In the mid-2000s, many credit unions sold off their credit card portfolios, taking the cash and leaving the servicing and profits of this core product to others.

Then the recession hit, lending markets reeled, margins got squeezed, and net income became hard to come by. Plus, those third-party outfits didn’t always operate the way a member-owned credit union expected.

That gave Jon Rasmussen the idea to offer a credit card loan participation model through Suncoast Credit Union($6.0B, Tampa, FL). For a fee, Suncoast does the heavy liftingand the participating cooperatives share profits and risk.

|

| Jon Rasmussen, VP of Card Services at Suncoast Credit Union. |

We saw all these non-compete clauses coming up for expiration, says Rasmussen, Suncoast’s vice president of card services. We kept hearing about bad service from other credit unions, so we thought the market might be prime forsomething like this.

The participation program, called CC4MBRS, provides processing through FIS, branded marketing, rewards programs, underwriting, application and issuing, contact center support, and portfolio buy-back options.

We’re the only one participating in the balances and offering credit unions the ability to buy back their portfolio at some point, says Julie Renderos, executive vice president and chief financial officer. We were looking fordiversification and growth in our loan portfolio, and the stars just aligned.

The participant credit union programs are a mirror of their host at Suncoast, including net yield, expenses, and risk. Profits and losses are split according to the ownership percentage of the individual portfolio, up to 90% for federal credit unionsand 95% for state-chartered credit unions.

Suncoast executives say CC4MBRS embodies the movement’s philosophy of credit unions helping other credit unions by offering a member-friendly path into credit cards. Suncoast, meanwhile, generates some fee income while boosting its own cards balances,something it couldn’t do operating solely as a third-party vendor.

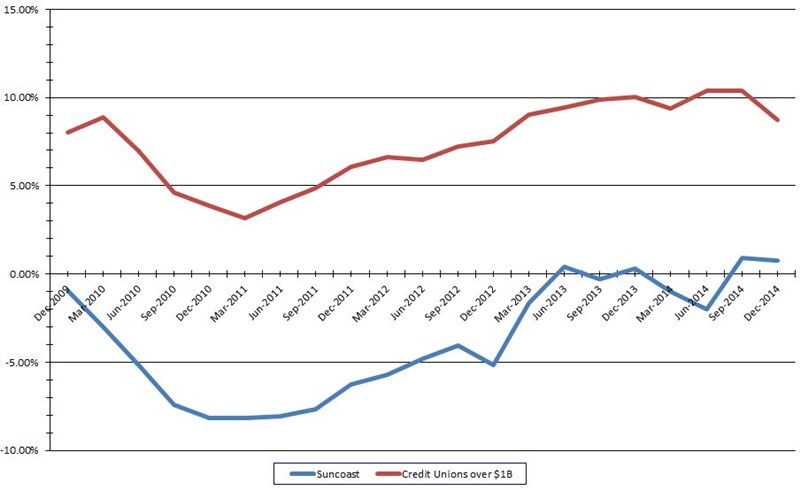

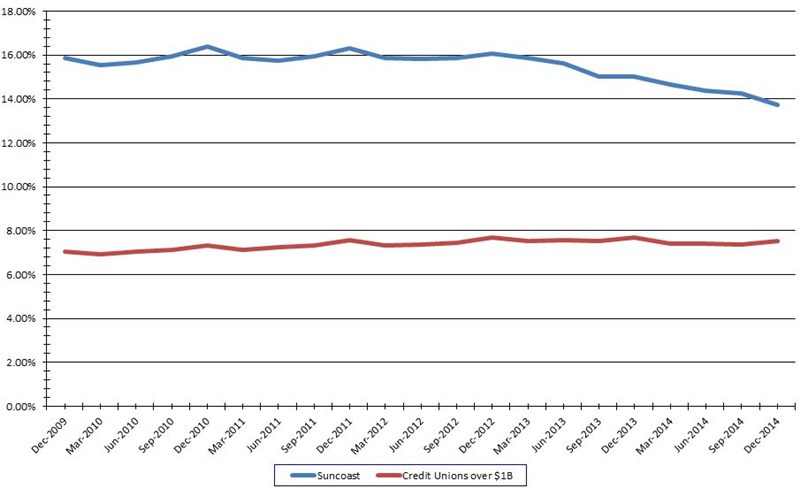

Credit cards represent 13.73%, or $576 million, of Suncoast’s total loan portfolio, compared with 7.51% $136 million on average for credit unions of $1 billion or larger in assets nationally, according to Callahan data. That’s10th highest among the 227 billion-dollar credit unions at the end of fourth quarter 2014. However, Suncoast’s asset-based peer group notched 8.75% growth over the year-ago quarter, whereas Suncoast’s increased 0.9% during thesame period.

