Credit unions should regularly review their charter to make sure it is optimized to best fulfill their mission and achieve their strategic goals. After all, credit unions are at least partly defined by their field of membership (FOM) and this can often be an obstacle to success.

Over the past 20 years, credit unions have generally moved away from multiple common bond charters (the traditional Select Employee Group (SEG) charter) to community charters. The trend has now reversed. Credit unions are increasingly reclaiming their old SEG charter because the federal multiple common bond charter is generally simply better.

Most credit union executives know the federal multiple common bond charter allows credit unions to serve an infinite number of employers and associations. Some are aware that under a multiple common bond charter a credit union can have associational groups that can serve as a path to membership for prospective members willing to join the association to make themselves eligible.

Few, however, are aware that they can also serve communities. Even fewer, probably only our clients, know that a SEG charter can counterintuitively serve larger communities than those available under a federal community charter and many state charters.

Despite benefitting from a dual chartering system, most state charters are going to struggle to offer what the federal multiple common bond charter provides for the foreseeable future. After all, federal chartered credit unions only answer to one regulator and have broader tax exemptions and federal pre-emption. All of which generally means they pay lower taxes, aren’t subject to certain state regulations that conflict with federal regulations and have an easier time engaging in multistate branching and FOMs.

Historically, the perception has been that state charters have benefited from having more liberal field of membership rules. However, that has changed since the NCUA’s most recent modernization efforts due to the increase to maximum allowable population of a rural district from 250,000 to 1,000,000 residents.

Underserved areas, underserved rural districts in particular, are what make the federal multiple common bond charter so attractive. The definition of an underserved area is complex but the key facts are:

- Underserved areas are community affinities meaning that anyone who lives, works, worships, attends school, or businesses within them are eligible to join the credit union.

- Currently, underserved areas are only available to multiple common bond charters.

- Multiple common bond-chartered credit unions can have an infinite number of underserved areas in their FOM.

Additionally, an area of any geographic size qualifies as a rural district if:

- The total population of the proposed district does not exceed 1,000,000;

- More than 50% of the proposed district’s population resides in census blocks or other geographic units designated as rural by either the Consumer Financial Protection Bureau or the United States Census Bureau, OR the district has a population density of 100 persons or fewer per square mile; and

- The boundaries of the well-defined rural district do not exceed the outer boundaries of the states immediately contiguous to the state in which the credit union maintains its headquarters (i.e., not to exceed the outer perimeter of the layer of states immediately surrounding the headquarters’ state).

