Three mutually reinforcing relationships at the core of the virtuous cycle promote credit union growth, even during times of economic fluctuation.

In the December 2006 issue of the Callahan Report, Rick Heldebrant, CEO of Star One Credit Union ($4.6B, Sunnyvale, CA), coined the term virtuous cycle to describe the credit union’s model for successful growth: Higher balancesleads tolower expense ratio to higher rates to higher balances, and so on.

While this cycle may make sense intuitively, how does the virtuous cycle play out in practical terms? Further, what is the relative strength of these relationships during a recession? How does a credit union start the virtuouscycle?

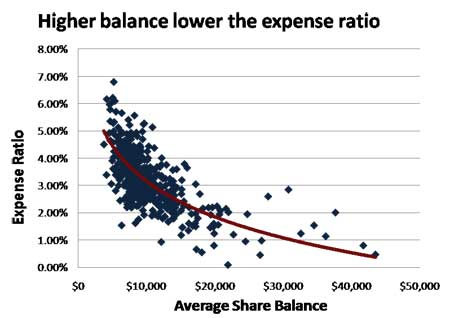

Higher balancesto Lower Expense Ratio

The graph below displays the relationship between the average share balance per member and the operating expenses-to-assets ratio for a sample of 500 credit unions: as average balances increase, the expense ratio tends to decrease.

Source: Callahan’s Peer-to-Peer Software

Source: Callahan’s Peer-to-Peer Software

The logic behind this is not altogether surprising; servicing expenses for a $20,000 share account is roughly equivalent to a $10,000, but the difference in balances causes the expense ratio to decrease.

For Star One, the core of this virtuous cycle is their primary savings product, the Money Market Savings Account, supplemented by a simplified line of other products. By offering a streamlined selection free of gimmicks, the credit union avoidshigher costs associated with marketing and educating members about a more complicated selection of products; they also save in staff training. Further, they drive deposits into fewer, higher balance accounts rather than having members spread theirbalance among many accounts. These additional savings and higher balances combine to further fuel the virtuous cycle.Lower Expense Ratioto Higher Rates

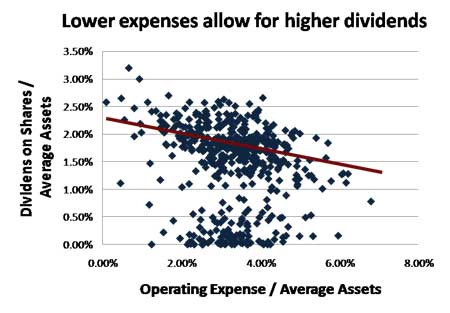

The second relationship in the virtuous cycle is the trade-off of operating expenses and savings rates (holding interest and non-interest income constant). Star One works under the belief that comparatively lowering their operating expenses yields a higherportion of funds to distribute to members through higher dividends.

Source: Callahan’s Peer-to-Peer Software

Source: Callahan’s Peer-to-Peer Software

There are two discernable clusters in this graph. The relationship between operating expenses and dividends breaks down for the lower cluster, but it is important to note this group only accounts for 20% of the credit unions included in theanalysis. These credit unions are clumped around a near 0% dividend rate and 3.3% expense ratio, the average for the group. This suggests that these credit unions may be focusing on minimizing expenses across the board. The remaining 80% of creditunions appear to be at the frontier where this trade-off occurs. Star One’s operating efficiency allows them to offer higher rates; Heldebrant explains that We price for relationships andwe have set up our systems and brand todeliver great rates.

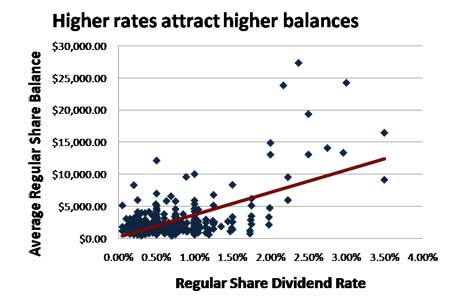

Higher Ratesto Higher balances

Many factors contribute to the average share balance at a credit union: field of membership, local market conditions, number of savings products offered (see above), depth of relationship, and other influencers. However, there nevertheless appears tobe a direct relationship between rates and balances, especially in the range of more competitive savings rates.

Source: Callahan’s Peer-to-Peer Software

Source: Callahan’s Peer-to-Peer Software

A key component behind the rates/balances relationship is making sure that higher rates are properly visible in the credit union’s marketplace. A local paper in Santa Clara would routinely publish the rates of money market funds for financial institutionsin the area. Star One had an N/A next to their name because they did not specifically offer a money market account, despite having regular share rates higher than any competing money market rates. Responding to this opportunity to havetheir rates published in a widely read newspaper, the credit union rebranded their primary savings account into the Money Market Savings Account and have since regularly sat at the top of the list.

Entering the Virtuous Cycle

One element typically attributed to growth is absent from the virtuous cycle: new members. It is possible for credit unions to maintain solid growth relying primarily on existing membership.

Star One confirms this as they identify the origins of the virtuous cycle at their credit union: We believe that member retention is the key to the health of our credit union We have seen from analysis of our MIF (member information files)that generally the longer a member has been with the credit union, the higher the savings balances. The process of minimizing member turnover allows the credit union to forge stronger, deeper relationships with members, which in turn generatesthe beginning of the virtuous cycle.