Credit card loan growth

Data as of Sept. 30, 2014

Callahan & Associates | www.creditunions.com

Suncoast aims to drive credit card loan growth with its new participation program.

Source: Callahan & AssociatesPeer-to-Peer Analytics

CC4MBRS aims to broaden Suncoast’s portfolio exposure beyond its southwest Florida base. Rasmussen, meanwhile, is working to get the message out at conferences and meetings.

There are a lot of credit unions that regret selling their portfolios, he says. We’ll give them the tools necessary to compete and we’ll handle the administration and processing while sharing in the profits and expenses.

The first two partners have approximately $3 million in balances at CC4MBRS.

We can’t buy portfolios outright, of course, from a regulatory standpoint, and this lets them get some skin in the game, Rasmussen says.

Credit CARD LOANS/TOTAL LOANS

Data as of Sept. 30, 2014

Callahan & Associates | www.creditunions.com

Suncoast has among the highest credit card loans-to-total loans ratio in its asset peer group.

Source: Callahan & AssociatesPeer-to-Peer Analytics

Getting Back In The Business

Many years ago we made a wise decision and sold our credit card portfolio, says Shannon Duran, senior vice president and chief operating officer at PBC Credit Union ($119.6M, West Palm Beach, FL), Suncoast’s first credit card loan participation partner.

PBC went live with CC4MBRS in April 2013 after member demand and the economic climate made the time right for the credit union to re-enter the credit card business. Now it has roughly 1,300 accounts among its 26,132 members.

We wanted to bring our members back into our realm for credit card servicing, Duran says. This was a great opportunity for us to do it on the asset side.

QUICK FACTS

SUNCOAST CREDIT UNION

data as of 09.30.14

- HQ: Tampa, FL

- ASSETS: $5.99B

- MEMBERS: 611,784

- BRANCHES: 56

- 12-MO SHARE GROWTH: 8.2%

- 12-MO LOAN GROWTH: 10.21%

- ROA: 1.53%

PBC CREDIT UNION

data as of 09.30.14

- HQ: West Palm Beach, FL

- ASSETS: $119.55M

- MEMBERS: 26,130

- BRANCHES: 5

- 12-MO SHARE GROWTH: 4.87%

- 12-MO LOAN GROWTH: 4.50%

- ROA: 1.03%

SMW FEDERAL CREDIT UNION

data as of 09.30.14

- HQ: Lino Lakes, MN

- ASSETS: $$64.26M

- MEMBERS: 6,791

- BRANCHES: 2

- 12-MO SHARE GROWTH: : 8.89%

- 12-MO LOAN GROWTH: 11.61%

- ROA: 0.14%

Suncoast’s second partner isSMW Federal Credit Union($64.3M, Lino Lakes, MN), which launched in spring 2014 and nowhas 201 accounts among its 6,791 members. Aeton De Long-Hersh, the suburban Minneapolis credit union’s chief financial officer, says he first heard about the program at a CUNA CFO Council meeting and committed to CC4MBRS after examining RFPsfrom other vendors using more traditional models.

We found they would take about three years to become profitable and we’d still have to do a lot of the work in house, De Long-Hersh says. He says SMW earned a profit three months into its 20% portfolio participation plan with Suncoast,which charges a per account service fee.

Suncoast’s partners get a monthly statement that shows the service fee, plus any charge-off or fraud losses and Visa’s quarterly reporting and scorecard redemptions, all based on the credit unions’ percentage of participation.

Approving More Members

PBC and SMW said the program allows them to concentrate on member service and, critically apply their own underwriting standards while letting Suncoast handle the back office work.

We went from 1% percent approval from our third-party card vendor to something like 95% now, De Long-Hersh says. We had members who are good risks who were being denied or not getting as large a line as they’d like. Now, ninetimes out of 10, Suncoast listens to us and approves it.

Duran at PBC agrees with that assessment. She adds that credit cards are an area of management expertise all to its own and requires a full-time staff to be successful. In addition, third-party relationships should be with trusted partners who handledirect member relationships the way a credit union member expects to be handled.

The member response has been good, Duran says of her card participation experience. It’s seamless to Suncoast and attractive to us.

Efficiencies And Expansion

Suncoast operates the program through its cards department and has absorbed the additional operational needs without changing its current staffing, but that will change as the program grows.

Our intent is to pull these participations into a separate area responsible for servicing these accounts, Renderos says.

Meanwhile, the credit union wants to add two or three new credit union portfolio partners this year and is building on its experience with its credit card program to do more member business and vehicle lending participations. But it’s not workingwith just anybody.

Due diligence is key, along with transparency, Renderos says. You need to understand your partner and they need to understand Suncoast and have the same philosophy of growing the portfolio responsibly.