Seventy percent of American consumers use credit cards because they are a convenient form of payment, according to CreditCards.com. Not so convenient is the risk of credit card fraud.

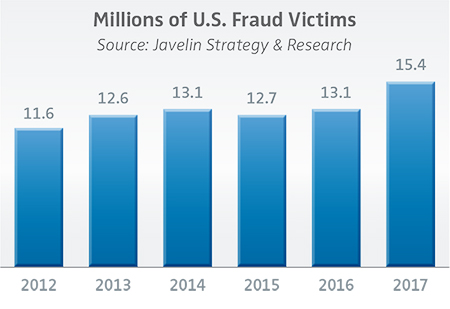

In 2017, 16.7 million U.S. consumers were victims of identity fraud (which includes credit card fraud), resulting in $16.8 billion in total losses. Javelin Strategy says this figure was up 8% from 2016 despite new security protections implemented by the credit card industry such as EMV chips. Because EMV chips make in-person fraud more difficult, criminals are now focusing on digital channels.

As credit unions adopt more digital strategies, it is imperative that they keep fraud prevention at the forefront of security measures.

Types Of Credit Card Fraud

Credit card fraud is a form of identity theft that involves taking a person’s credit card or account information for the purpose of charging purchases to the account or stealing funds from it. There are four main types of credit card fraud, according to BankRate.com.

1. Card-present fraudulent activities occur when a criminal physically takes another person’s card without his or her consent and uses it to make purchases in-person or uses stolen card information to furnish counterfeit cards.

2. Card-not-present fraud allows criminals to avoid detection by stealing card information and making purchases online or by phone. Javelin Strategy says card-not-present fraud is now 81% more likely to be committed than card-present fraud. Account takeovers have increased 120% from 2016 to 2017, totaling $5.1 billion in losses.

3. Account takeover occurs when criminals obtain personal data in order to access credit card accounts. Account takeovers have increased 120% from 2016 to 2017, totaling 5.1 billion in losses, according to the same Javelin study.

4. Loyalty redemption fraud is a way for criminals to launder money by stealing and then reselling the rewards points or goods that cardmembers accumulate from their card transactions.

Cost To Credit Unions And Fraud Prevention Tools

According to the LexisNexis 2017 True Cost of Fraud study, every $1 of fraud costs organizations in industries such as financial services and lending sectors an average of $2.67.

Credit unions can take measures to proactively prevent and minimize fraud’s impact; including offering members account activity alerts and controls, having a breach response plan, and educating staff and members about fraud trends.

Offer Account Activity Alerts And Controls

Offering members the tools needed to control and remain aware of account activity is a critical factor in preventing fraud. Services such as viewing account activity on a mobile app, and the ability to turn cards on and off, set transaction-based alerts, and deny transactions based on criteria they set will help cardmembers mitigate the chances of fraud.

Have A Breach Response Plan

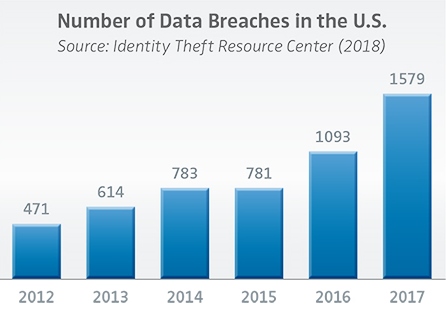

In 2017, U.S. companies and government agencies suffered a record 1,579 breaches, according to a report in Dark Reading. In 2017, one of the largest known breaches to date, the Equifax breach, impacted the data of 143 million Americans whose names, Social Security numbers, birth dates, addresses, credit card numbers, and more were exposed.

Because data breaches are a when and not an if, credit unions must have a detailed response plan in place.

Depending on the size of the breach, it may be necessary for a credit union to shut down certain business activities like online or mobile banking. Resources will be needed to field calls and help members secure their accounts.

The credit union must decide whether or not to reissue cards, which can be costly. One study estimated that the average cost to reissue a card after a breach ranged from $3 to $20.

