It’s been quite some time since credit union investment managers have had to seriously consider the impact of rising rates on their portfolios. As newer employees look to enhance their knowledge of fixed income investments and more seasoned professionals seek to refresh their skills, we’ve been asked by a number of credit unions to offer more investment education options.

TRUST, mutual funds for and by credit unions, began offering our Fundamentals of Fixed Income webinar series in late June and will continue the series through Aug. 18. Get all the details on the webinar here.

Below are a few of the highlights from our most recent webinar, which focused on Yield Curve Analysis Pricing.

What Does A Yield Curve Look Like?

The yield curve is often used as a predictor of future economic activity. A flat yield curve shows little or no difference between short-term and long-term rates. An inverted (or negative) yield curve occurs when long-term rates are lower than short-term rates. Both flat and inverted curves have previously foretold recessions, with inverted curves typically occurring right before a recession.

A positive yield curve, which is the most common, is an upward sloping graph where short-term rates are lower than long-term rates. The positive yield curve we’re seeing today shows expectations of continued growth in the economy.

An example of each type of yield curve, using images from Bloomberg, is displayed below:

1. Positive/Normal. A positive or normal yield curve has an upward-sloping graph where short-term rates are lower than long-term rates. The U.S. Treasury yield curve from April 3, 2014, below shows that short-term rates were yielding less than long-term rates. For example, the two-year rate was 0.448% and the 10-year rate was 2.785%.

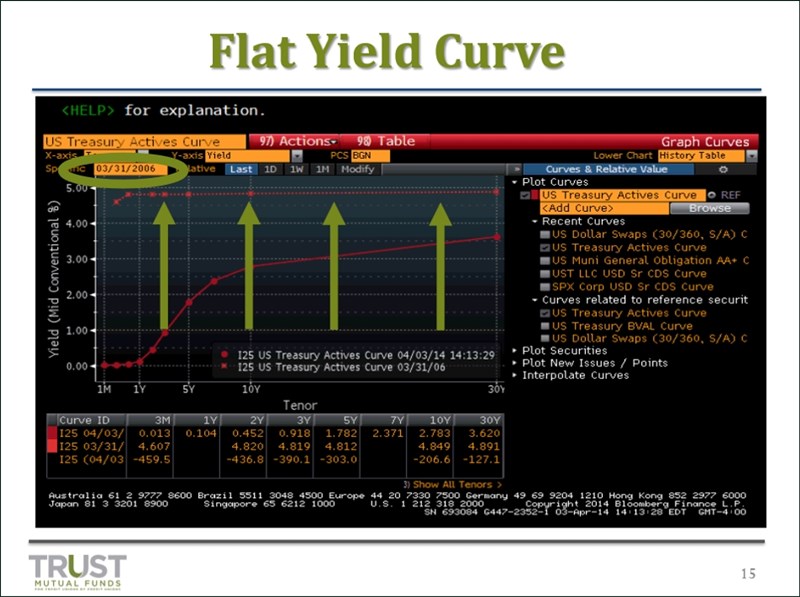

2. Flat:In a flat yield curve there is little or no difference between short-term and long-term rates. The graph below depicts the yield curve on March 31, 2006, compared with the current yield curve. The yield on the Treasury two-year was 4.82% and the yield on the Treasury 10-year was 4.85%. This is typically followed by an inverted yield curve.

