Winona Nava knew the check was in the mail, but she was still relieved when her $2 million grant arrived in mid-March. The president and CEO of Guadalupe Credit Union ($152.4M, Santa Fe, NM) had already made three hires based on her credit union’s latest cash infusion from the Community Development Financial Institutions (CDFI) Fund.

Those three people are working as financial outreach coaches in the impoverished northern New Mexico communities where Guadalupe is helping proprietors of small businesses become banked in traditional ways that will give them access to the credit they need to survive, much less thrive.

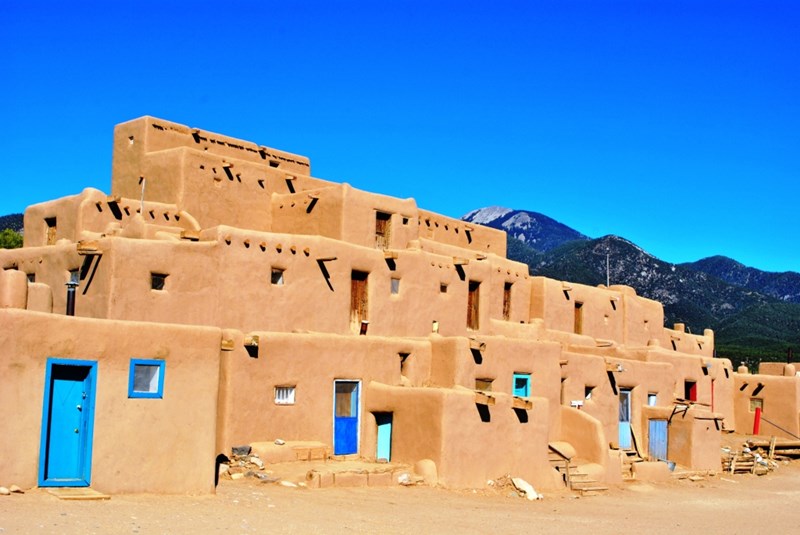

One of those businesses is the Taos Pueblo, the 90,000-acre, 4,500-resident reservation anchored by the pueblo itself where jewelers sell their wares outside one of the oldest continuously inhabited buildings in the Americas.

Continuously occupied for at least 1,000 years, the Taos Pueblo is one of the oldest homes in North America. Some of the tribe members still live in the adobe structure itself but most live in often-dilapidated housing nearby. Guadalupe Credit Union is using grant funding to help the jewelers and other residents there establish credit to build new homes on the New Mexico reservation.

Other communities where Guadalupe is working focus on agriculture. Small equipment loans are one way to help these business people smooth out the feast-or-famine cycle, and financial education, often through partnerships with local organizations and schools, is proving to be the best way to reach them and help them join the financial services mainstream.

CU QUICK FACTS

Guadalupe Credit Union

Data as of 12.31.16

HQ: Santa Fe, NM

ASSETS: $152.4M

MEMBERS: 18,606

BRANCHES:6

12-MO SHARE GROWTH: 9.1%

12-MO LOAN GROWTH: 5.6%

ROA: 0.73%

Guadalupe has received nearly $3 million in CDFI grants in recent years and has used each in different ways to achieve the same goal.

Our emphasis is on helping the unbanked become banked, Nava says. We try to be an alternative to payday and title lending.

The credit union offers loans with savings components as well as a range of programs and products made possible by the bolstered reserves Guadalupe needs to take on riskier loans in places other financial institutions won’t go.

Funding In Phoenix

Robin Romano can also speak to the benefits of CDFI grants. The CEO at MariSol FCU ($36.6M, Phoenix, AZ) has guided her financial cooperative through applying for and receiving two $750,000 CDFI grants since 2011.

CU QUICK FACTS

MariSol FCU

Data as of 12.31.16

HQ: Phoenix, AZ

ASSETS: $36.6M

MEMBERS: 6,805

BRANCHES:3

12-MO SHARE GROWTH: 4.3%

12-MO LOAN GROWTH: 9.1%

ROA: 2.41%

The first, a capital grant, MariSol used to increase the products and services the 3,600-member credit union provides to the Hispanic communities it serves through its three branches. The second, awarded in 2013, MariSol used for its Pay Yourself mortgage, an FHA-like program that offers 3% down payments with a twist.

