Gone are the days when the point-of-sale (POS) was simply a tool to record sales transactions. Propelled by the consumer expectation for seamless transactions, recent developments have enabled numerous options for technology at the terminal, includingcontactless payments, mobile terminals, and more.

Which trends at the POS are having the greatest impact? For a credit union wanting to offer businesses a robust merchant services program, these top five technologies at the terminal will satisfy both merchants and consumers.

1. Frictionless payments (contactless, mobile, and beyond)

Nearly four in 10 Americans own a contactless card, and that number is growing. Visa estimates that by the end of 2020, there will be more than 300 millioncontactless cards in the market. Therefore, now is an ideal time for merchants to upgrade their POS toenable contactless payments to take advantage of two main benefits: convenience and security.

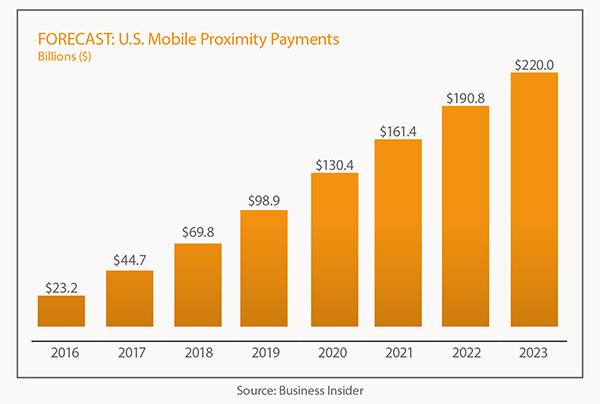

Also increasing in acceptance, mobile proximity payments take contactless payments to the next level by removing the friction of consumers having to carry a physical card. Although adoption has been low in the U.S. since introduction, the acceptance ofmobile wallets is growing. The transaction value of in-store mobile proximate payments is forecast to jump from $98.9 billion in 2019 to $220 billion in 2023, growing at a 22.1% compound annual growth rate (CAGR).

Payments made via wearables is also increasing. Mostly propelled by smartwatches, the global value of transactions completed via wearable devices is predicted to grow from $312.4 billion in 2018 to $1.1 trillion by 2026.

2. Mobile POS

Mobile POS (mPOS) refers to a POS terminal that is not anchored to the ground within a retail space and can be taken on the go to allow payments to be completed anytime, anywhere. mPOS are facilitated through a mobile device such as a smartphone or tabletby coupling that device’s existing functionality with terminal software and a card reader which is plugged into the device.

Propelled by convenience and flexibility, transaction value for payments made via mPOS is expected to show an annual growth rate (CAGR 2020-2023) of 28.1% resulting in the total amount of $2.1 billion by 2023.

3. Fraud/Security

Security and fraud are top-of-mind for merchants and consumers alike. Among merchants upgrading their POS system, 45% name security as their top priority.

To fight against fraud at the POS, merchants must ensure that their merchant services partner provides up-to-date fraud prevention tactics. Developments such as biometric technology have the potential to combat fraud as they become more commonplace. Itis predicted that by 2021, there will be more than 18 billion biometric transactions every year.

4. Loyalty programs

Nearly half of U.S. online 18- 35-year-olds admit that loyalty programs influence what they buy and how much they spend and 72% of US adultsbelong to at least one loyalty program.

As shopping increasingly happens online, loyalty programs that offer in-store coupons, discounts, and rewards are a compelling way to get consumers into brick-and-mortar stores. Facilitating rewards programs via the terminal makes a more seamless experiencefor consumers, who can opt to sign up for or redeem rewards at the same time they make a payment.

5. Tailored financing options such as Buy Now Pay Later (BNPL)

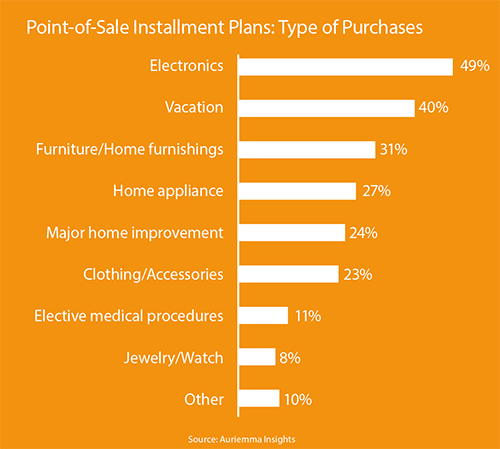

Tailored options for financing at the terminal have been gaining steam because they appeal to consumers’ growing desire for alternative payment options. With Buy Now Pay Later (BNPL), consumers can take out a loan at the POS and payback the amount in increments that may seem more manageable.

Interestingly, research shows that consumers who exclusively use or prefer debit cards are most likely to consider using payment plans at the terminal, even for everyday items. Four in 10 debit users would consider an installment plan for everyday purchases like groceries or household items.

Partnering with Elan Advisory Services can help credit unions offer top tech at the terminal to businesses.

Credit unions that engage with Elan Advisory Services have access to Elavon, one of America’s leading merchant solution providers. Elavon offers state-of-the-art merchant services solutions which include software, POS terminals, mPOS, and loyaltyprograms designed to meet the needs of numerous merchant industries.

Through a collaborative approach, Elan Advisory Services and Elavon can help partner credit unions offer an attractive merchant services program to businesses.

About Elan Advisory Services

Elan Advisory Services provides strategic consultation to ensure your credit union has the right products and services to compete in your market. Through Elan Advisory Services’ internal partners, we deliver best-in-class products and exceptionalservice to more than 3,000 financial institutions across the United States. With solutions such as end-to-end agent credit card services, mortgage services, and merchant processing, Elan Advisory Services can help your credit union increase revenueand efficiencies. For more information, visit Elan Advisory Services at www.elanadvisoryservices.com.

Click here to download a whitepaper titled Top 5 Trends at the Terminal from Elan Advisory Services.