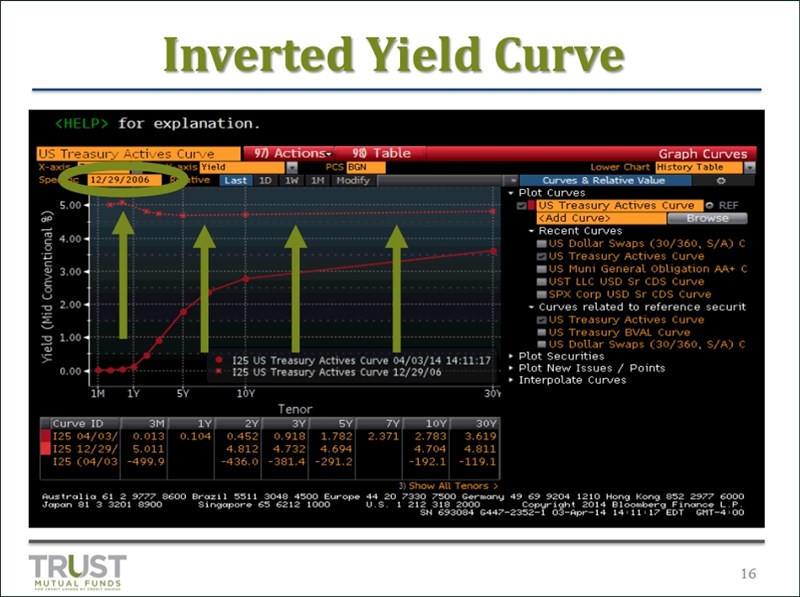

3. Negative/Inverted: In a negative or inverted yield curve, long-term rates are lower than short-term rates. When the curve inverts, it is a pretty reliable indicator that a recession is imminent. The last time the yield curve inverted was Dec. 29, 2006; in 2007, the housing market crashed. The graph below shows the inverted yield curve on top and the current yield curve below. At the end of 2006, the yield on the Treasury two-year was 4.81% and the yield on the Treasury 10-year was 4.70%, resulting in a difference of -11 basis points.

What Can I Buy In A Rising Rate Environment?

Another key concept to understand in fixed income investments is duration a bond’s price sensitivity given changes in interest rates. Managing the duration of the portfolio is an important tool for investment managers. As the chart below shows, bonds with longer maturities will typically experience more pronounced price changes as interest rates rise.

Here are some of the specific securities we’ve been hearing credit unions discuss buying in a rising rate environment, securities which won’t drastically impact the overall duration of their portfolios:

- Short Reset Agency ARMs Those that are past their teaser period and will adjust annually

- CMO Floaters A challenge is that most of the CMO floaters available are linked to very short indices such as 1-month LIBOR. If you sell a fixed rate instrument, you may be giving up income today and hoping that, over the long term, the return is greater as LIBOR adjusts.

- SBAs Similar to mortgage-backed securities but made up of pools of loans guaranteed by the Small Business Administration. Credit unions typically buy more than one issue due to premium risk. These are usually based on the Prime Rate.

- TIPS or Treasury Inflation Protected Securities The coupon stays the same but the inflation component is added to the principal, which may make accounting more challenging.

- Derivatives For those who have derivative authority, we’re seeing fixed to floating rate swaps as credit union investors hope that, over time, the floating rate returns more than the fixed rate.

Interested in learning more?The Fundamentals of Fixed Income webinar series was designed to help you better understand or refresh your knowledge regarding the basic building blocks of fixed income investments.The five one-hour webinars are held every other Tuesday through Aug. 18.

Archived versions of all five sessions will also be available on demand so that registrants may watch at their convenience. Register today at or contact us at tcugroup@callahan.com to learn more about the series.

Kevin Heal is vice president ofCallahan Financial Services (www.TRUSTcu.com). He has more than 25 years of sales and trading experience with both large investment banks and regional broker-dealers.

About TRUST

TRUST helps credit unions succeed in serving their members by providing a professionally managed family of mutual funds — exclusive to credit unions — as well as the information and analysis they need to support investment decisions. Created by some of the leading credit unions with oversight by a board of trustees, TRUST’s mutual fund options allow credit unions to meet their short duration needs, are professionally managed, and are based on the cooperative values of credit unions.

Visit www.trustcu.comor call us at 800-237-5678 to learn more.

The Trust for Credit Unions (TCU) is a family of institutional mutual funds offered exclusively to credit unions. Callahan Financial Services is a wholly-owned subsidiary of Callahan Associate and is the distributor of the TCU mutual funds. Goldman Sachs Asset Management is the advisor of the TCU mutual funds. To obtain a prospectus which contains detailed fund information including investment policies, risk considerations, charges and expenses, call Callahan Financial Services, Inc. at 800-CFS-5678. Please read the prospectus carefully before investing or sending money. Units of the Trust portfolios are not endorsed by, insured by, obligations of, or otherwise supported by the U.S. Government, the NCUSIF, the NCUA or any other governmental agency. An investment in the portfolios involves risk including possible loss of principal.