Instead of paying the FHA premium, borrowers pay 75 basis points to themselves every month as part of the escrow, Romano says. They’re not allowed to touch it for the first five years. After that, they can begin using it for home repairs.

After 10 years, borrowers have no restrictions on that money.

Romano says MariSol has booked more than $2 million Pay Yourself mortgages since launching them in late 2012.

The CDFI grant money allows me to fund our allowance for loan losses for those mortgages, she says. But we haven’t had any.

Congress approved more than $200 million for 2017 for the CDFI Fund, which helps provide affordable credit to consumers, boost entrepreneurship, expand businesses, and facilitate homeownership. The Trump administration has proposed cutting that to $19 million in 2018, just enough to keep the program on life support but not much else.

When they give us $2 million, we’ll turn it into $20 million.

Even in more certain times, obtaining CDFI grants is not easy. Demand exceeds supply, and many applications are rejected. But what is certain, its advocates say, is that public funds investments amplify through the community.

When they give us $2 million, we’ll turn it into $20 million, says Nava at Guadalupe.

That 10-1 ratio is typical and is often higher, according to the National Federation of Community Development Credit Unions.

These investments generate billions of dollars annually in the form of loans to grow businesses, create jobs, increase job mobility, expand access to affordable healthcare and child care, build and improve homes, and create greater financial capability to expand consumer purchasing power, says Federation president and CEO Cathie Mahon.

Innovative products? Strategic new services? Callahan’s Strategy Lab is a great way to help leadership teams think outside the box while staying inside the credit union’s four walls. Find out if this program is a fit for you.

The Federation helped the Treasury Department establish the CDFI Fund in 1994. There now are more than 280 CDFI-certified credit unions, and advocates note CDFI credit unions often outperform their peers in some key measures.

The grants are a big part of that performance success, but CDFI grants are not the only money out there that credit unions can use to further their mission of financial wellness and inclusion.

The Regulator Rolls It Out

The NCUA provided $2.5 million to 309 credit unions in 2016 through the Community Development Revolving Loan Fund (CDRLF) grants administered by the regulator’s Office of Small Credit Union Initiatives.

The grants are available to the 2,000 or so institutions designated as Low Income Credit Unions (LICU) and range from $7,500 to $25,000 apiece. The regulator selects different initiatives each year. For example, 2016 was cybersecurity, staff training, capacity growth, and student interns. Financial education and disaster recovery also have been funded areas of focus.

OSCUI director Martha Ninichuk notes that unlike CDFI grants, CDRLF grants are reimbursable. That means the recipient must go through the approval process and then, if approved, spend the money up front and submit documentation to get that spending reimbursed by the NCUA.

The reimbursement to the credit union only covers those expenses associated with the initiative and up to the approved limit of the grant, Ninichuk says. At the time of reimbursement, the credit union must provide a short narrative that states the results of the initiative.

Credit unions that have done that successfully include Southern Chautauqua Federal Credit Union ($75.5M, Lakewood, NY), Fibre Credit Union ($989.4M, Longview, WA), Park View Federal Credit Union ($161.M, Harrisonburg, VA).

CU QUICK FACTS

Southern Chautauqua FCU

Data as of 12.31.16

HQ: Lakewood, VA

ASSETS: $75.5M

MEMBERS: 13,247

BRANCHES:7

12-MO SHARE GROWTH: 15.6%

12-MO LOAN GROWTH: 20.0%

ROA: 0.63%

Southern Chautauqua has used NCUA grants to team up with the local United Way in the VITA tax preparation program and to operate schools-based programs that include bonuses for savings and financial education that follows the Common Core curriculum.

We spend $300 to $400 to attract a new member, says Southern Chautauqua CEO John Felton. This is just spending it in a different way. Maybe 30% of the kids come bank with us. We’ve picked up some parents, too.

Fibre, meanwhile, received a 2015 Fraud and Cybersecurity Grant to help pay for deploying EMV chip cards for debit and credit.

