Top-Level Takeaways

-

Michigan State University Federal Credit Union targeted inactive credit card accounts with a mailer touting the benefits of mobile pay options.

-

The mailer netted an 11% response rate and brought in more than $400,000 in account balances.

CU QUICK FACTS

MSUFCU

Data as of 09.30.18

HQ: East Lansing, MI

ASSETS: $4.1B

MEMBERS: 266,005

BRANCHES: 19

12-MO SHARE GROWTH: 8.1%

12-MO LOAN GROWTH: 14.2%

ROA: 1.21%

When the Financial Accounting Standards Board set forth a new credit loss accounting standard model, known as CECL, Michigan State University Federal Credit Union ($4.1B, East Lansing, MI) sprang into action.

In the summer of 2016, the Great Lakes State cooperative reviewed the number of inactive credit cards on its books. It had a plan to mitigate risk and lower the number of inactive cards on its books by turning inactive users into active ones. As an added benefit, MSUFCU knew active card users tend to be more active users of the credit union as a whole.

ContentMiddleAd

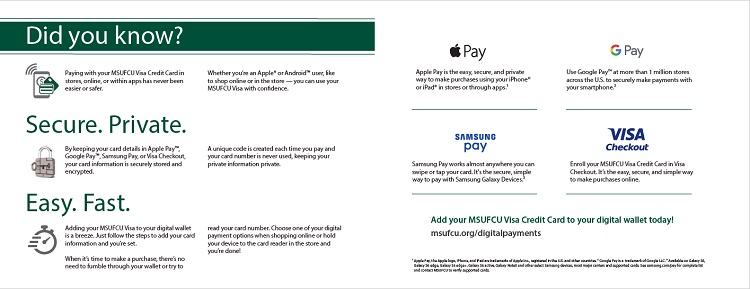

In the third quarter of 2016, MSUFCU targeted inactive credit card users with a marketing flyer informing them of the card’s integration with Apple Pay, Samsung Pay, Google Pay, and VISA Checkout. Response was immediate and significant. The flyer did not offer a call to action but still netted an 11% response rate and brought in more than $400,000 in account balances in three months.

Deidre Davis, CMO, MSUFCU

In this Q&A, Deidre Davis, MSUFCU’s chief marketing officer, talks about the mailer, how the credit union has evolved it in the months since, and lessons learned.

When did MSUFCU start discussing credit card usage? Why?

Deidre Davis: We are always cognizant of our credit card usage, but CECL was announced in the summer of 2016 and we knew we needed to look at inactive cards in terms of how we were reserving for loan losses. At this point it’s been delayed, but at the time we didn’t know that.

We also want our cards to be top of wallet. It doesn’t cost our member anything to use our card, but it does increase income for the credit union. If members see enough benefit for our card to be top of wallet, that’s a win-win for us.

How did you tackle inactive users?

DD: Within our marketing department we brainstormed ways we could make cards more active. We often run offers where members can use their card to win something or be entered into a drawing. We didn’t have that many people using our digital options, so we thought we could explain how easy it is to use the card with VISA Checkout, Android Pay, Apple Pay, or Samsung Pay and how safe and secure they are. That’s where we started, and we’ve had a great response.

When did you send the marketing mailer with this information on it?

DD: We sent the mailer for the first time in the third quarter of 2016.

Who did you send it to? What was the initial response?

DD: We sent it to all members 21 and older who had a credit card with us but hadn’t used it in the past 12 months.

MSUFCU’s mailer explained the ease and benefits of using a digital wallet, with no other calls to action. Click to view the front andback as larger images.

Within the next three months, we saw a response rate over 11%. We also brought in more than $400,000 in new balances from those who received the mailer. We were impressed by that. Maybe these individuals really had forgotten this card and we just needed to remind them of it.

We also wondered whether this was a fluke. We wanted to test it another time or two to see if it would perform as well.

When did you send the next one? What was different?

DD: We sent the next one in the first quarter of 2017 to folks who had been inactive the previous three months. The response rate jumped to more than 13%. We tried it again in the second quarter with the same qualifications and the response rate was more than 19%. That was when we decided to do it quarterly.

RESPONSE RATE BY QUARTER

FOR MICHIGAN STATE UNIVERSITY UNIVERSITY CREDIT UNION | DATA AS OF 09.30.18

| Quarter | Response Rate |

|---|---|

| 3Q16 | 11.07% |

| 1Q17 | 13.30% |

| 2Q17 | 19.04% |

| 1Q18 | 18.69% |

| 2Q18 | 19.09% |

| 3Q18 | 19.52% |

Why do you think this mailer was so successful?

DD: I think it was a combination of things. Digital payments are getting more and more common. The number of people using them in 2016 was much lower than it is today. Now, not only are our members seeing our messaging, they’re also seeing VISA’s on television. They are learning more about digital payments beyond our one-time send.

Are these members staying active card users?

DD: Approximately 80% have continued to make transactions. So, it has worked to make our card top of wallet if they are using it, then they will continue to use it as long as they know the benefits.

How will you change the mailer in the coming quarters?

DD: This is going to turn into a monthly mailer for us in 2019, and we’re doing a few other things in tandem. For those who don’t respond to the initial mailer, we’ll send them two additional letters in the mail to encourage them to use the card or find out why they aren’t. Did they forget they had the card? Is the limit not enough?

What lessons, if any, have you learned from this?

DD: We know that people pay for things in various ways, so we wanted to make our members comfortable with digital and make sure our card was part of that.

It was a bit surprising to us that we didn’t have any specific offer associated with this and we still saw a huge response. Sometimes we’ll have a promotion with an offer to enter to win and we’ll see a great response of 3% to 4%. Compared to that, this is a crazy high response rate. So maybe the lesson is you don’t always need an offer, but you do always need to tell your members and potential members what the credit union has to offer. Credit unions have great products and services, our members just don’t always know about them.

It’s as simple as letting people know?

DD: It’s like that old piece of advice for speakers: Tell em what you’re gonna tell em, tell em, and then tell em what you’ve told em.’

This interview has been edited and condensed.

Need Help Taking The First Steps?

Callahan & Associates is here to help. Using industry data, a network of leading executives, and more than 30 years of experience in the credit union industry, Callahan helps leadership teams think differently about framing challenges and developing answers.