Educate Staff And Members About Fraud Trends

As technology evolves, the vulnerabilities that criminals try to exploit shift and thus so do the types of fraud committed. Providing education to members about fraud trends can be done a number of ways including via a mobile app, online, in person, or with printed materials.

Choosing a credit card partner that offers up-to-date fraud fighting capabilities helps credit unions keep members’ accounts safe without significant upfront investment.

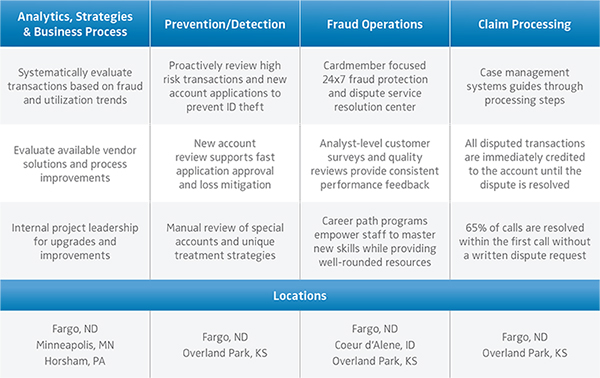

Within a comprehensive fraud strategy, Elan combines robust risk management with the objective of providing an excellent member experience. Elan employs the latest fraud detection neural network infrastructure and comprehensive fraud trend analysis to systematically evaluate transactions. By focusing holistically on the fraud lifecycle to best serve our credit union partners’ cardmembers and proactively prevent fraud, Elan utilizes measures such as reviewing transactions that meet pre-set criteria and reviewing new account applications for identity theft prevention. This new account review supports fast application approval and loss mitigation.

There are four distinct groups that Elan focuses on as seen in the table below:

Compared to other industry players, Elan has a consistently low fraud loss per event due to its comprehensive fraud prevention program which seeks to quickly and effectively solve potential fraud issues. Our 24/7 customer-focused fraud prevention and dispute service resolution center works with our partners’ cardmembers to resolve issues.

Elan actively manages potential fraud risks by notifying cardmembers via text message, phone call, or other methods when suspicious activity occurs. Using multiple communication channels between fraud specialists and cardmembers ensures speedy issue resolution. The majority of customer service phone calls are resolved within the first call without a written dispute request.

Partnering with Elan also allows credit unions to offer digital innovations to their cardmembers that help fight fraud, including a Geolocation Service App and fingerprint authentication for mobile applications. The Geolocation Service App uses mobile geolocation data in real time to further enhance Visa’s predictive fraud analytics. When a cardmember transacts in a store, Visa can tell the card issuer in the payment authorization message whether the cardholder’s mobile phone is located near the merchant. The issuer can then use that information as a factor in its decision to approve or decline the transaction. This added information helps prevent mistaken declines and fraud false-positives.

Elan is always looking out for current data breach news and is prepared to aid partner credit unions and cardmembers if a breach occurs. Elan will reissue cards if needed to protect cardmember data en masse or on a case-by-case basis.

In addition, credit unions partnered with Elan can offer their cardmembers:

- A competitive credit card product suite with the rewards cardmembers desire.

- Alert preferences for dependent cards and ability to turn a registered card on and off between purchases (with no disruption to recurring bill payments).

- Mobile payment options such as Apple Pay, Google Pay, Samsung Pay, and Microsoft Pay.

- Tools to help them learn how to manage credit, including a credit education website, Smart Credit Matters (smartcreditmatters.com).

Finally, credit union partners have free access to a robust marketing engine to generate new customer accounts.

Click here to download the full Elan Fraud white paper.

As America’s leading agent credit card issuer, Elan serves over 250 active credit union partners. For 50 years, Elan has offered an outsourced partnership solution that provides credit unions the ability to offer a competitive credit card program. Elan has developed industry-leading technologies to improve cardmember satisfaction and drive growth all while sharing the program economics with our partners. For more information, visit www.cupartnership.com/.