CU QUICK FACTS

Fibre Credit Union

Data as of 12.31.16

HQ: Longivew, WA

ASSETS: $989.4M

MEMBERS: 89,643

BRANCHES:14

12-MO SHARE GROWTH: 6.2%

12-MO LOAN GROWTH: 6.1%

ROA: 0.43%

We were seeing an increasing number of comprised card numbers, counterfeit cards, and counterfeit fraud even with the use of neural network monitoring, says Shelly Buller, the Evergreen State credit union’s senior vice president of member services.

Learn more about Grant Funding in 2016 on CreditUnions.com.

Fibre’s $7,500 grant helped pay for processor costs and expensive new card inventory.

Having NCUA assistance in defraying some of these costs helped us both financially and in keeping to our mindset of being a financial cooperative focused on helping our members, Buller says.

CU QUICK FACTS

Park View FCU

Data as of 12.31.16

HQ: Harrisonburg, VA

ASSETS: $161.0M

MEMBERS: 10,020

BRANCHES:7

12-MO SHARE GROWTH: 11.4%

12-MO LOAN GROWTH: 10.8%

ROA: 0.81%

In part, Park View used its $10,000 2015 Digital Growth Grant to create a Spanish version of its website. The credit union’s president and CEO, John Beiler, says that enhancement supports the outreach of its bilingual staff to the large and growing Hispanic segment of its potential membership.

Staff now has an online resource to refer to when they visit SEGs with workers who prefer Spanish, Beiler says.

Other site enhancements the credit union rolled out include a responsive design that integrates digital presence across devices, search engine optimization to make it easier for members and potential members to find the credit union online, and enhanced social media components.

With the help of this grant, Park View Federal Credit union has improved its technology offerings and made ourselves more competitive as a primary financial institution for both the millennial generation and our Spanish-speaking community, Beiler says.

People On The River Are Happy To Give

The National Credit Union Foundation joins the CDFI and NCUA as primary sources of source of grant funding for the member-owned financial cooperative movement. One major difference: the foundation gets its money from credit unions themselves.

Executive director Gigi Hyland says the Foundation has provided nearly $36 million in grants over the past 35 years or so, with a recent emphasis on financial wellness, reality fairs, and disaster recovery for staff through CUAid.coop.

We work closely with the leagues and rely on them to find out what’s needed and distribute the funds, Hyland says about CUAid, which offered relief during the wildfires in California and extreme flooding in the Mississippi River delta region in Louisiana. Credit union people are generous and want to give.

The Foundation also worked to bring credit union reality fairs to nearly 100,000 kids in 2015-2016, according to Hyland. And for 2017, the Foundation has approved funding to help six credit unions pay for consumer financial health assessments for members and staffers through the Center for Financial Services Innovation (CFSI). Those credit unions are: BECU ($16.4B, Tukwila, WA); Community Financial Credit Union ($766.1M, Plymouth, MI);IH Mississippi Valley Credit Union ($1.1B, Moline, IL); Mid Minnesota FCU ($317.1, Baxter MN); University FCU ($2.1B, Austin, TX); and Virginia Credit Union ($3.3B, Richmond, VA).

Financial wellness is one of five Big Ideas for 2017 at Callahan & Associates. Read how credit unions Turn Financial Wellness Talk Into Action to learn more.

Hyland says the Foundation also will fund and provide technical support to up to five state leagues and foundations this year to help them set up their own non-prime auto loan programs that will provide loans to consumers who would not otherwise quality for credit for affordable, reliable transportation.

A Little Help From A Lot Of Friends

Many of the state leagues have grant opportunities, and there’s help available to credit unions from perhaps an unexpected source: Wells Fargo. The big bank has become a major supporter of the Opportunity Finance Network coalition of CDFIs.

That includes a $2 million grant to Appalachian Community FCU ($199.1M, Gray, TN) and $100,000 to Lower Valley Credit Union ($111.1M, Sunnyside, WA) to help them bring financial services to banking deserts. Both were 2016 recipients of Wells Fargo NEXT Awards for Opportunity Finance.

Coming up soon will be the Warren Morrow Fund from Coopera, the Hispanic credit union marketing subsidiary of the Iowa Credit Union League. Coopera CEO Miriam De Dios says her firm is working with the NCUF to create the fund named for Coopera’s founder who died unexpectedly at age 34 in 2012.

The Warren Morrow Fund will provide Hispanic marketing services to credit unions. That application process is now being finalized.