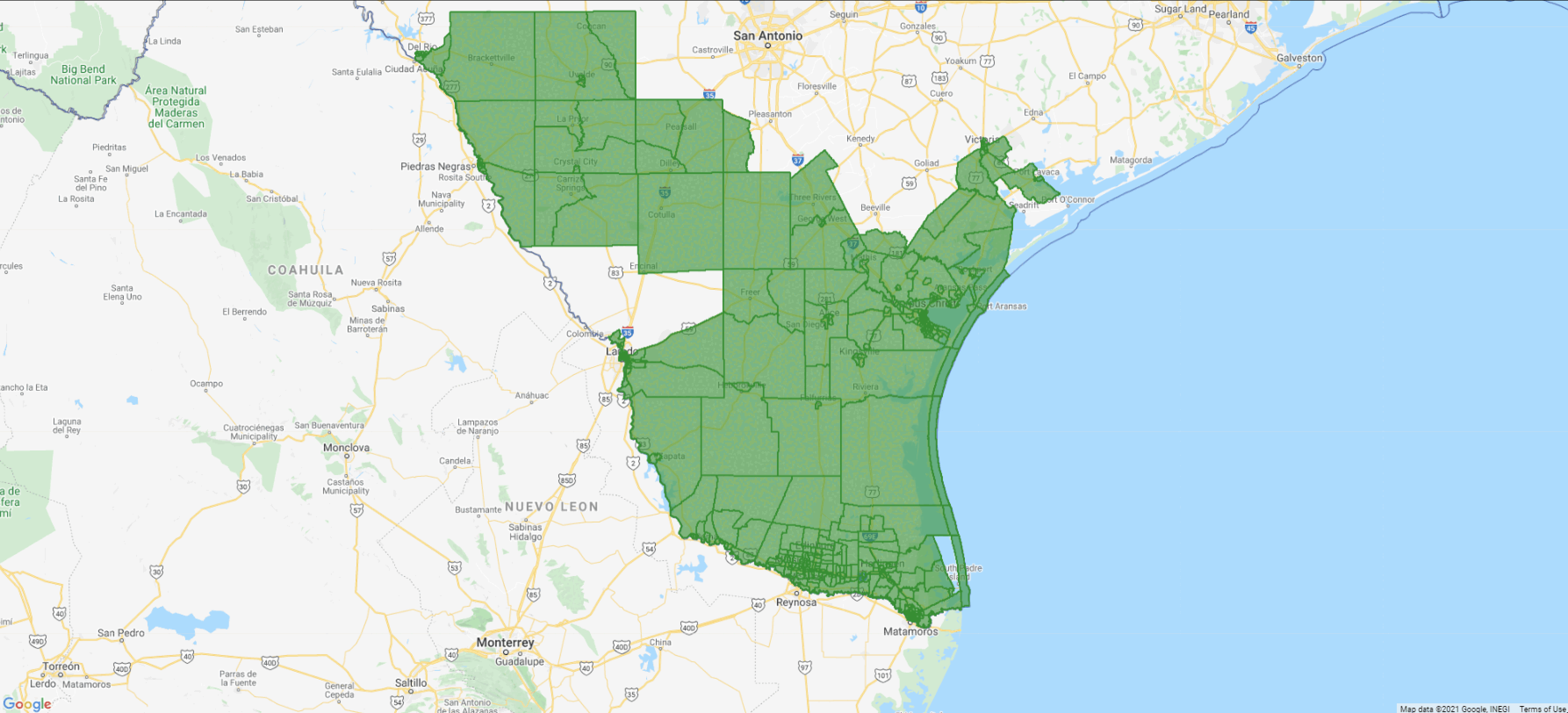

The fact that multiple common bond credit unions can have an infinite number of underserved areas in their field of membership and that rural districts can consist of any unit within the state a credit union is headquartered in, and its surrounding states, allows for a lot of flexibility in defining the communities a credit union serves.

