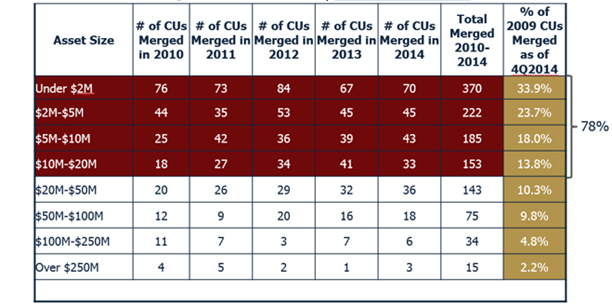

The rate of credit union mergers is steadily increasing, making the availability for alternative strategies to help smaller institutions remain independent critical. The chart below underscores the need for smaller institutions to innovate, as credit unions with less than $20 million in assets represent a full 78% of merged institutions over the past five years.

CREDIT UNION MERGERS (2010-2014)

For all U.S. credit unions | Data as of 12.31.14

Callahan Associates |

Source: Peer-to-Peer Analytics by Callahan Associates

To help small credit unions tap into the power of the cooperative system while remaining as independent as possible, MidAtlantic Corporate Federal Credit Union and a group of committed credit union participants created the ReKindle initiative. Its No. 1 goal? Provide credit unions alternative solutions to their daily challenges.

One such solution is the rkGoBig credit union service organization. The CUSO is owned by six natural person credit unions whose assets range from $57 million to $150 million.

The immediate goal of the rkGoBig CUSO is to gain scale in our operations without merging, says Peter Barnard, CEO of rkGoBig. We’re committed to achieving a 25% reduction in operating expenses.

Shared Service Solutions (S3), itself a spinoff of the shared service model Open Technology Solutions (OTS), is the initial source of inspiration for rkGoBig. When Joan Moran, CEO of Department of Labor FCU and board member of Mid-Atlantic Corporate, learned of the S3 shared processing center in Maryland, her pitch to Jay Murray, CEO of Mid-Atlantic Corporate, and Peter Barnard, was simple: I want one of those!

Six credit unions came together, and rkGoBig was born.

| Credit Union | Total Assets | State |

|---|---|---|

| Destinations Credit Union | $57,019,062 | MD |

| Viriva Community Credit Union | $66,291,142 | PA |

| Department of Labor FCU | $68,094,962 | DC |

| SPE FCU | $80,120,966 | PA |

| Century Heritage FCU | $119,906,513 | PA |

| Everence Federal Credit Union | $149,643,766 | PA |

The Coordination

The idea of joining forces to achieve scale is nothing new, but that doesn’t make it easy to coordinate.

Bank holding companies have been doing this for a long-time Barnard says. But it takes a lot of time and hard work to achieve convergence among six different institutions.

The CUSO defines convergence as making many of our back-office processes, procedures, and practices similar while maintaining the identity of each credit union. In doing this, all of the credit union participants will increase efficiency and save money.

The rkGoBig credit unions have committed real dollars and real time to the shared model, spending nearly a year planning and making multi-million dollar decisions collaboratively. This planning is just the beginning as the CUSO looks to cut costs through merging core systems and key vendor relationships and streamlining processes to achieve greater efficiency.

According to the CUSO, hen gelling multiple credit unions, it is always a challenge to match the different vendor contracts and end dates for each. Accordingly, rkGoBig is in the midst of a three-year plan for the credit unions to integrate with the shared service solution.

Click on top right of slide to view full slideshow from rkGoBig.

You Might Also Enjoy

- 3 Credit Unions, 1 CEO

- 2 Tips To Build A Strong Employee-Sharing Arrangement

The Cost Savings

Even though the CUSO’s efforts are still in the early phases, its initial math is projecting significantly higher cost savings in areas such as collections and compliance.

We’ve already launched several of the services in the shared environment: collections, compliance and vendor management, Barnard says. These shared services have been running very well.

The first of the six credit unions converted its core system, online banking solution, and debit card processor in May of 2015. Two others will convert before the end of the summer. The remainder will convert their cores in 2016.

When what we’re doing is well-articulated to the vendor, we are seeing radically different pricing, Barnard says.

For example, as the table below shows, the CUSO’s chosen outsourced collections solution is projected to save the credit unions 43% annually. And rkGoBig projects it can save the credit unions 47% annually on compliance.

PROJECTED SAVINGS IN COLLECTION COSTS

Current projections for all rkGoBig credit unions

| 6 CU Group Costs Annually |

6 CU Group Costs Annually |

|

|---|---|---|

| Current State Today | $433,298 | $72,216 / CU |

| Future State Plan | $246,491 | $41,082 / CU |

| Annual Savings $$ | $186,807 | $31,135 / CU |

| Annual Savings % | 43% |

Source: rkGoBig

Ultimately, we will measure the savings on the actual 5300 reports from each credit union, Barnard says. But as part of our research, we spent about two months isolating costs of current day processing to estimate our future savings.

It costs money to get across the bridge if you believe there is value in developing scale in the back office without losing independence.

Cool With The Concept

The credit unions’ CEOs are well-versed in what it means to be a part of rkGoBig. After all, they’ve spent nine full days, measured in 24-hour increments, over the past year together. But rkGoBig is taking a page from OTS governance and communication playbook and also providing monthly board reports about the CUSO’s progress.

We provide one consistent board update per month that all the credit unions share, Barnard says. We find it is vital for all of our volunteers to have the same information. And each of the CEOs rotate the responsibility of preparing the update.

The CUSO holds one joint board meeting each year, and Barnard attends individual credit union board meetings on a regular basis. In the beginning, the CUSO CEO spent a half-day with each board to let them ask blunt questions and gain a greater comfort level with the shared operations model.

Ensuring the boards of directors have consistent information and are comfortable with the CUSO’s planning is as critical to the service organization’s success as detailed coordination among its participants.

It takes time to build trust and cohesion within a group, Barnard says. It also costs money to get across the bridge if you believe there is value in developing scale in the back office without losing independence.