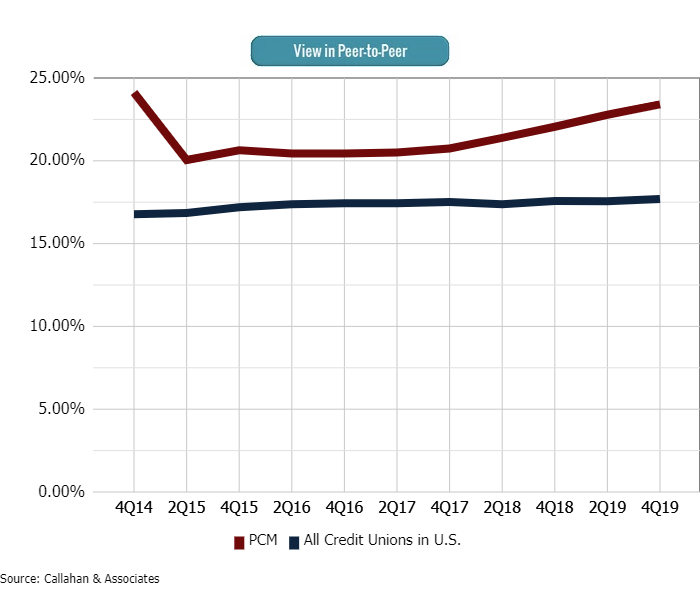

CREDIT CARD PENETRATION

FOR PCM CREDIT UNION | DATA AS OF 12.31.19

Callahan & Associates | CreditUnions.com

A fee-free credit card at 9.88% and a rewards card that pays 5% on the first $1,000 charged a month has helped PCM achieve a penetration for that product that’s 33% higher than the industry average.

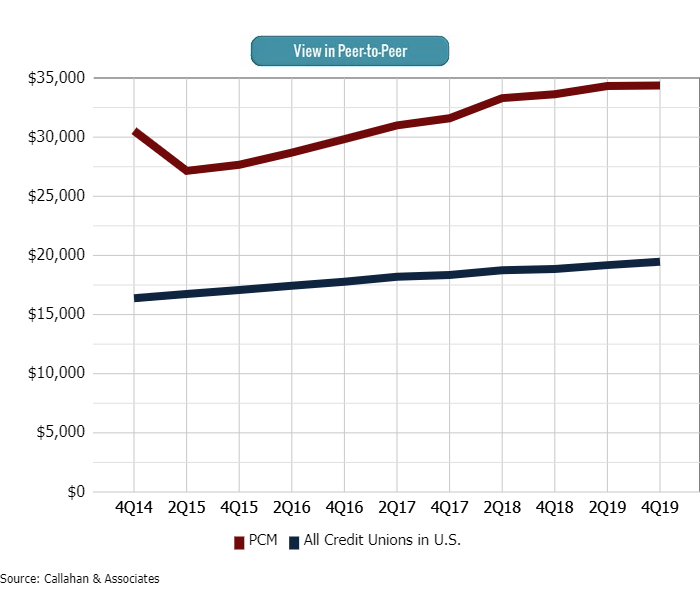

AVERAGE MEMBER RELATIONSHIP

FOR PCM CREDIT UNION | DATA AS OF 12.31.19

Callahan & Associates | CreditUnions.com

PCM’s average member relationship, buoyed by above-average loan and deposit relationships, was a robust $34,359 in the fourth quarter, a full 76% more than the $19,474 average for all U.S. credit unions.

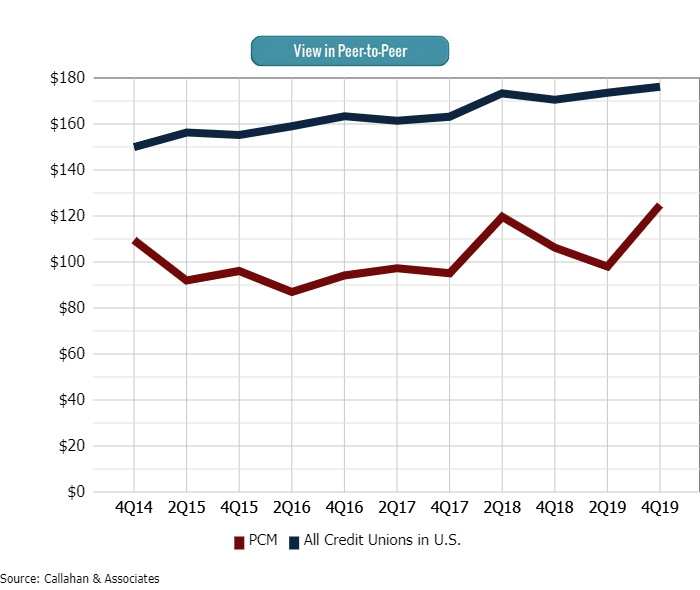

NII PER MEMBER

FOR PCM CREDIT UNION | DATA AS OF 12.31.19

Callahan & Associates | CreditUnions.com

A low fee structure is part of PCM’s People Caring More philosophy. The Wisconsin credit union’s fourth quarter average non-interest income per member is usually lower than the industry average. It was $125versus $176 for the industry in the fourth quarter of 2019.

Encouraging members to hang on to their money has always been part of PCM’s philosophy and the thinking behind longstanding programs that incent members to keep in their accounts at least $500 for emergencies and participate in save-to-win promotions.

It’s also one of the reasons PCM is limiting cash withdrawals to $2,000 a day right now, although that doesn’t work for everybody. One member wanted to take out $40,000 in cash. He was sure the financial system was in trouble and interestrates would soon dip below zero.

Wollin told the concerned member that PCM is consistently ranked among the most financially stable in the country and all accounts are insured by the NCUA for up to $250,000.

In fact, enough members with enough money trust PCM so much that nearly 10% of its total shares and deposits are uninsured $21.4 million out of $226.4 million primarily in accounts that exceed that $250,000 threshold. Wollin didn’tsay if the member seeking $40,000 was one of them.

We had to tell him to come back in a couple of days, but we also talked to him about his concerns and took them seriously, Wollin says. All fears are valid if not necessarily accurate.