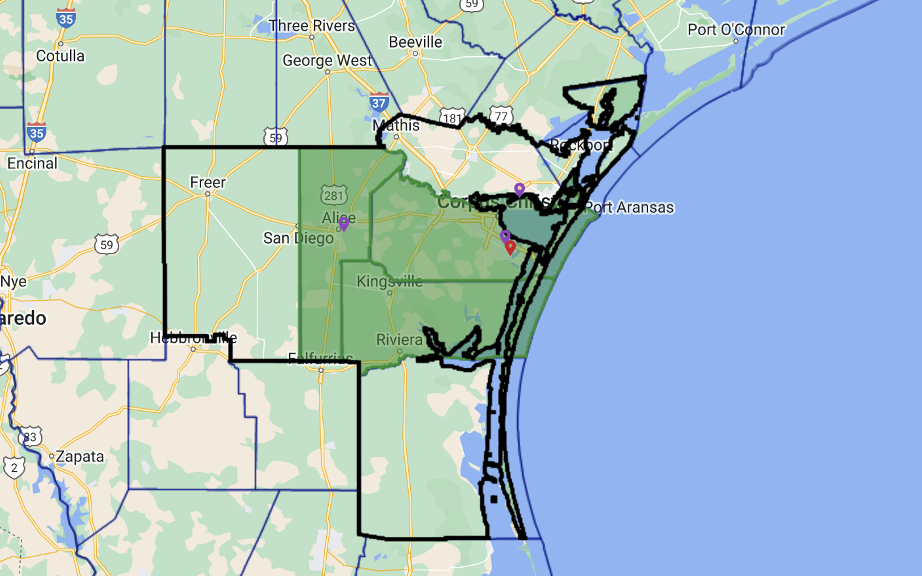

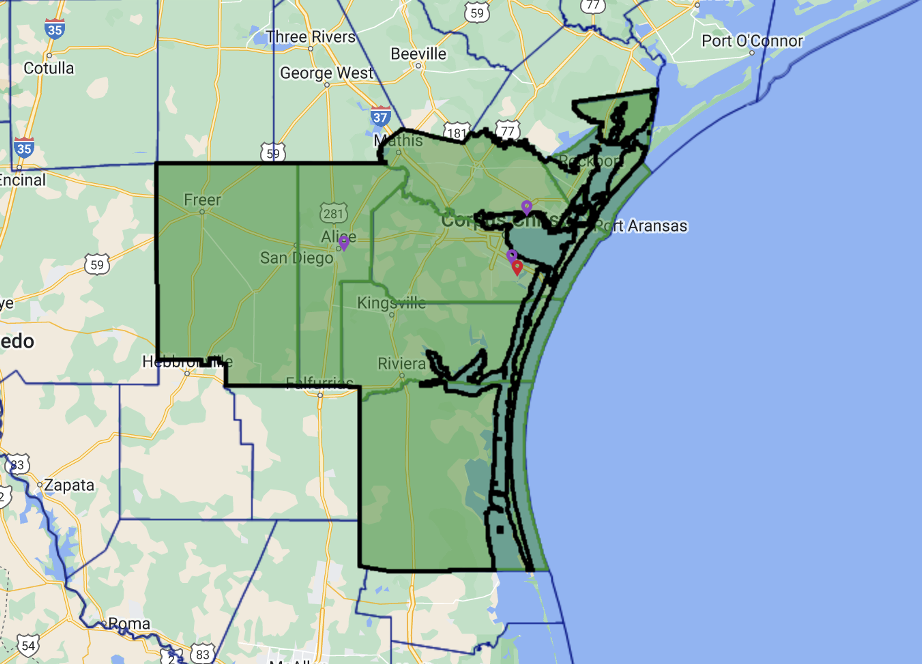

While it would take someone thousands, if not millions, of hours, it is possible to identify ways to draw multiple qualifying underserved rural districts that work together to cover entire statistical areas or even states (CUCollaborate has developed software that does this, but it still takes a day or two). Take, for example, the case of Gulf Coast Federal Credit Union (TX), previously chartered to serve the following community of 422,561 residents:

Persons who live, worship, work (or regularly conduct business in), or attend school in Nueces, San Patricio, or Jim Wells Counties, Texas.

The most they could serve through a community charter defined by their statistical area was the following community of 526,866 residents:

Persons who live, worship, work (or regularly conduct business in), or attend school in a portion of the Corpus Christi-Kingsville-Alice, TX Combined Statistical Area consisting of Aransas, Duval, Kenedy, Kleberg, Jim Wells, Nueces, and San Patricio Counties, Texas.

The credit union could have expanded to a rural district that would have covered their entire statistical area but ultimately be capped at 1,000,000. However, they instead converted to a federal multiple common bond charter and added several groups and the following three underserved areas:

By adding the three underserved areas, Gulf Coast Federal Credit Union was able to serve a community of 2,379,247 residents, consisting of their entire statistical area and many more counties and census tracts.

Credit unions should be aware of this strategy as it offers the most flexibility when it comes to organic and inorganic growth. Gulf Coast Federal Credit Union can now partner with any indirect acquisition partner nationally, expand into new communities organically, and has a path to voluntarily merge with any credit union in the country.

For a free charter and field of membership expansion evaluation, please request a demo below.

CUCollaborate specializes in field of membership expansion, among other things, and has helped numerous credit unions through the process with a 100% success record. On average, credit unions that work with CUCollaborate add underserved areas with more than double the number of new potential members.